Intel, once a titan among global chipmakers, has seen its market value plummet to $94 billion, significantly trailing behind industry giants like Advanced Micro Devices, Nvidia, Qualcomm, Broadcom, and Texas Instruments.

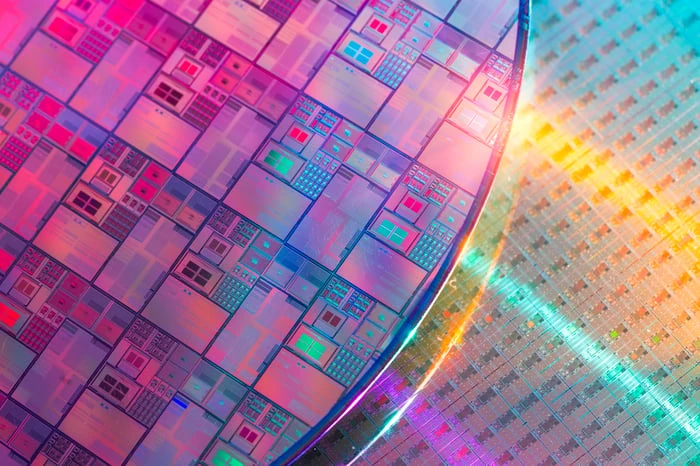

Historically, Intel was a cornerstone of the semiconductor industry, dominating the market as the leading producer of x86 CPUs for personal computers and servers. However, its significance waned as the industry shifted towards Arm’s energy-efficient chip designs, which are favored for mobile devices, automotive applications, and the Internet of Things (IoT). Additionally, Intel lagged behind Taiwan Semiconductor Manufacturing Company (TSMC), the premier and most sophisticated contract chipmaker globally, in the race to develop smaller, more advanced chips. Consequently, AMD, which contracts its production to TSMC, has outpaced Intel with its superior chip offerings.

In an attempt to reclaim its leadership in chip manufacturing, Intel has been striving to upgrade its own production facilities, but these efforts have been both costly and largely ineffective. There is speculation that Intel might spin off its financially draining foundry division to curtail losses.

Currently, analysts project Intel’s revenue to grow at a compound annual growth rate (CAGR) of 4% from 2023 to 2026, as it introduces new chip models and the PC market stabilizes. However, even if Intel meets these growth targets and maintains a valuation of 2.5 times sales, its market capitalization would only rise to approximately $154 billion by 2026, still lagging behind AMD, Nvidia, Qualcomm, Broadcom, and Texas Instruments at present.

I foresee that two smaller chipmakers might soon surpass Intel’s market value within the next two years: Marvell Technology and Micron Technology.

1. Marvell Technology

Marvell produces a diverse array of chips for data processing, infrastructure, Wi-Fi, and custom applications, serving sectors such as cloud computing, 5G, automotive, enterprise networking, and artificial intelligence. With a current market capitalization of $66 billion, analysts anticipate Marvell’s revenue to grow at a CAGR of 18% from fiscal 2024 to fiscal 2027 (ending February 2027).

Although Marvell’s stock is valued at 12 times this year’s sales, a seemingly high figure for a diversified chipmaker, this valuation is driven by the soaring demand for its optical and networking chips, essential for upgrading data centers to manage the influx of data from cutting-edge AI applications.

In fiscal 2024, Marvell derived 10% of its revenue from AI-focused chips, and this percentage is expected to rise in fiscal 2025. This growth is likely to enhance the recovery of its carrier, enterprise networking, consumer, automotive, and industrial markets within a more favorable macroeconomic climate.

If Marvell meets Wall Street’s expectations and continues to trade at 12 times sales by fiscal 2027, its market value could increase to $108 billion, surpassing Intel’s current valuation. If it trades at 20 times sales, its market cap could soar to $180 billion.

2. Micron Technology

Micron stands as one of the largest global producers of DRAM and NAND memory chips. Earlier this year, its market cap exceeded Intel’s, currently standing at approximately $107 billion. I believe Micron can sustain this lead over the next two years.

Micron’s operations are notably cyclical. In fiscal 2023 (ending August 2023), its revenue plummeted by 49%, resulting in a loss. This downturn was due to a decline in PC shipments and the conclusion of the 5G smartphone upgrade cycle.

However, from fiscal 2023 to fiscal 2026, analysts forecast Micron’s revenue to grow at a CAGR of 42% as a new cyclical growth phase unfolds. The company is also expected to return to profitability in 2024, with earnings per share (EPS) projected to grow at a CAGR of 306% over the following two years. These impressive growth rates are notable for a stock trading at just 4 times this year’s sales.

If Micron achieves Wall Street’s projections and maintains its current price-to-sales ratio by fiscal 2026, its market cap could exceed $190 billion by that year. This rapid growth is likely to be fueled by the stabilization of the PC and smartphone markets, expansion in automotive and industrial sectors, and increasing sales of solid-state drives (SSDs) and high-bandwidth memory (HBM) to support more AI tasks in data centers.

Are Marvell and Micron better investments than Intel?

While Intel is not yet out of the running, it clearly faces significant existential threats. Instead of gambling on Intel’s uncertain recovery, it may be wiser to invest in Marvell’s ongoing expansion or Micron’s latest multiyear growth phase.