Intel’s stock experienced a significant decline of 8.80% last month, largely due to a disappointing second-quarter earnings report. The report featured lackluster performance, unsatisfactory future guidance, the removal of the dividend, and a restructuring plan that includes cutting at least 15% of its workforce.

This news dashed any hopes that Intel was progressing in its anticipated turnaround. Later in the month, the company faced another setback with the departure of a key director, who criticized Intel’s slow-paced strategy in the chip industry and its reluctance to embrace risks. However, on the final day of the month, the situation slightly improved when Bloomberg revealed that Intel was exploring strategic options, including the possibility of separating its manufacturing segment from its main chip-design business.

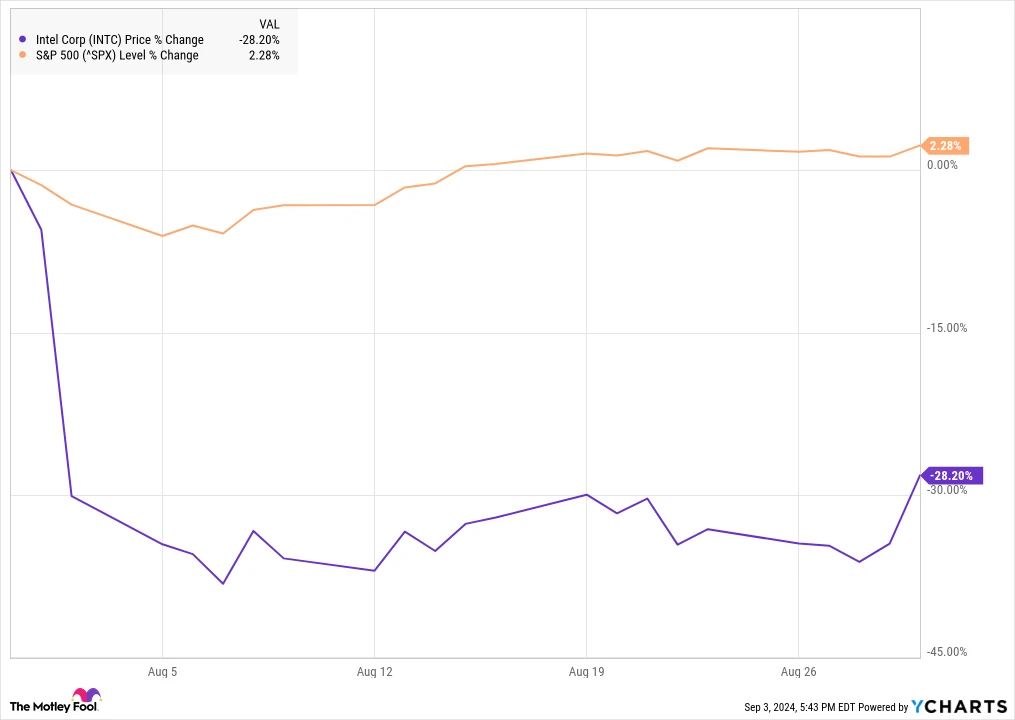

S&P Global Market Intelligence data shows that Intel’s stock ended August with a 28.2% decline. The chart below illustrates its performance.

Intel surprises investors

It’s uncommon for a renowned blue-chip company like Intel to deliver such a stream of negative news in a single quarter. The core takeaway from the report is that Intel is struggling at a critical juncture in its industry, particularly as demand for AI is on the rise.

The company’s second-quarter performance fell short, hindered by ongoing losses in its foundry division and stagnant growth in key business areas. Revenue for the quarter dipped by 1%, totaling $12.8 billion, and adjusted earnings per share dropped to $0.02, a decrease from $0.13 in the same quarter the previous year.

The third-quarter forecast was equally disappointing, with expected revenue ranging from $12.5 billion to $13.5 billion, indicating an 8% decline at the midpoint. Additionally, an adjusted loss per share of $0.03 was projected.

Beyond the weak results and forecasts, the decision to eliminate the dividend disheartened investors, although it aligns with a strategy to conserve cash. While layoffs sometimes please Wall Street, the announcement of a 15% workforce reduction further signaled disarray within the company.

Intel requires assistance

As the month progressed, Intel postponed its Intel Innovation conference and lost a crucial director. Investors found some hope in the speculation that the company might consider a breakup or reduce capital expenditures, but Intel has not confirmed any such actions, making it speculative at this stage.

Furthermore, the likelihood of Intel’s removal from the Dow Jones Industrial Average has increased substantially. The company faces a considerable challenge in revitalizing its business and stock performance, and investor patience may once again wear thin.