For investors searching for stocks capable of delivering substantial gains quickly, a small-cap biopharmaceutical company named Instil Bio has captured attention with its remarkable ascent.

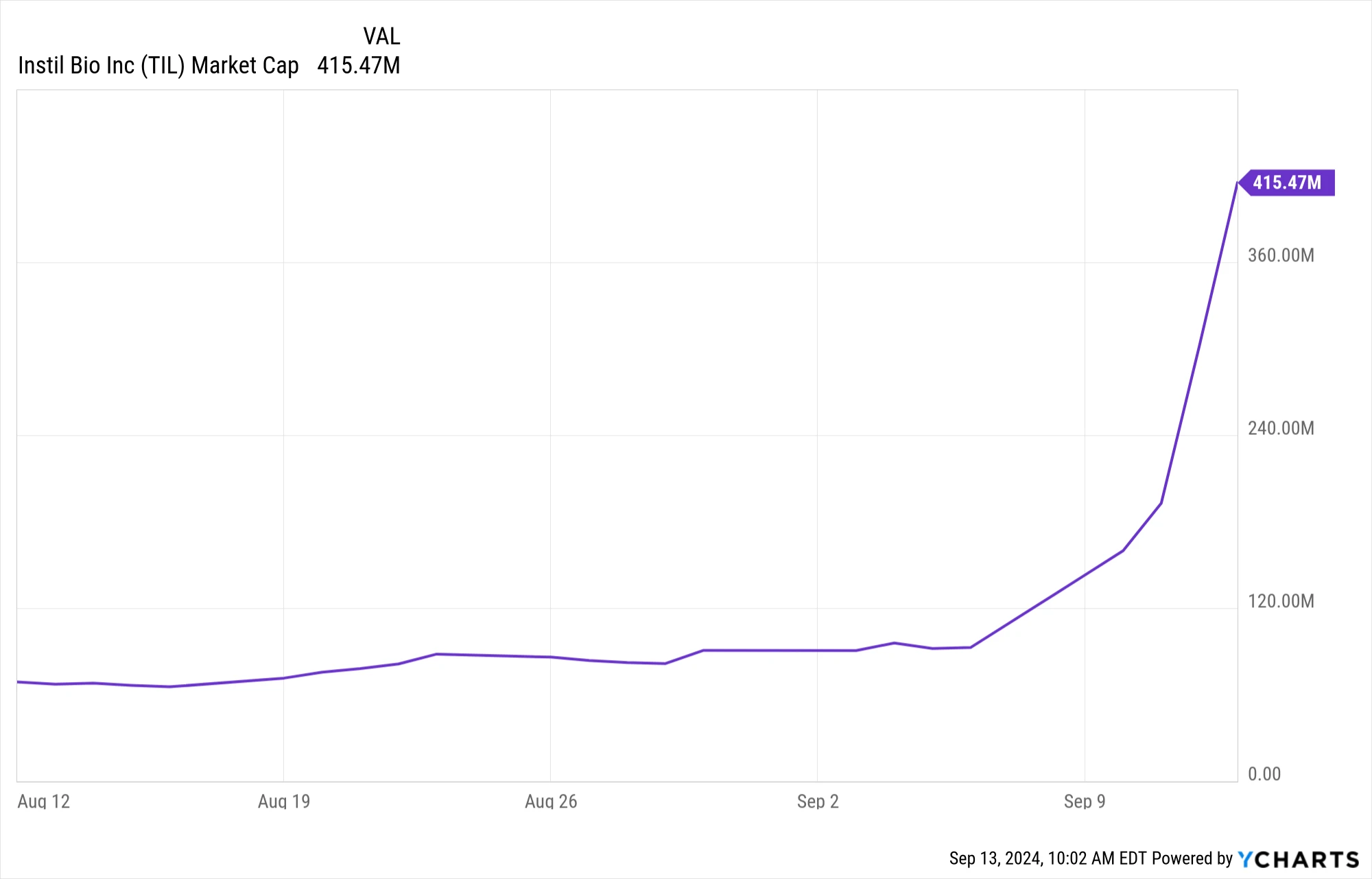

Between September 6 and September 12, the clinical-stage drugmaker’s stock surged approximately 235%, elevating its year-to-date increase to a staggering 510%. Investors are eager to know if this momentum can sustain.

Below, we delve into the factors driving Instil Bio’s stock upwards, alongside the challenges it faces. Additionally, we’ll weigh the positives against the negatives to assess whether everyday investors can reasonably anticipate continued growth in this stock.

Contents

The Reasons Behind Instil Bio’s Stock Surge

As 2024 commenced, Instil Bio was focused on developing cell-based cancer therapies utilizing tumor-infiltrating lymphocytes (TILs). However, in August, the company shifted its strategy by in-licensing IMM2510, a bispecific antibody targeting programmed death ligand 1 (PD-L1) and vascular endothelial growth factor (VEGF).

Instil Bio’s collaboration partner, ImmuneOnco Biopharmaceuticals, operates out of China, where another bispecific antibody targeting PD1 and VEGF has already received approval. Akeso’s ivonescimab gained marketing approval in May for treating second-line lung cancer patients in China.

Summit Therapeutics, Akeso’s partner, secured licensing rights for ivonescimab outside China and Australia. The company recently attracted significant attention on Wall Street following positive outcomes from a head-to-head study against Keytruda, the world’s top-selling cancer therapy. In the Harmoni-2 trial, newly diagnosed lung cancer patients who received ivonescimab were 49% less likely to experience disease progression compared to those treated with Keytruda.

While Instil Bio itself has not yet completed clinical trials with IMM2510, and its partner has only conducted a single-arm ascending dose study, the drug’s resemblance to ivonescimab leads analysts to speculate it may eventually emerge as a leading cancer therapy.

As of early September, the acquisition of all outstanding shares of Instil Bio would have cost less than $100 million. Although its market capitalization has increased, it remains relatively low for a company potentially harboring a blockbuster drug in its development pipeline. This prompted Baird analyst Jack Allen to elevate his price target for Instil Bio to $180 per share, suggesting a 235% gain from its price at 9:40 a.m. ET on Friday, September 13.

The Risks Associated with Instil Bio’s Stock

Despite both ivonescimab and IMM2510 being bispecific antibodies with similar targets, notable differences exist. Ivonescimab binds exclusively to VEGF-A, whereas IMM2510 binds to both VEGF-A and VEGF-B. These distinctions could enhance its efficacy, but with limited data from Instil Bio and ImmuneOnco, it’s challenging to draw conclusions.

In a phase 1 ascending dose study involving patients with advanced solid tumors in various organs, including the lungs, response rates were underwhelming. Only three out of 25 patients experienced tumor shrinkage, and none achieved complete remission.

Apart from the uncertainty regarding IMM2510’s superiority over ivonescimab, doubts persist about whether a bispecific antibody targeting PD-1 and VEGF offers advantages over Keytruda (a PD1 drug) combined with Avastin (an anti-VEGF drug).

Instil Bio recently leased a cell therapy manufacturing site to AstraZeneca for 15 years, generating over $7.5 million annually. Although this reduces its cash-burn rate, it won’t suffice to prevent significant losses. By June’s end, the company held $152.6 million in cash, having expended $39.2 million in the first half of 2024.

Despite spending just $10.2 million on research and development during the first half of 2024, Instil Bio continues to incur substantial losses. If IMM2510 progresses beyond phase 1 trials, expenses will escalate dramatically, necessitating additional capital from investors long before knowing if IMM2510 can evolve into a commercial-stage product with recurring sales.

Should You Consider Buying Now?

Instil Bio epitomizes the high-risk, high-reward nature of biotech stocks. While positive data for IMM2510 and related candidates could propel its shares even higher, the drug remains in phase 1 trials. Numerous obstacles must be overcome before the company can introduce products to the market.

Although Instil Bio has the potential for further ascent, this stock is suitable only for those with a considerable appetite for risk. If you rely on employment for your livelihood, it may not be the best fit for your investment portfolio.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Ever feel like you missed the chance to invest in highly successful stocks? Here’s your opportunity.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re worried about having missed your chance, now is the time to act before it’s too late. The numbers speak for themselves:

– Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $308,911!*

– Apple: A $1,000 investment when we doubled down in 2008 would be worth $42,142!*

– Netflix: A $1,000 investment when we doubled down in 2004 would be worth $370,385!*

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this opportunity may not arise again soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/14/2024