Wall Street and experts in the industry are very optimistic about artificial intelligence (AI). Here are a few of the predictions being discussed:

- Ark Investment Management, led by Cathie Wood, forecasts that artificial intelligence will contribute $200 trillion to the worldwide economy by 2030.

- According to consulting firm PwC, the figure is estimated to be a more conservative $15.7 trillion by the same year, which is still a significant amount.

- Goldman Sachs AI is expected to contribute approximately $7 trillion to the worldwide economy in the next decade.

- Nvidia Jensen Huang, the CEO, has stated that a total of $1 trillion will be invested in improving data center infrastructure within the next five years to cater to the needs of AI developers.

If those predictions become a reality, I believe one company stands to gain more than any other. Amazon ( AMZN -0.08% ) Utilizing its cloud computing platform, the tech giant is rapidly expanding its involvement in AI hardware, large language models (LLMs), and AI software applications. Furthermore, it is leveraging AI to improve its traditional e-commerce operations.

As we approach the year 2030, investors may look back on this time and regret not investing in Amazon stock due to its potential growth and success.

The trifold structure of artificial intelligence

Creating artificial intelligence (AI) is a costly and intricate process, however, enterprises are eager to adopt this technology in order to enhance efficiency and explore fresh sources of income. Amazon Web Services (AWS) stands as the largest provider globally. Cloud computing refers to the delivery of computing services such as storage, servers, databases, networking, software, and more over the internet. platform and is increasingly popular among users AI Programmers are drawn to this platform due to its robust infrastructure and wide range of artificial intelligence tools and offerings.

Andy Jassy, the CEO of Amazon, describes hardware as the foundational component of AI, encompassing data centers and the processors housed within them. Similar to many other cloud service providers, AWS relies on this infrastructure. Nvidia The cutting-edge graphics processors in the industry ( GPU In its data centers, Amazon has been using third-party chips, but according to Jassy, developers are always looking for improved cost-effectiveness. This is why Amazon has created its own chips known as Trainium. AI training ) and Inference (for AI inference ).

For instance, Trainium provides cost savings of up to 50% compared to Amazon’s alternative infrastructure, enabling developers to extend their budget for developing more sophisticated models. This leads us to the intermediate level of AI, which includes pre-built components. LLMs Businesses looking for a ready-made solution can turn to Bedrock on AWS, offering the widest range of third-party LLMs in the field. Among them is Anthropic’s Claude 3.5 lineup, known for being the top-performing models globally. By integrating these models with their own data, businesses can speed up the process of AI software development.

Software represents the last layer in Amazon’s services, and they have also developed a new virtual assistant called Amazon Q within AWS. According to Jassy, Amazon Q is an advanced AI tool specifically designed for software development, boasting the best performance in suggesting code and detecting security flaws compared to other similar products.

During the second quarter of 2024 (which ended on June 30), AWS achieved a new revenue high of $26.2 billion, showing a 19% increase compared to the same period last year. This marks the third quarter in a row where revenue growth has accelerated, with AI playing a significant role in this success.

Picture credit: Amazon.

Artificial intelligence is improving Amazon’s online retail business.

Amazon continues to focus on improving its e-commerce sector, which is its main revenue generator. To enhance efficiency, the company divided its national fulfillment network into eight separate regions last year, aiming to lower logistics expenses and ensure faster product deliveries to customers. Furthermore, Amazon has integrated hundreds of thousands of AI-driven autonomous robots to optimize its fulfillment operations.

Currently, Amazon is introducing Project Private Investigator, a system that utilizes artificial intelligence and computer vision to detect faulty items prior to their delivery to consumers. This initiative is expected to decrease the number of product returns, subsequently cutting expenses and enhancing customer contentment.

This contributes to the existing array of AI tools currently in use on amazon.com. AI The recommendation engine is powered to display the most suitable products to shoppers, ultimately boosting sales. Moreover, customers have access to a virtual shopping assistant named Rufus, which is knowledgeable about Amazon’s complete product range and can assist with inquiries and product comparisons.

Amazon provides a range of AI software tools to sellers, enabling them to develop more captivating product pages and advertisements in order to boost their sales.

The present moment may present a favorable opportunity to invest in Amazon shares.

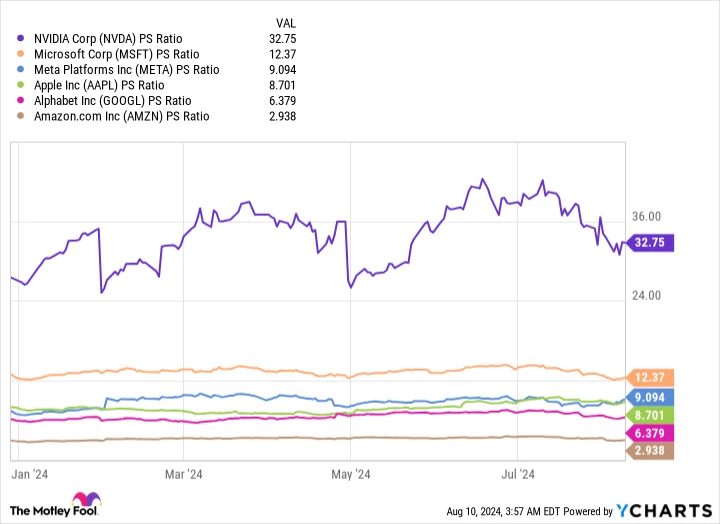

During the second quarter, Amazon’s total revenue from all its operations reached $148 billion, marking a 10% growth compared to the same period last year. This brought the company’s total revenue for the past 12 months to $604.4 billion. The value of a company’s outstanding shares of stock on the open market. With a market capitalization of $1.7 trillion, its shares are being traded at a The ratio of a company’s market capitalization to its revenue is known as the price-to-sales ratio (P/S). with a price-to-earnings ratio of only 2.9, which is lower than that of any other technology behemoth valued at $1 trillion or above.

Amazon has faced challenges in turning its sales into profits previously, leading investors to give it a low P/S ratio. Essentially, this means investors believe that Amazon’s sales are not as valuable as Nvidia’s sales, for instance, because a higher percentage of Nvidia’s sales result in profit.

Nevertheless, Amazon has significantly enhanced its profitability in recent quarters. It achieved a revenue of $13.5 billion. net income In the second quarter, there was a significant surge of 101% compared to the same period last year. This came after three consecutive quarters of net income growth of over 100%, indicating a strong upward trend. While AWS remains the primary source of profit for the company, Amazon’s online retail business is also experiencing positive effects from its artificial intelligence and efficiency projects, leading to increased profit margins.

Wall Street anticipates that Amazon will experience a growth in profitability that will extend into 2025. profit divided by the number of shares outstanding It is possible that the price could be $5.85, positioning its stock at a certain level. future price-earnings ratio At 28.5, the price-to-earnings ratio is lower than the current 29.6 P/E ratio. Nasdaq-100 Therefore, Amazon appears appealing from that point of view as well.

In the long run, this could serve as an excellent opportunity for investors who are prepared to keep the stock as the AI industry gains strength in the coming years, as indicated by numerous predictions.