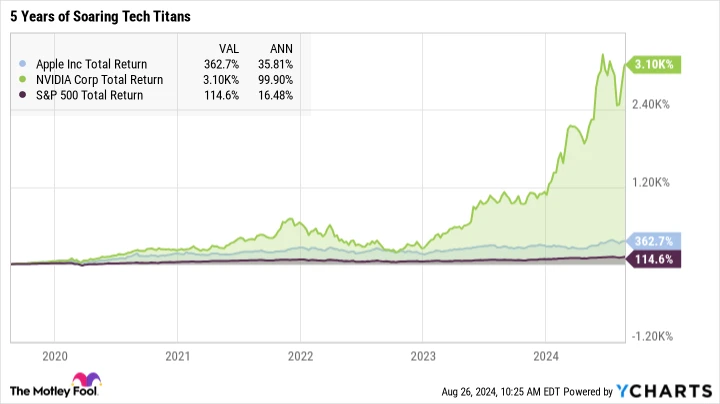

In today’s tech-driven world, Apple (-0.68%) and Nvidia (-2.10%) reign supreme, boasting the highest market valuations and delivering impressive returns over the past five years. Apple’s total returns have achieved a compound annual growth rate (CAGR) of 36% during this time, while Nvidia has outpaced this with a staggering 100% five-year CAGR, largely benefiting from the booming artificial intelligence (AI) sector.

These substantial gains were realized during a robust period for the market, making the S&P 500 index seem rather sluggish in comparison:

AAPL Total Return Level data by YCharts

It would be great if Nvidia and Apple were set to continue their impressive market performance. One could invest in these leading market players, relax, and expect continued success in the years ahead. Unfortunately, I believe both companies are currently overvalued, with Nvidia’s market cap at $3.1 trillion and Apple’s at $3.4 trillion. While it’s like comparing mountains of cash to rivers of revenue, these valuations represent roughly 23% of the United States’ gross domestic product.

In my view, that’s excessive. Apple and Nvidia might be on the verge of a significant correction. At best, I don’t anticipate substantial growth for them in the near future.

Meanwhile, International Business Machines (-0.14%) is making strides in the AI arena, and its stock is undervalued at present. While I don’t foresee IBM reaching a trillion-dollar valuation in the next five years, its stock should certainly appreciate as the company’s enterprise-class AI tools add value. Many investors still overlook this traditional computing giant as a promising AI investment, which is a significant oversight.

Don’t Overlook IBM’s Cash-Generating Strength

At first glance, IBM’s valuation metrics might not seem particularly attractive. The stock trades at 22 times trailing earnings and 2.9 times sales, which are decent figures for mature companies, slightly below the averages seen in the S&P 500 and Dow Jones Industrial Average indices.

However, IBM’s price-to-free cash flow (P/FCF) ratio is eye-catching. When you evaluate IBM’s metrics based on its substantial cash profits, the stock appears to be a bargain on Wall Street. This ratio is just 14 times free cash flows, a little over half of the S&P 500’s or Dow Jones’ figures.

Cash is king, and IBM has it in abundance. The company’s impressive cash profits, coupled with its relatively modest earnings, indicate that IBM’s financial experts excel at minimizing taxable profits while accumulating substantial cash reserves. I consider cash flow a superior measure of profitability, making it easy to overlook IBM’s moderate price-to-earnings ratio.

IBM’s Role in the AI Revolution

Reflect on the five-year chart I shared earlier. During the same period, IBM’s chart presents a different picture:

IBM Total Return Level data by YCharts

After years of underperforming broad market indices, IBM has transformed its hardware-centric business model into a more lucrative focus on software and services. Notably, the revamped IBM emphasizes cloud computing, data security, and AI tools.

This company was a leading AI researcher long before the release of ChatGPT sparked a surge in AI investments. Many investors have overlooked this connection, as IBM’s business results didn’t immediately skyrocket in this thriving AI era. However, the significant AI contracts are on their way, albeit a bit delayed.

IBM is content to leave consumer-friendly innovations, like ChatGPT-style chatbots, to other tech firms. Instead, it targets large corporate contracts, enhancing them with additional layers of security, business-oriented data analytics, and data tracking to mitigate legal risks. Potential clients may take several quarters to evaluate and approve IBM’s AI solutions, but the end result is a lucrative long-term partnership that is difficult to replace.

Approvals are now coming through, establishing a strong revenue stream for the future. Market analysts are still not fully tuned in, so IBM’s stock continues to trade at extraordinarily low cash flow ratios. I am eager to see the developments in a few years when AI contracts have matured into generous and highly profitable revenue sources.

One Final Thought…

I acknowledge that Nvidia and Apple are also generating substantial cash profits. However, their inflated stock prices already reflect these high-quality earnings. Currently, Apple’s P/FCF ratio stands at 33, and Nvidia’s is an astounding 79 times free cash flows.

No, thank you. I prefer to invest in IBM’s undervalued stock instead.