Energy remains the backbone of global economies, with its demand only set to rise. According to a recent Goldman Sachs study, the burgeoning sector of artificial intelligence (AI) applications and services, such as OpenAI’s ChatGPT, will significantly increase energy needs, with data center power demand projected to surge by 160% by 2030.

Various energy sources can cater to this increasing demand, with hydrogen emerging as a promising solution. Considered the “new oil,” hydrogen burns cleaner, facilitating corporate carbon reduction objectives. Bloom Energy, with a 5.52% increase, is at the forefront of developing grid-independent, low-carbon power generation technologies. Given the hydrogen energy market’s potential to expand into an $11 trillion industry, Bloom Energy presents an intriguing opportunity for investment.

Contents

Bloom Energy’s Initiative to Meet AI’s Energy Requirements

Hydrogen-fueled power generation provides a sustainable, clean, and adaptable alternative to traditional fossil fuels. The conversion of hydrogen into energy results in mere water and heat as byproducts, making it an attractive choice for those aiming to minimize their carbon emissions. Moreover, hydrogen can be stored, transported, and utilized as needed. Although the conversion process has historically been cost-prohibitive, Bloom Energy has tackled this challenge with their advanced technology.

Over the past twenty years, Bloom Energy has enhanced its technology to generate hydrogen with greater efficiency. Their Bloom Energy Server employs unique solid oxide technology to convert fuels such as hydrogen, natural gas, and biogas through an electrochemical process devoid of combustion.

Bloom’s modular servers, which can be clustered to supply energy from hundreds of kilowatts to megawatts, stand out due to their resilience against weather disruptions, cyber threats, and grid failures. These servers can also be installed more swiftly than conventional energy sources.

Bloom’s clean, grid-independent power generation system is particularly appealing to data center operators, who face an energy demand surge driven by the AI boom.

In May, Bloom Energy secured a power capacity agreement with Intel to deploy additional megawatts of its fuel cell-based Energy Server at Intel’s high-performance computing data center in Santa Clara, California. Last month, they joined forces with Nvidia-backed AI hyperscaler CoreWeave to supply on-site power for its high-performance data center in Illinois.

Current Financial Overview of Bloom Energy

Bloom Energy derives much of its revenue from energy server sales, requiring significant upfront capital, and offers financing or pay-as-you-go arrangements to assist customers.

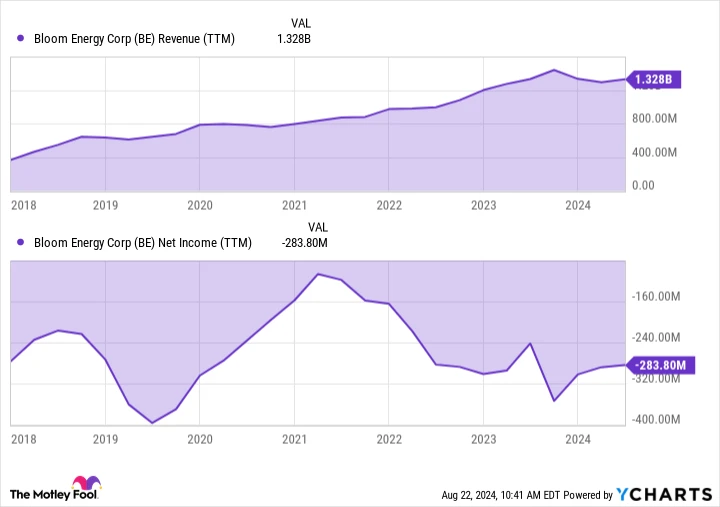

While revenue growth has been robust, the company is experiencing a slowdown in sales this year. Bloom reported $571 million in revenue over six months, a 1% decrease from the previous year. Sales can fluctuate due to the nature of the product. Nonetheless, management anticipates a rebound in the second half, projecting $1.4 billion to $1.6 billion in revenue for the year, representing a 12% growth at the midpoint.

Investors should remain attentive to Bloom’s profitability. Last year, the company incurred a net loss of $308 million, with an additional $119 million loss in the first half of this year. Profitability remains an elusive target for Bloom.

The company is making strides in its non-GAAP operating income, excluding stock-based compensation and restructuring charges. Since last year, Bloom has reduced its non-GAAP operating loss from $26 million to $3.2 million this year, with a projected non-GAAP operating income of $75 million to $100 million by year’s end.

Should You Consider Investing in Bloom Energy?

Bloom Energy is making commendable progress in expanding its business, having secured pivotal agreements recently that reinforce its product’s value. With its solid position to meet the escalating power needs of data centers and its resilient power solutions aiding carbon footprint reduction, Bloom Energy remains a promising investment. If you already own the stock, it holds potential, making it wise to retain it for now.

For investors eager to capitalize on the clean hydrogen trend, Bloom Energy’s stock might be tempting despite its profitability challenges. However, it would be prudent to wait for further expansion in its data center presence and improvements in financial performance before purchasing shares.

Summary

The text discusses the rising energy demand driven by AI applications and the potential of hydrogen as a clean energy source. Bloom Energy is positioned to capitalize on this demand through its innovative, low-carbon power generation technology. While facing financial challenges, Bloom is expanding its business, making it a potential investment opportunity, especially as the hydrogen market grows.