Contents

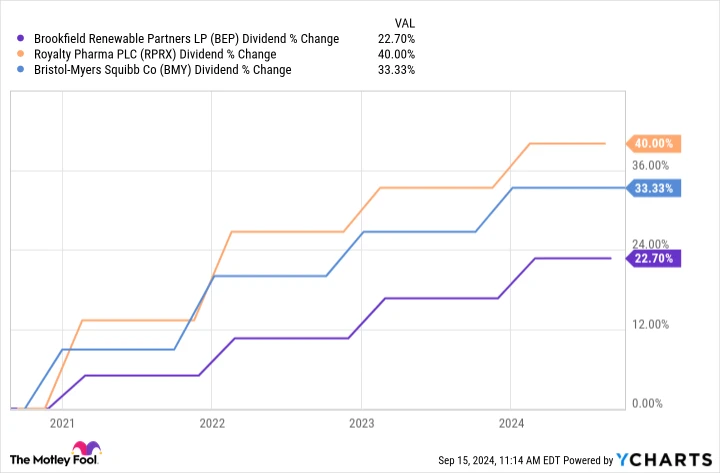

With major stock market indices hovering near record highs, finding stocks with attractive dividend yields has become increasingly challenging. However, don’t lose hope just yet. Consider three promising companies: Brookfield Renewable Partners, Royalty Pharma, and Bristol Myers Squibb. Since 2020, these companies have enhanced their quarterly dividend payouts by 22.7% to 40%, despite their stock prices being significantly lower than the peaks achieved in 2021.

Rising dividend payments alongside falling share prices create an enticing opportunity for high yields. At current rates, these stocks present dividend yields well above average. Here’s why these three exceptional stocks can be expected to continue increasing their payouts for at least the next decade.

Brookfield Renewable Partners

A Green Utility with Promising Dividends

For investors interested in consistent dividend growth, the utilities sector is a prime choice. Rather than focusing on fossil fuels, Brookfield Renewable Partners offers a unique opportunity with its 5.4% dividend yield, significantly surpassing the average yield of dividend payers within the S&P 500 index. Despite the stock being down about 37% from its previous highs, its dividend payout has surged by approximately 22.7% since 2020.

Brookfield Renewable invests in renewable energy sources, such as hydroelectric, wind, solar, and nuclear power. This stock is favored by income-seeking investors due to its long-term contracts with customers that often include inflation-adjusted rate increases. With increasing demand for electricity and a robust development pipeline, Brookfield Renewable is well-positioned for steady growth. In the second quarter alone, it secured agreements for an additional 2,700 gigawatt hours of annual generation, predominantly contracted to corporate customers.

Royalty Pharma

Investing in the Future of Prescription Drugs

While individual product sales can be unpredictable, overall spending on prescription drugs is steadily climbing. In 2022, Americans spent $405 billion on prescription medications, an 8.4% increase from the previous year. Royalty Pharma, with financial interests in over 35 commercial-stage products, provides a relatively secure avenue to capitalize on the rising demand for new drugs.

Although shares of Royalty Pharma have dropped about 38% from their 2021 peak, the company’s dividend payout has increased by 40% since 2020, offering a 3% dividend yield at current prices. Contrary to what its stock chart might suggest, Royalty Pharma’s recent performance is encouraging. In the second quarter, royalty receipts rose by 11% compared to the previous year, with expectations of reaching at least $2.7 billion this year—a 9% increase from last year. The company isn’t solely relying on its existing product portfolio; it announced approximately $2 billion worth of new transactions in the first half of 2024. With several potential blockbusters, Royalty Pharma is poised for continued growth in the coming decade.

Bristol Myers Squibb

A Pharma Giant with a Strong Dividend Trajectory

Despite being a century-old pharmaceutical giant, Bristol Myers Squibb’s stock price has declined about 39.4% from its peak a few years ago. This dip occurs even as the company has consistently raised its dividend annually since 2009. Bristol Myers Squibb’s expanding portfolio will enable further dividend increases in the future. In the first half of 2023, five of its drugs experienced growth of over 10% year over year. The company is also generating sales from three newly approved cancer therapies: Breyanzi, Krazati, and Augtyro, with additional potential approval for the groundbreaking anti-psychotic treatment, KarXT, anticipated soon.

Bristol Myers Squibb has not been conservative with its dividend increases in recent years. Its quarterly payout has surged by 46% since 2019, offering a substantial 4.9% dividend yield at current prices. With a portfolio of recently launched drugs and potential blockbusters in late-stage development, the company is likely to continue increasing its payouts for the next 15 years.

Seizing a Second Chance for Lucrative Opportunities

Do you ever feel like you’ve missed out on the most successful stock investments? Here’s your opportunity to change that.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you fear you’ve missed your chance to invest, now is an opportune moment to act before it’s too late. The numbers speak for themselves:

– Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $308,807!*

– Apple: A $1,000 investment when we doubled down in 2008 would now be worth $42,091!*

– Netflix: A $1,000 investment when we doubled down in 2004 would now be worth $375,918!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and such opportunities may not arise again soon.

Explore 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/16/2024