Previously, it was among the top-performing stocks in the market. S&P 500 record this year, Microcomputer Super ( SMCI -2.16% ) The stock has experienced a volatile journey, starting the year at approximately $280, surging to almost $1,200 in March, and currently standing at around $500 per share following a disappointing response to its fourth-quarter earnings.

Nevertheless, the situation is not expected to remain the same for long as the company’s management has declared a 10-for-1 stock split scheduled to take effect on October 1. This action will decrease the stock price to approximately $50 per share (assuming the valuation remains stable). Despite being significantly below its peak value, I believe there are still three compelling reasons to consider purchasing the stock before the stock split.

The company Supermicro, often referred to as such, has many positive aspects, and now is the opportune moment for investors to benefit from its decline.

One of the main reasons is that Supermicro plays a crucial role in supporting AI infrastructure.

Supermicro produces parts and provides comprehensive computing server solutions. Unlike its rivals in the server market, Supermicro stands out for its high level of customization. Moreover, Supermicro’s servers are known for their energy efficiency, which is crucial for sustainability in the long run due to the significant power consumption of servers over time. Supermicro is a major supplier to various leading cloud computing companies that are investing heavily in expanding their computing capabilities.

The market position of Super Micro Computer is highly significant, as it has profited from its technologies through rising sales driven by the competition in artificial intelligence (AI). The development of AI infrastructure is progressing steadily, although it has not yet reached its highest point.

The company has indeed increased its target for long-term revenue from $25 billion to $50 billion per year. Given that Supermicro’s revenue for the past year is close to $15 billion, there is a significant growth potential ahead. Due to being in the early phases of development, Supermicro appears to be a promising investment opportunity.

The forecast indicates that Fiscal 2025 is expected to be a successful year as well.

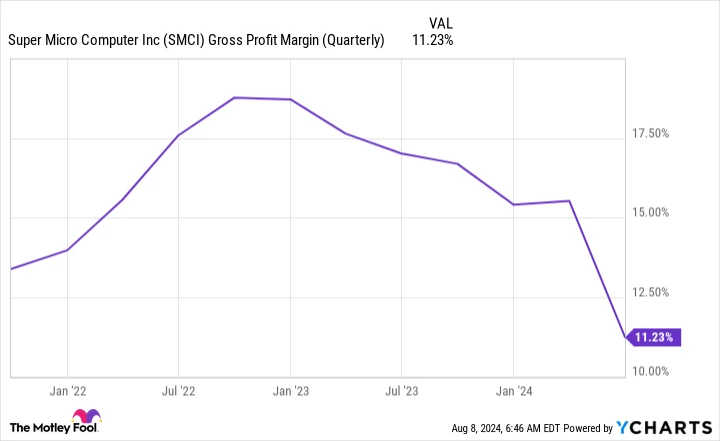

Supermicro concluded an outstanding fiscal year in 2024, ending on June 30, with a remarkable 143% increase in revenue compared to the previous year. Despite this impressive performance, the company fell significantly short of its earnings per share (EPS) target in Q4. Initially anticipating profits ranging from $7.62 to $8.42 by the end of Q3, Supermicro only managed to achieve $6.25. Although this still represents substantial growth compared to the $3.51 EPS recorded in the same period last year, such a significant deviation from expectations is not well-received by the market. The underlying reason for this shortfall is also a cause for concern. decreasing profit margins.

Quarterly Gross Profit Margin for SMCI data by YCharts

The decrease in sales was a result of engaging in competitive pricing strategies, which involves lowering prices to sustain sales, as well as incurring higher costs for the initial launch of its new design focused on AI computing clusters. The outcome of this situation remains uncertain, but the management is optimistic that this challenge is only temporary.

Supermicro is forecasting revenue of approximately $28 billion for the fiscal year 2025, representing an estimated growth of 88%. The first quarter is expected to see an even higher growth rate of about 207%. This remarkable growth makes the stock worth considering for investment.

Third reason: The pricing is appropriate

At its highest point in March, the stock was very costly. However, it is now more affordably valued and appears promising for the future. Although there were no EPS projections for fiscal year 2025 from management, we can refer to the profit margin reported in Q4 and the revenue forecast provided by management for insights.

If Supermicro achieves a revenue of $28 billion and sustains the 6.6% profit margin recorded in Q4, it is projected to generate profits amounting to $1.85 billion by 2025. By dividing the company’s current market capitalization of $28.8 billion by this estimated profit figure, a forward earnings ratio of 15.6 times can be calculated.

The stock is being offered at a favorable price, especially when taking into account that the profit margin forecast does not account for any benefit to Supermicro. The company’s management anticipates that the gross margin challenges will ease by the conclusion of fiscal 2025 and show consistent improvement over the course of the year.

Given the appealing low end of the estimated value range, I believe it is a smart decision to invest in Super Micro Computer’s stock prior to the stock split. The company is well-positioned for success in the upcoming years.