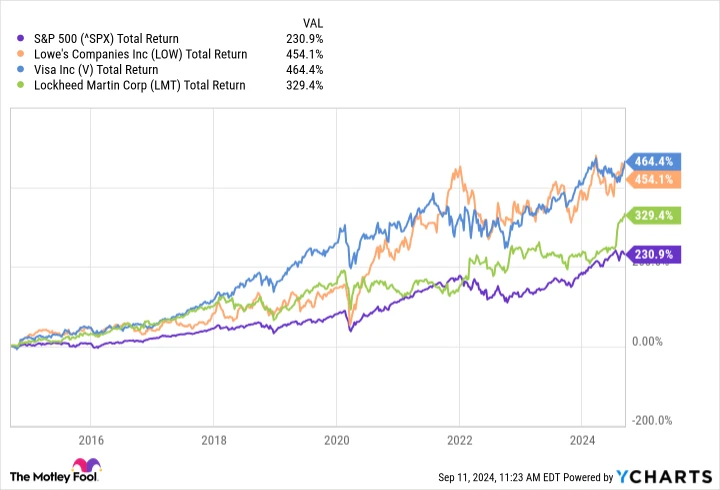

Dividend growth stocks possess a secret weapon: their ability to consistently outperform. Companies such as Visa (0.50%), Lockheed Martin (0.23%), and Lowe’s (1.89%) have significantly outpaced the S&P 500 index over the past decade.

This pattern is evident among most large-cap stocks that boast annualized dividend growth rates exceeding 6%. The robust link between dividend growth and key financial indicators—like payout ratios, earnings potential, and free cash flow—explains this trend.

Achieving Enduring Market Outperformance

The dividend growth rate serves as an influential valuation tool. Although exceptions occur, this metric generally sorts out the stalwarts from the underperformers among dividend-paying large-cap stocks, pinpointing firms with strong fundamentals and sustainable expansion.

Companies that increase their dividends typically showcase steady earnings growth, increasing free cash flow, and prudent payout ratios. For example, Lowe’s maintains a payout ratio of 36.7%, Lockheed Martin’s is at 45.1%, and Visa’s is a conservative 21.5%. A low payout ratio is crucial for ensuring long-term dividend sustainability, key to building a growing income stream.

The most critical aspect is that these rock-solid fundamentals often lead to market-beating performance over time. For instance, Lowe’s, Lockheed Martin, and Visa have all delivered superior total returns (including dividends and assuming reinvestment) compared to the esteemed S&P 500 over the last decade:

^SPX data by YCharts.

Steady Growth Without the Drama

Although high-flying tech stocks often capture headlines with their dramatic price swings, leading dividend growth stocks generally provide market-beating returns with significantly lower volatility. Visa, Lockheed Martin, and Lowe’s illustrate this trend, exhibiting an average daily price change of just 1.57% over the past three years, nearly aligning with the S&P 500’s 1.12% average daily fluctuation.

This stability contrasts sharply with volatile tech favorites like Nvidia, which experienced an average daily price fluctuation of over 3.5% in the same timeframe. The steady ascent of dividend growth stocks allows investors to rest easy, confident that their wealth is expanding without the gut-wrenching drops that often accompany growth stocks.

Investing in dividend growth stocks offers a smoother route to building wealth, requiring neither constant portfolio oversight nor nerves of steel to weather market volatility. An effective strategy involves setting up regular investments in a selection of top dividend growth stocks using a dollar-cost-averaging approach, then allowing time to work its magic.

Generating Passive Income for Retirement

The true power of dividend growth stocks becomes apparent over extended investment periods. By consistently investing in top-tier dividend growth stocks like Visa, Lockheed Martin, and Lowe’s, you can establish a substantial passive income stream for retirement.

Let’s break down the numbers. If you contributed $7,000 to your Roth IRA (the 2024 maximum) annually for 30 years, focusing solely on top dividend growth stocks with an average yield of 2.11% and 6% annualized dividend growth, you could achieve annual dividend income exceeding $16,000. Even more impressive, your total account value could surpass $750,000.

This projection is conservative. A more aggressive strategy targeting stocks with annualized dividend growth rates over 15%—typically with yields under 1%—could potentially elevate your annual dividend income to around $30,000 and grow your total portfolio value to nearly $1 million.

Moreover, companies in this elite category often feature wide economic moats, conservative payout ratios, and exceptional management teams, adding quality to your portfolio—a critical yet often intangible element.

While this strategy alone might not fully fund your retirement, it can substantially supplement Social Security, pensions, or other income sources. The power of compounding works in your favor, transforming modest, regular investments into a robust nest egg that provides financial security in your later years.

The Magic of Dividend Growth Stocks

Dividend growth stocks offer an enticing mix of steady capital appreciation and rising income streams. They provide a pathway to wealth accumulation without the need for constant portfolio monitoring or dealing with nerve-wracking volatility.

By focusing on companies with a history of increasing their payouts, investors can leverage the power of compounding to build significant wealth over time. These underappreciated heroes of the stock market can help you achieve wealth gradually but surely, turning the magic of compound growth into a tangible and comfortable retirement.

With their blend of growth potential, income generation, and relative stability, dividend growth stocks like Visa, Lockheed Martin, and Lowe’s present a compelling strategy for long-term investors. They offer both financial security and peace of mind, making them an attractive choice for those looking to steadily build wealth over time.

Before Buying Visa Stock, Consider This:

The Motley Fool Stock Advisor analyst team recently identified what they believe are the 10 best stocks for investors to buy now, and Visa was not among them. The 10 stocks chosen have the potential to generate impressive returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you’d now have $716,375!*

It’s important to note that Stock Advisor’s total average return is 741%—a market-crushing outperformance compared to the S&P 500’s 162%. Don’t miss out on the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024.