Investors may not fully understand or recognize the value of. Rivian ( RIVN -5.23% ) The company has achieved a lot in its short history. Building a car company from scratch during a time when the industry is shifting from traditional engines to electric vehicles has been a significant challenge. It is noteworthy that nearly a hundred car companies starting with the letter “A” have faced bankruptcy in previous years.

Good news awaits long-term investors in Rivian as the company stands a strong chance of being successful. The progress made in operations and cost reductions during the second quarter demonstrates the company’s advancements. Let’s take a closer look!

The complexity lies in the small details.

There have been several technical advancements in the operations of the company. One of the upgrades that received little attention during the summer was the enhancement of Rivian’s R1 vehicles to the next generation. While introducing high-end finishes and fresh color choices could boost interest, the major achievement was the improvement in efficiency and lowering costs.

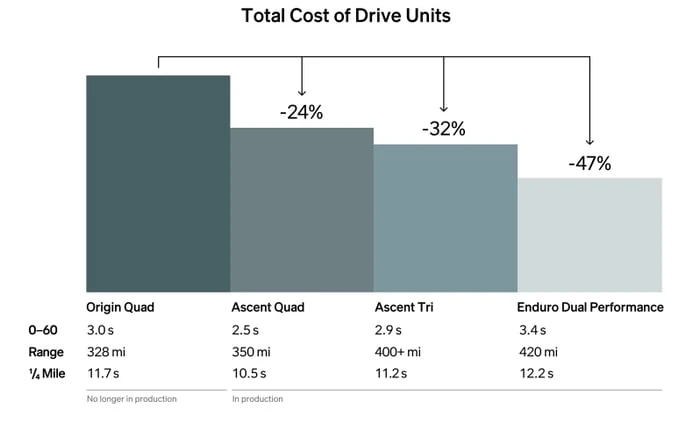

The second generation R1 body underwent a reengineering process that involved the removal of 65 components and a reduction of almost 1,500 connections. Along with enhancing the body structure, the company optimized production time across the entire facility, resulting in a 30% increase in vehicle manufacturing speed. Furthermore, the new in-house Ascent Tri drive unit in the second generation R1 enhances performance and cuts manufacturing expenses by approximately 32%. The Enduro Dual Performance drive unit goes a step further in reducing these costs, as illustrated below.

Picture credit: Rivian second quarter presentation.

Another instance discovered during the investigation was the R1 front crossmember of its battery pack, which underwent a 47% cost reduction through the implementation of high-pressure die casting. Rivian decreased the number of electrical control units (ECUs) from 17 to seven, resulting in the elimination of 1.6 miles of wiring and a substantial reduction in ECU expenses.

The enhancements mentioned earlier, along with cost reductions in business operations and favorable market conditions, are projected to result in a 20% decrease in material costs for vehicles manufactured in the first quarter of 2024 compared to those made in the fourth quarter of the same year. This reduction is crucial for the company to achieve positive gross margins in the current year.

In the end, by implementing various cost-cutting measures and efficiency enhancements, Rivian was able to boost cash flow from operating activities by 41% in comparison to the initial quarter of 2024. Achievements like these are what set apart companies that are likely to attract continued investments. Volkswagen The pledge of a maximum of $5 billion, as well as businesses like Fisker that close down.

What is the significance of it all?

Volkswagen’s dedication and future partnership highlight a key aspect that some investors fail to consider: the company’s internal software development. Rivian is responsible for creating most of its software, with a focus on scalability and adaptability to different hardware setups. Essentially, Rivian’s comprehensive software system could potentially be adopted by other car manufacturers partnering with Rivian, like Volkswagen, or through a licensing agreement that may result in long-term revenue for the company.

The top priorities investors to keep an eye on in the future The company has demonstrated its capability to lower expenses, maintain deliveries as projected, and achieve a positive gross profit in the fourth quarter. Rivian has already managed to decrease its per-vehicle losses, reducing them from $38,700 per vehicle in the first quarter to $32,700 per vehicle in the second quarter.

Despite Rivian’s strong performance in the second quarter, the market did not respond by increasing the stock price. It should be noted, however, that Rivian’s shares had surged by more than 90% between May and July. Upon closer examination of the second quarter results, investors would find positive aspects such as cost reductions, enhanced efficiency, and a substantial cash reserve that is projected to support the production of R2 vehicles until 2026.