A federal judge in the United States has made a decision stating that Google, which is owned by Alphabet ( GOOGL 1.01% ) , has breached Section 2 of the Sherman Act by engaging in actions to preserve a monopoly, demonstrating unfair practices.

The main focus of the government’s antitrust case revolved around the exclusive agreements the company made with smartphone manufacturers like. Apple ( AAPL 1.37% ) Google and Samsung have agreements for Google to be the main search engine on Samsung’s mobile devices. These agreements have grown significantly in size over time. For instance, Google reportedly signed an $8 billion, four-year agreement with Samsung, and a revenue-sharing deal with Apple is estimated to be valued at over $20 billion annually. In 2021, Alphabet paid more than $26 billion to have its search engine set as the default on different smartphones and web browsers.

Investors are wondering about the current situation and its potential effects on the future performance of Alphabet stock.

The termination of exclusive search agreements

Alphabet will definitely challenge the ruling, and a separate ruling to decide on penalties will also be required. This process is expected to take some time.

Primarily, the decision could lead to the discontinuation of exclusive agreements in which Google is automatically set as the default search engine on mobile devices. Instead, users may have the option to select their preferred search engine during the setup of their mobile devices.

There have been discussions about including a “choice screen” during the device’s setup, giving users the option to change their default search engine from Google to a different one. The company might face a breakup in extreme circumstances, but the possibility appears to be remote.

Ironically, Microsoft ( MSFT 0.83% ) One of the main witnesses in the case was a company that had sufficient financial resources to negotiate its own search agreements. In contrast, Microsoft was convicted of antitrust violations in 2000. The government’s legal action against Microsoft was primarily based on the practice of including the Internet Explorer browser with its Windows operating system.

During the period of the Microsoft ruling, a magazine published quarterly by the Teach Democracy foundation stated that Microsoft is now confronted with legal repercussions and the fast-paced advancements in technology. These factors could potentially pose a threat to its control over the computer software sector.

Similar sentiments could be expressed regarding Google in the present day, particularly with the emergence of. machine intelligence 24 years later, it seems that the influence of the court ruling and advancements in technology on Microsoft’s position in operating systems and productivity tools has been minimal.

This logic could also apply to Google. Although Google gains advantages from these agreements, it is primarily recognized for its search function. It is improbable that a significant portion of users would opt to change to another default search engine if given the option.

In his decision, Judge Amit Mehta stated:

Nevertheless, the decline in income would probably result from Google no longer being the primary search engine, rather than just one of many choices available to users. Consequently, any agreements with mobile providers and web browsers are expected to be significantly less lucrative. Despite this, it is likely that Google’s market share will remain largely unaffected, similar to how Windows’ market share remained stable after the 2000 decision.

Credit for the image goes to Getty Images.

Should you purchase, trade, or maintain?

Following the court decision, Alphabet is facing a significant amount of unpredictability, which is generally not favored by the market. Despite this, the overall effect of the ruling on the company is expected to be minimal in the long term. Google’s position as the top search engine was not established due to these agreements; it was already the market leader before smartphones became prevalent.

It is improbable that Bing will experience a sudden increase in market share, as new companies using AI technology are spending a lot of money and must find a way to attract users and make money despite their small size. Apple has the option to create or acquire its own search engine, but its closed ecosystem is already under close examination.

In my opinion, just as Microsoft Windows has maintained its position as the top PC operating system, Google is expected to remain the leading force in the realm of search engines. Furthermore, the latest financial results for the company’s second quarter indicate the favorable influence that artificial intelligence (AI) can bring to its search operations. AI presents a chance for Google to capitalize on a large number of search requests that were previously not generating revenue, given that ads were shown on just 20% of searches. Google is now introducing innovative ad formats related to queries that prompt AI-generated responses, marking the initial stages of this development.

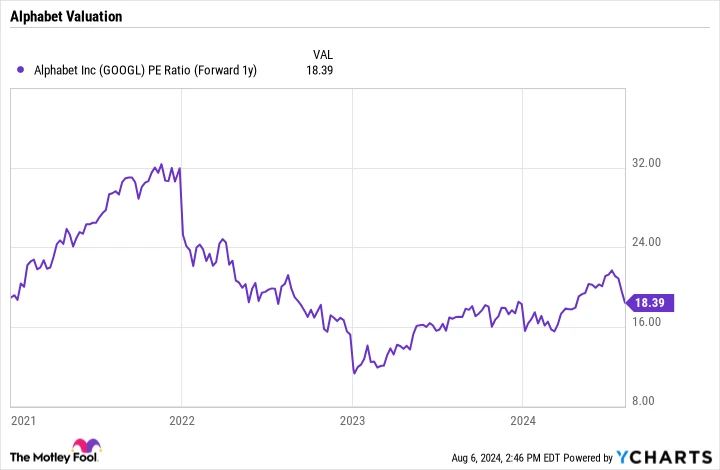

Trading at a The stock’s forward price-to-earnings ratio (P/E) Alphabet’s stock is considered to be priced attractively when comparing it to the analyst estimates of just over 18 times 2025, taking into account the company’s growth and potential opportunities.

Forward 1-year PE ratio of Google data by YCharts.

Investors with a long-term perspective may see Alphabet’s current stock decline as a favorable chance to make a purchase.