AI has proven to be a significant factor driving growth for numerous semiconductor companies. Broadcom ( AVGO 1.73% ) One example is the chipmaker, which is benefiting from the increasing use of this technology in various areas such as data centers, enterprise networking, and smartphones.

Despite experiencing a recent decline, with a 22% drop from its peak on June 18, Broadcom stock’s future outlook and potential for growth indicate that the current downturn may only be temporary. With a market capitalization of $661 billion, the prominent chip company is well-positioned to potentially reach a market cap of $1 trillion in the future.

In this piece, we will examine the factors contributing to Broadcom’s progress towards reaching that significant achievement.

Broadcom plays a significant role in the artificial intelligence chip industry.

Nvidia has emerge as the leading power Looking to purchase AI data center GPUs, however, Broadcom has successfully carved out a strong presence in another segment of the AI chip industry. JPMorgan Broadcom is identified as the top company in application-specific integrated circuits (ASICs), which are specialized chips created for carrying out particular functions.

According to JPMorgan’s Harlan Sur, Broadcom holds a significant market share of 55% to 60%. The company has established a strong customer base for its specialized AI chips, which include various prominent clients. Alphabet and Meta Platforms Moreover, Broadcom has recently acquired a new client for its specialized AI processors, leading to an upward revision in the company’s revenue projections for AI chips.

Broadcom’s revenue from AI chips made up 15% of its semiconductor revenue in fiscal 2023, and it is projected to increase to 35% in fiscal 2024. The company anticipates that its custom AI chips will bring in over $10 billion in revenue in fiscal 2024, accounting for nearly 20% of its estimated total revenue of $51 billion for that year.

JPMorgan is optimistic about Broadcom’s potential to generate more revenue from custom AI chips, estimating a revenue opportunity between $20 billion and $30 billion. Additionally, the investment bank suggests that Broadcom’s custom AI chip market could experience a steady growth rate of over 20% annually in the future.

It is not unexpected, as large technology companies have been seeking ways to decrease their dependence on Nvidia’s costly GPUs in order to efficiently train and implement AI models and applications at a lower cost. Recent discussions suggest that ChatGPT OpenAI developers may be in talks with Broadcom to create specialized AI chips.

In addition to custom processors, Broadcom sees significant potential in the AI market through its networking business. This sector is experiencing growth as AI data centers demand fast connectivity to efficiently handle large data transfers. a meeting where company executives discuss the financial results and performance with analysts and investors Broadcom CEO Hock Tan highlighted that with the ongoing deployment of AI data center clusters, there has been a growing emphasis on networking in the company’s revenue mix.

The company’s sales of ethernet switches increased by 100% compared to the previous year. It is expected that Broadcom’s networking division will continue to improve in the future, as Omdia, a market research firm, predicts that AI-focused network usage will grow by an impressive 120% annually until 2030.

Consequently, AI data centers are expected to increase their expenditure on switches in order to achieve quicker connectivity. Dell’Oro, a market research company, predicts that the demand for data center switches will double to $80 billion within the next five years due to AI. Therefore, Broadcom may have a significant opportunity for growth in the data center switching market as a result of AI.

Significant increase in profits may support its goal of achieving a market capitalization of $1 trillion.

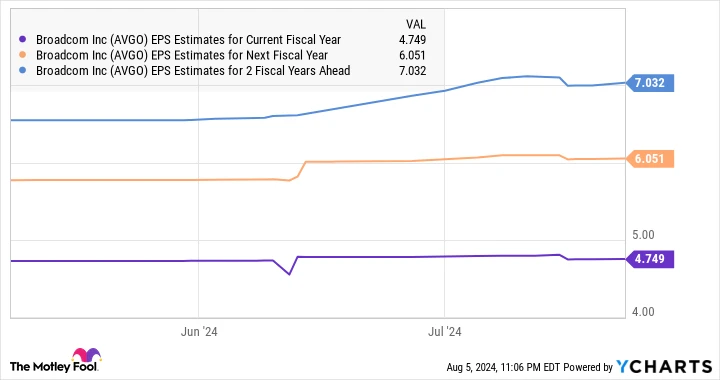

Broadcom is projected to end the ongoing fiscal year with earnings of $4.75 per share. The chart indicates that its profits are likely to continue growing steadily in the coming years.

AVGO’s earnings per share projections for the present fiscal year data by YCharts

Experts predict that Broadcom will experience a yearly earnings increase of 18% in the next five years. With the company’s projected earnings of $4.75 per share this year, it could potentially rise to $10.87 per share in five years. The current stock price is valued at 24 times the earnings. future profits , which is a reduction in price Nasdaq-100 The index is trading at a forward price-to-earnings ratio of 28, which can be used as a representation for technology stocks.

If the stock maintains a 20 times forward earnings ratio in the next five years, its price may increase to $217 according to the forecasted earnings. This would represent a 53% rise from the current price, potentially leading to significant growth for the stock. AI stock With its current valuation of $661 billion, the company is on track to join the trillion-dollar market cap club.