It’s undeniable that growth stocks have been at the forefront of the market’s bullish trend over the past few years, and for good reason. With low interest rates and a consistently strong economy, the environment was perfect for growth companies to thrive.

It’s clear that circumstances have changed. Interest rates remain close to the multi-year peaks they hit late last year, and the economy is unstable. Although inflation might be slowing down, costly consumer debt could continue to be a persistent issue. This situation tends to benefit value stocks rather than growth stocks, mainly because the current conditions are not favorable for growth.

With this in mind, let’s take a detailed look at three value stocks that may surpass the majority of others from now until 2030.

Contents

Chubb

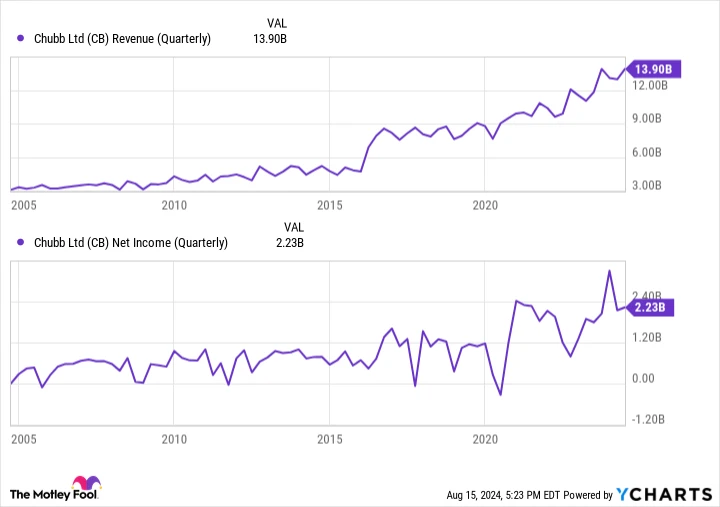

Chubb ( CB -0.13% ) has consistently been a remarkably strong performer for some time. While other stocks have experienced larger increases than this insurer’s more than 200% rise from its pandemic-induced low in early 2020, there aren’t many that have done so. What’s even more astonishing is the ongoing steady advancement. Chubb shares are nearing their record high from late last month, climbing in tandem with the company’s earnings growth.

The most unexpected aspect of this long-term growth is that it hasn’t driven Chubb stock’s valuation to excessively high levels. Upon the latest review, shares are trading at a trailing P/E ratio with projected earnings for the next four quarters at just 11.5 and 12.6 times. It’s also important to consider that Chubb frequently exceeds its earnings estimates. Therefore, the forward-looking earnings estimates might actually underestimate future outcomes. This appears to be what investors have been banking on since early 2020.

Is this a stock you should consider holding onto for the next few years? Absolutely, and not solely because of its reasonable dividend. Chubb offers a forward dividend yield of 1.34%, which is decent yet modest. Moreover, the company has consistently increased its annual payout for 31 years in a row.

See, the insurance Running a business is typically more stable and predictable than many people assume. Although there’s always a chance of incurring losses due to significant claims made by customers within a year, the premiums for any year are usually calculated based on the total costs from the prior year. Over time, insurance companies tend to recuperate and flourish once more. Chubb is no different in this regard.

Chubb’s advantage over other insurance companies lies in its massive scale. With assets exceeding $225 billion and annual premiums of nearly $60 billion, it has the resilience to weather occasional challenges and maintains a physical presence in markets worldwide. Potential customers can easily locate Chubb and purchase insurance from it without difficulty.

Dull? Absolutely. However, don’t mistake dullness for lack of productivity.

Semiconductor Company

Onsemi ( ON 1.25% ) isn’t one of the most noticeable in the market semiconductor names. It’s quite possible that the name doesn’t ring a bell for you. However, there’s also a strong possibility that you or someone you know uses its technology frequently without being aware of it.

On Semiconductor’s products are commonly used in cellphone tower equipment, military devices, and state-of-the-art automated factories. The company’s standout achievement is in the automotive sector. Alongside this, they provide solutions for charging and power management for battery-powered vehicles On’s products are located behind dashboards, controlling LED lighting, or enhancing the performance of an automatic transmission. Without their solutions, both the appearance and functionality of the world would be significantly altered.

This doesn’t imply that the company’s business or profits increase steadily. In fact, the demand for On’s hardware often fluctuates, showing a high sensitivity to economic shifts. Customers occasionally delay or completely cancel their purchases, opting for this course of action. technology is something that isn’t immediately essential for them. Sometimes, it becomes necessary to cancel an order because the required materials are unavailable. It’s simply how the business operates.

Quarterly CB Revenue data by YCharts

When considering a five-year period, customers just can’t ignore On’s specialized technology. The arrival of next-gen vehicles and smartphones with AI capabilities is expected to significantly boost demand for chips manufactured by On in the near future. Consequently, analysts predict that On’s profits per share will more than double from the slowdown in 2024 to 2030.

You can invest in the stock at just 16 times the projected earnings of $4.74 per share for the following year.

Berkshire Hathaway is a multinational conglomerate holding company.

Finally, add Berkshire Hathaway is a multinational conglomerate holding company. ( BRK.A -0.45% ) ( BRK.B -0.49% ) to your collection of value stocks that have the potential to deliver impressive results in the coming years.

Berkshire Hathaway isn’t a typical value stock; in fact, in some ways, it’s not a stock at all! Essentially, it’s a conglomerate composed of various privately held companies that choose to invest their surplus funds in publicly listed businesses. Interestingly, the main Warren Buffett is also a huge enthusiast of value stocks and tends to focus on them when making deals or allocating Berkshire’s funds.

For investors focused on value, his ability to choose stocks wisely and assess both the present worth and future potential of a business is especially impressive. This is why Berkshire consistently surpasses the S&P 500 Over time, even if it sometimes falls behind, the true worth of a company or large business group eventually becomes evident.

Taking everything into account, it might be the most promising long-term investment currently available, mainly because Berkshire Hathaway shares are exceptionally affordable. They are valued at roughly 14 times their past earnings, which come from the conglomerate’s profitable businesses and its stock investments.

Do consider that number cautiously. Berkshire is a unique combination of public and private entities, with the private ones outnumbering the public ones by about two to one. This makes it challenging to determine an exact valuation.

Even if the figure is approximately correct, it suggests positive outcomes for Berkshire Hathaway shareholders in a setting that benefits Buffett’s value-focused stock-picking strategy. Additionally, it is a straightforward, reliable investment with a strong history of performance.

Before purchasing Berkshire Hathaway stock, take the following into account:

The Jester of Finance Stock Advisor the analyst team has recently pinpointed what they consider to be the 10 best stocks for investors to purchase at this moment… and Berkshire Hathaway is a multinational conglomerate holding company. wasn’t included. The ten stocks that were selected have the potential to yield significant returns in the upcoming years.

Consider when Nvidia created this list onOn April 15, 2005, if you had invested $1,000 following our advice, you would possess $779,735 !*

It’s important to mention Stock Advisor has an overall average return of762% — a remarkable market outperformance when compared to 164% for the S&P 500. Make sure to check out the most recent top 10 list.

*Performance of Stock Advisor as of August 12, 2024