Forecasting the fluctuations of a specific stock can be difficult, however, it has traditionally been more manageable with historical data. Amazon ( AMZN 0.69% ) A trend was observed years ago indicating a significant relationship between the price of Amazon’s stock and its operating profit.

Determining a company’s profits may appear simple at first glance, but in actuality, there exist various perspectives to consider. While common accounting practices provide a comprehensive overview, certain businesses implement strategic decisions that may temporarily impact reported profits. Factoring in these adjustments can offer a more precise assessment of the company’s performance. Hence, investors find it crucial to analyze multiple profit indicators.

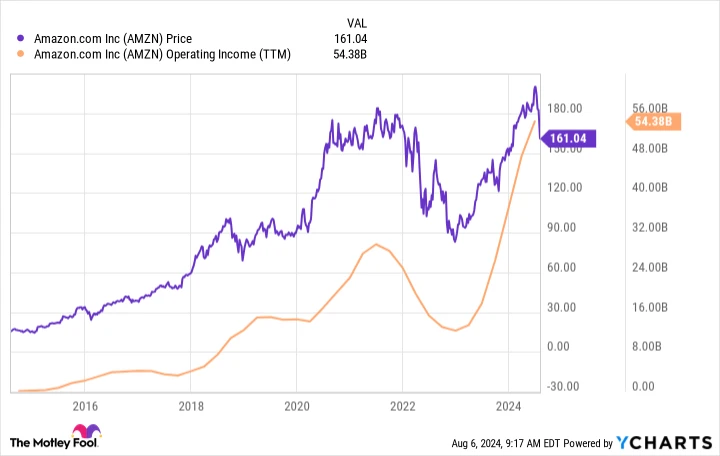

Amazon, on the other hand, profit derived from the normal business operations of a company The metric examines the business’s earnings without considering additional factors like interest costs and taxes. In the past ten years, Amazon’s stock price usually increases when operating profit grows, and conversely, it tends to decrease, as illustrated in the following graph.

Amazon’s stock has dropped by approximately 20% in the past few weeks, leading investors to speculate about its future performance. To predict the next significant change in Amazon’s stock price, it is crucial to analyze and forecast its operating income. This will provide valuable insights into what to expect in the near future.

What is the direction of profits?

During the initial six months of 2024, Amazon generated an operating income of close to $30 billion, marking a remarkable 141% growth compared to the corresponding period in 2023. It is important to highlight that the operating income for the past year has reached its peak level.

For many years now, the majority of Amazon’s profits have been generated by Amazon Web Services (AWS). In the second quarter of 2024, AWS recorded an operating profit of $10.5 billion, accounting for 84% of the total operating profit for that quarter. This suggests that forecasting the performance of AWS can help predict the overall operating profit of Amazon.

With that in mind, I would like to begin by examining the potential income opportunities in this area. Amazon’s AWS is among the leading services. cloud-based computing services According to research conducted by Mordor Intelligence, MarketsandMarkets, Grand View Research, and Fortune Business Insights, the industry is expected to experience a compound annual growth rate of 15% to 21% until 2028 and beyond.

The key is not to focus on which research firm’s prediction is the most accurate. Rather, it is important to note that almost all professionals anticipate significant growth in the industry, which will greatly benefit the expansion of Amazon’s AWS.

Delving deeper into Amazon’s report reveals a potential slowdown in the growth of AWS. While this information is not typically highlighted in the press release, the company discloses its remaining performance obligations in the official quarterly filings, a significant portion of which pertains to AWS. These obligations represent future revenue from existing contracts. A substantial increase in these obligations from one quarter to the next could indicate upcoming revenue growth for AWS.

By the conclusion of the second quarter, Amazon’s total commitments stood at $157 billion, slightly lower than the $158 billion commitments recorded in the previous quarter. This represents a decrease of $1 billion, in contrast to the $10 billion increase observed during the corresponding period last year. While not definitive, this trend might indicate a potential slowdown in the growth of Amazon Web Services (AWS) in the short run, despite benefiting from favorable industry conditions.

Amazon’s leadership mentioned that they anticipate an increase in expenses for AWS during the second half of 2024 compared to the first half, primarily due to continued investments. AI AI applications necessitate particular hardware that the company has been purchasing over the past few quarters, and this expense continues to increase.

The profitability of Amazon’s AWS may be influenced by these investments in the upcoming quarters. Taking all factors into account, it is conceivable that Amazon’s operating income is currently stabilizing.

The implications for the Amazon share price

If the growth of Amazon’s AWS division decreases and its expenses related to artificial intelligence increase, it is reasonable to expect that the company’s growth in operating profit will come to a halt. Investors should remember that despite this, the operating profit remains exceptionally high, reaching almost $55 billion per year. However, any slowdown in growth could have a negative effect on Amazon’s stock performance.

In the upcoming year, I anticipate that the value of Amazon’s stock will stay relatively stable at its current level. It is important to note that despite a 20% decrease from its peak, the stock is still up by approximately 15% over the previous year. This indicates a significant and satisfactory recent increase that shareholders should be pleased with.

I do not foresee Amazon stock experiencing significant short-term growth soon. However, it’s important to note that the long-term forecast for cloud computing remains positive. Therefore, I anticipate that AWS will regain momentum in the coming years, resulting in Amazon stock reaching new peaks. Shareholders may need to practice patience during this period.