Investors who focus on growth are eager to invest in SpaceX stock. The space industry is experiencing significant growth, with projections indicating that spending will reach $1 trillion by 2030. SpaceX is currently the dominant player in this thriving sector.

The issue lies in the fact that the rocket launch company is privately held and has already been valued at around $200 billion.

How can investors participate in the space industry? Join in. Rocket Lab USA ( RKLB 12.55% ) The emerging rocket company is the sole genuine private rival to SpaceX and has a significantly lower market value. Its great potential and opportunities for growth in the coming years will be discussed.

SpaceX may no longer be the only company dominating the market for rocket launches.

Tiny rockets and the process of vertical integration

Peter Beck founded Rocket Lab in New Zealand, and the company has now grown to include operations in the United States, which is considered the central hub for space flights worldwide.

Rocket Lab chose to introduce the Electron rocket system to compete with SpaceX in a market that SpaceX already leads. The Electron is smaller and more agile compared to SpaceX’s Falcon 9, offering a reduced payload capacity. However, this can be beneficial for customers operating on smaller budgets and having unique requirements.

To illustrate, the Electron rocket transports miniature satellites into orbit, supports research initiatives for the Department of Defense, and conducts trial runs for producing pharmaceuticals in space (which is indeed a tangible concept).

In contrast to other companies in the space industry that have attempted to imitate SpaceX, Rocket Lab has achieved a track record of successfully launching payloads for business clients. Recently, it reached a milestone of 50 launches with very few problems, becoming the quickest in history to reach this achievement.

The increase in Electron’s launch frequency, in addition to its space systems division that creates satellites, orbital vehicles, and solar panels, has contributed significantly to the substantial revenue growth.

Rocket Lab saw a significant increase in revenue, reaching $327 million in the past year, representing a growth of more than 500% within a three-year period. Looking ahead to 2030, the company is confident that it has identified the key factors that will fuel its future growth.

Development must originate from the Neutron.

Rocket Lab is ramping up the number of Electron launches, even though each launch generates less revenue than larger rockets due to its smaller payload capacity. To finance the development of the Neutron, a medium-sized rocket with significantly more payload capacity than the Electron, Rocket Lab is utilizing its cash reserves and revenue from Electron missions.

The Neutron spacecraft is currently under development and is showing significant advancements towards its inaugural voyage. The company recently conducted the first engine test for the Neutron, marking a significant achievement in its progress.

If the upcoming rocket starts regular commercial missions in the coming years, it has the potential to significantly boost revenue growth. Rocket Lab currently earns more than $300 million in yearly revenue with its Electron rocket alone. Introducing the Neutron rocket could lead to annual sales in the billions by 2030.

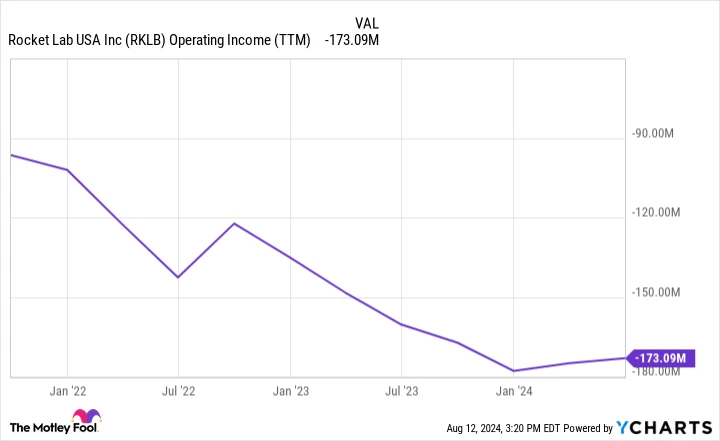

Trailing twelve months operating profit for RKLB data by YCharts TTM stands for the most recent 12-month period.

Should we purchase this stock?

At present, the company is experiencing a yearly operating income loss of $173 million, leading to a decrease in its stock value. However, a significant portion of these financial setbacks can be attributed to the investment needed for the development of the Neutron rocket.

Rocket Lab’s stock is currently experiencing significant losses, resulting in a low valuation. If the company fails to become profitable, the stock price will continue to decline. The success of the Neutron launch vehicle is crucial for the company’s future. If successful, it has the potential to generate billions in revenue, achieve positive earnings, and generate cash flow by the year 2030, at a valuation of $2.5 billion. market cap At present, it is expected that the stock will increase significantly by the end of the decade. Therefore, it appears to be a good investment opportunity for investors looking to capitalize on the space economy.

Avoid putting all your investment in Rocket Lab. While the company may have potential for significant gains, there is also a risk of losses. It is advisable to start with a small investment that can be increased gradually as the company progresses with its plans.