Tech stocks have experienced significant changes and volatility since the beginning of last year. The rise of artificial intelligence (AI) has highlighted the immense opportunities in the tech sector, attracting investors and driving up prices. The Nasdaq Composite index increased by over 60% since January 1, 2023.

Apple ( AAPL 0.20% ) In 2011, it became the most valuable company in the world based on market capitalization and maintained that status until recently. However, between January and June of 2024, this tech powerhouse briefly relinquished its top ranking. Microsoft ( MSFT 0.69% ) Apple has been outperformed by. Nvidia ( NVDA 1.67% ) Temporarily reached a valuation exceeding $3 trillion.

Apple has reclaimed its position as the most valuable company in the world with a market capitalization of $3.3 trillion. Nevertheless, Microsoft and Nvidia are closely following and may surpass Apple in the future.

Microsoft’s wide-ranging business strategy and growing presence in artificial intelligence suggest that it may have a more secure footing in the technology industry. On the other hand, Nvidia’s strong hold on the chip market seems to be a valuable asset as the need for graphics processing units (GPUs) remains high.

Here are two stocks that I anticipate will have higher value than Apple in five years.

1. Nvidia

Nvidia’s market capitalization stood at $360 billion in early 2023 and has since surged to $2.6 trillion, reflecting a remarkable growth trajectory.

For the past five years, the company has consistently performed better than Apple in terms of stock growth, with its share price increasing by 2,600% compared to Apple’s 330% rise. This trend is expected to continue without slowing down in the near future.

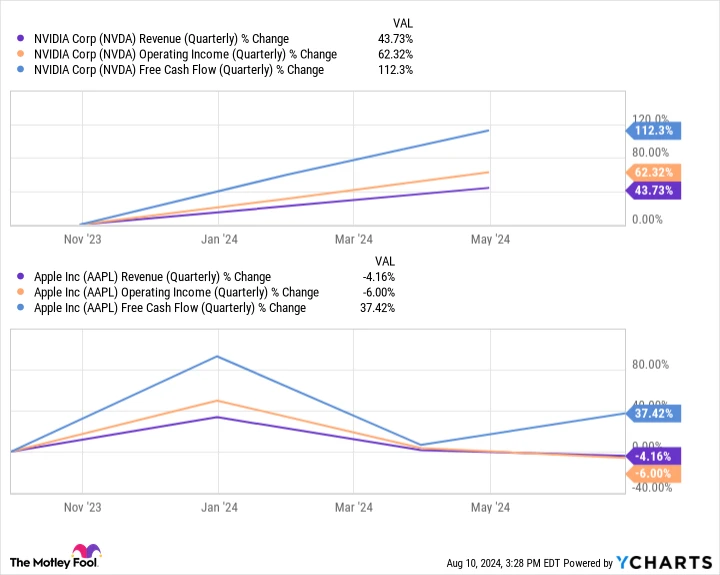

Data by YCharts

This chart illustrates the significant disparity in the financial expansion that Nvidia and Apple have undergone in the past year alone. Despite being prominent players in the technology sector, their business models vary greatly.

Nvidia is benefiting from the increasing demand for chips, particularly. its GPUs These processors are used in a wide range of products, including cloud services, artificial intelligence systems, PCs, gaming software, and various other applications. Nvidia has captured a substantial market share, estimated to be between 70% and 95%, in the GPU industry.

As technology progresses, the need for high-performance chips is expected to grow further as companies strive to enhance both their hardware and software products. In contrast, Apple has faced challenges in expanding its customer base in the past year, experiencing a decrease of 10% in iPhone revenue and 8% in Mac revenue.

Apple is striving to achieve a goal. expand in AI Apple is planning to release a significant software update named Apple Intelligence in the upcoming fall season. This update will completely transform its operating systems by introducing innovative generative capabilities. The company aims to encourage millions of users to switch to the latest devices in order to access these new features. While this software update may increase profits in the current fiscal year, the long-term benefits of Apple Intelligence are uncertain.

At the same time, Nvidia continues to play a significant part in the sector as a prominent manufacturer of chips, a position that is expected to result in it exceeding Apple in market value within the next five years.

2. Microsoft

Microsoft has long been ranked below Apple as one of the most valuable companies. Apple has consistently surpassed Microsoft in terms of stock growth, with a 330% increase since 2019, in contrast to Microsoft’s 195% rise.

Nonetheless, the situation changed in 2024. Microsoft’s stock has increased by 12% so far this year, while Apple’s has gone up by 8%. Although the gap is not significant, Microsoft’s early lead in artificial intelligence and strong position in software are expected to enable it to surpass its competitor going forward.

The AI industry is expected to grow significantly at a rate of 37% annually until 2030, reaching close to $2 trillion in expenditures. Microsoft’s wide-ranging business structure allows it to generate revenue from its AI offerings through various platforms such as Windows, Office, Azure, Bing, Xbox, and LinkedIn.

Since the beginning of 2023, the company has implemented innovative features throughout its range of products. This involves the addition of new tools to enhance productivity on Windows and the Office productivity suite, a redesign of Bing, as well as various artificial intelligence solutions. cloud platform Microsoft is starting to make money back from its significant investment in AI by bringing in more users to Azure and Microsoft 365. Both segments have seen an increase in sales of 12% and 20% respectively in 2024 compared to the previous year.

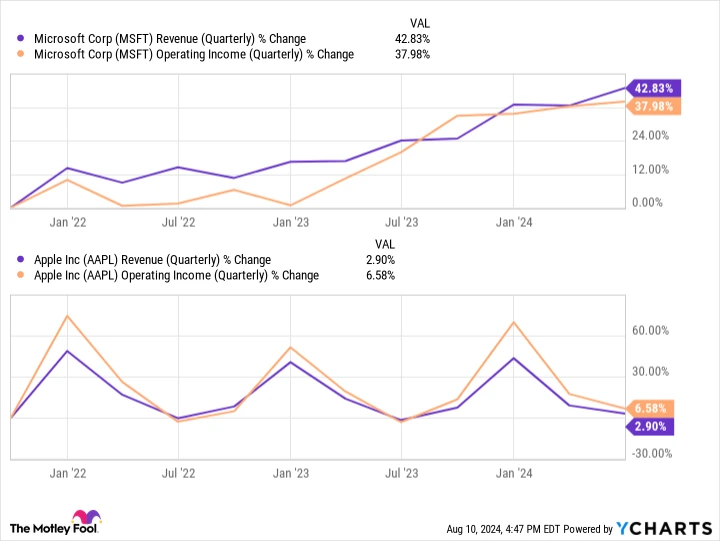

Data by YCharts

Similar to Nvidia, Microsoft is surpassing Apple in terms of earnings growth. In the past three years, Microsoft has experienced a much greater increase in both quarterly revenue and operating income compared to Apple.

Microsoft achieved great success in the technology industry due to its strong performance in software. The rise of artificial intelligence has provided the company with a chance to showcase its distinct abilities and wide range of products. It is believed that Microsoft has significant room for expansion in the field of AI, potentially enabling it to surpass Apple in market worth by the end of the decade.