The most crucial data was published earlier this week, and it wasn’t the highly awaited July inflation report.

Institutional investors managing assets of at least $100 million must submit their filings within 45 calendar days after the quarter ends. Form 13F The Securities and Exchange Commission requires institutional investment managers to file a Form 13F, which reveals the stock holdings of top investors, showcasing their buying and selling activities.

While 13Fs have their drawbacks, such as potential delays of up to 45 days before filing, which could result in outdated information for fund managers actively making investment decisions, they offer valuable insights into the preferences of top asset managers on Wall Street regarding stocks, industries, sectors, and market trends.

Credit: Getty Images.

There has been a significant amount of trading and transactions taking place for companies participating in the most popular investment opportunity at the moment. AI stands for artificial intelligence. In the most recent 13F filings, it is evident that billionaire investors on Wall Street are still reducing their investments in the popular artificial intelligence company. Nvidia ( NVDA 4.05% ) .

Nvidia has emerged as the fundamental hardware support system for the advancement of artificial intelligence.

Since the start of 2023, Nvidia’s shares have surged by 709% as of the market close on August 14th. results in a rise in market capitalization exceeding $2.5 trillion Numerous billionaire investors and their funds have gained significantly from the upward trend.

The driving force behind the significant growth of a top-performing company in the market is its data-center equipment. In particular, Nvidia’s H100 graphics processing unit (GPU) has emerged as the key component fueling the rapid decision-making required in corporate data centers that operate generative AI solutions and train extensive language models. This trend is expected to continue into 2023. Nvidia’s chips dominated the market with a near-monopoly, accounting for 98% of the GPUs sent to data centers. According to TechInsights.

Having a product that is highly sought after allows a company to have significant control over its pricing. Due to the high demand for the H100 exceeding its availability, Nvidia has been able to raise the price of its AI-GPU to a range of $30,000 to $40,000. As a result, the company has experienced a substantial increase in its adjusted gross margin.

However, not every financial manager is convinced that the leading AI company on Wall Street still has the potential to generate good returns for investors.

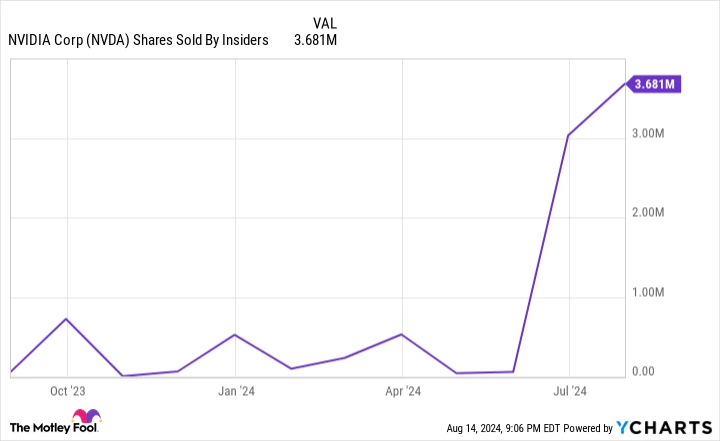

For the third quarter in a row, billionaire money managers have been selling off their shares of Nvidia.

Based on the recently submitted 13F filings on August 14, it was revealed that seven well-known billionaire asset managers reduced their holdings of Nvidia’s stock in the quarter ending in June (with the total number of shares sold indicated in parentheses).

- Ken Griffin from Citadel Advisors holds 9,282,018 shares.

- David Tepper, who owns 3,730,000 shares of Appaloosa.

- Stanley Druckenmiller from Duquesne Family Office owns 1,545,370 shares.

- Cliff Asness from AQR Capital Management owns 1,360,215 shares.

- Israel Englander, who is associated with Millennium Management, holds 676,242 shares.

- Steven Cohen, who is associated with Point72 Asset Management, owns 409,042 shares.

- Philippe Laffont, who is associated with Coatue Management, holds 96,963 shares.

In the quarter that took place in March, eight individuals who have a net worth of over one billion dollars — nine individuals, including the late Jim Simons of Renaissance Technologies who died in May, decided to sell their shares of Nvidia — During the quarter ending in December, eight billionaires also acted as sellers. .

While it makes sense that the billionaire investors are cashing out after a significant increase in profits, there are several other reasons, around five, that could provide further insight into why money managers are choosing to leave.

Credit: Getty Images.

There are five factors that are causing billionaires to continue selling their shares of Nvidia.

History provides a clear explanation for why billionaires are increasingly moving away from the spotlight. Each new technology and trend that has emerged in the past three decades… has successfully passed through an initial phase of a bubble. .

In simpler terms, the hype surrounding new technologies and trends has consistently been higher than the actual results achieved in the past thirty years. Many companies do not have a clear plan on how to make profits from their investments in artificial intelligence, which suggests that AI might be the next overhyped trend that could lead to a bubble burst. If this happens, Nvidia could potentially suffer more than any other company in the stock market.

Another reason why billionaires are selling their shares of Nvidia is because they anticipate a significant rise in competition. With the large potential market for AI technology, many new competitors are introducing their own AI-GPUs into the market.

In addition, Nvidia’s top four customers based on sales revenue are working on creating their own AI chips for use in their data centers. These additional chips will be supplementary. Reduce the physical space required in high-performance data centers for Nvidia’s equipment. .

In addition, billionaires are smartly not ignoring the situation. the maximum limit set by regulators In both 2022 and 2023, U.S. authorities placed limitations on exporting Nvidia’s advanced AI chips to China. After the initial restrictions in 2022, Nvidia created the modified H800 and A800 chips specifically for the second largest global economy. Regrettably, these graphic processing units were included in the list of restricted exports the following year. These trade restrictions have the potential to result in significant financial losses for Nvidia in terms of quarterly revenue, potentially amounting to billions of dollars.

Insiders have sold NVDA shares. data by YCharts .

One possible reason for billionaires continuing to sell could be the absence of purchases made by company insiders. There have been no instances of executives or board members buying Nvidia stock on the open market since December 2020. CEO Jensen Huang has been consistently selling large amounts of his company’s stock. starting from the middle of June.

While not all selling by individuals who have access to non-public information about a company Negative information has surfaced, indicating that although some sales may be conducted for tax reasons, the absence of any purchasing indicates that none of Nvidia’s senior executives consider the shares to be worth investing in.

Lastly, Nvidia’s valuation is unattractive. Even though the forward price-to-earnings (P/E) ratio indicates that the shares may be undervalued, the trailing-12-month (TTM) price-to-sales (P/S) ratio hit high levels in June that were comparable to the TTM P/S peaks seen in the past. Cisco Systems and Amazon before the dot-com bubble collapsed.

Despite the excitement about artificial intelligence, it seems that some of the most astute investment professionals on Wall Street are indicating that there may be trouble in the future.