It is common for investors to experience some level of sadness when they witness a decrease in the value of their portfolio, such as during the market decline on August 5th. However, there are several steps that can be taken to improve mood and better prepare for future market downturns.

Specifically, there are three immediate actions you can take to counteract some of the negative impact of the sell-off.

Credit: Getty Images.

1. Pause

If you are worried about the negative performance of your investments, the initial step is to take a break, remain calm, and avoid making impulsive decisions. Situations are often not as dire as they appear.

Selling your stocks suddenly during a market decline or panic usually results in selling them at a lower price, missing out on potential future profits, and is generally not advisable.

While you may not be in a state of panic, it is important to take depression following financial losses seriously. It is recommended to step away from the computer and go for a walk. Making hasty decisions right after experiencing a loss is more likely to be impulsive rather than well-thought-out.

Evaluate the situation thoroughly.

The following step is to gain a better understanding of the situation, identify which of your investments have been affected, and the reasons behind it. This analysis will help you decide on a plan of action, as making well-thought-out decisions can help protect you from feeling depressed.

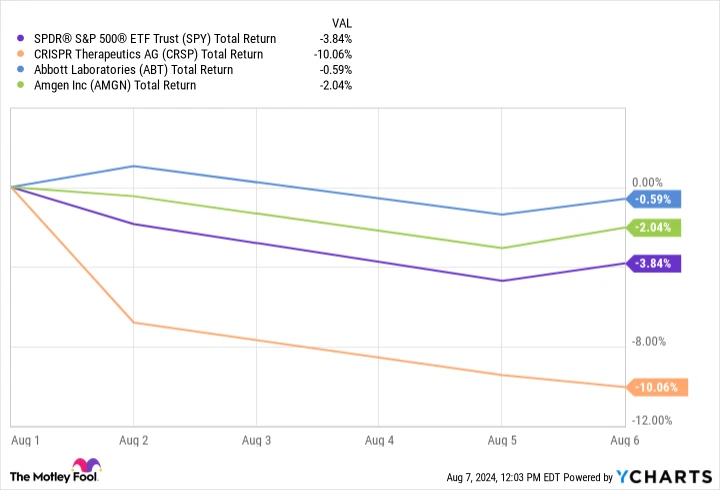

Suppose you hold a portfolio consisting of three stocks– Therapies utilizing CRISPR technology ( CRSP -1.78% ) , Amgen (NASDAQ: AMGN) , and Abbott Laboratories is the name of a company. (NYSE: ABT) — and as you gain an understanding of the situation. Here is how their stocks fared compared to the overall market during the downturn:

Total Return Level for SPY data by YCharts .

Based solely on the movement in prices, one might assume that the reason for the market decline has affected CRISPR Therapeutics in a way that is significantly different from the other two companies. However, this assumption would be incorrect.

The company released its financial results for the second quarter on August 5, coinciding with a decrease in the stock price. According to the information disclosed regarding the influx of new patients beginning treatment with its gene therapy, the onboarding process may be slightly behind schedule. This delay likely led investors to believe that revenue generation would be delayed, resulting in a drop in the stock price, with the subsequent sell-off exacerbating the situation.

On the contrary, both Amgen and Abbott Labs did not have any updates to share on that particular day. Therefore, the movement in their stock prices is probably just random fluctuations rather than meaningful information that needs to be closely monitored. Additionally, it appears that neither company is facing any major problems as a consequence. Explanation of how the carry trade works that caused the decline in sales.

In the case of this three-stock portfolio, the reason for the sudden decrease in stock prices did not have any impact on your overall situation. The rationale or argument behind an investment decision. It could have presented a short window to purchase additional shares at a lower price for any of the investments.

It is not guaranteed that your investment thesis will always hold true during a drawdown. External factors can sometimes undermine your original idea or raise concerns about a company’s future growth potential. In such scenarios, it might be prudent to think about selling your investment. However, it is crucial to fully comprehend the reasons behind this decision before taking any action, as you could unintentionally part ways with a company that is still performing according to your initial expectations when you invested in it.

Identify the perfect chance that is currently available, and then take action on it.

If you are feeling down about a sell-off, the next step is to leverage the clarity gained from taking a break and the understanding acquired from analyzing the situation. Use these to identify opportunities to benefit from the sell-off conditions.

Often, this involves purchasing stocks of companies that are likely to recover their previous worth. For instance, if Abbott Labs’ stock had decreased by 10%, it would be a sensible decision to invest in it. buy the dip After you verified that the reason for the decrease in sales would not have a lasting effect on its operations.

Conversely, if you have indications that a company’s profits and revenues may decline over an extended period, it might be wise to sell your shares before the situation worsens. In instances where there is a sudden negative change in the market or a company’s operating conditions, retaining your shares may not be advantageous as you would only be anticipating further losses. To gain insight into how management perceives the risk of such abrupt changes, it is essential to review the annual reports of each company in your investment portfolio.

Regardless of your decision, it is crucial to make a deliberate choice to take action – even if that decision is to remain passive for now. By proactively managing the situation through planning and action, you will notice that the negative effects of a decline in sales are less severe.