One of the most exciting types of stocks to discover are those representing companies with leadership roles in niche markets that are somewhat obscure. These businesses often secure a No. 1 or No. 2 market share in these smaller sectors, and they can possess a surprisingly robust competitive advantage, as potential challengers find little motivation to enter such modest markets.

Federal Signal (1.02%) exemplifies this idea perfectly. The company specializes in the production of vehicles and equipment that cater to the maintenance and infrastructure markets, alongside public safety equipment. Yet, Federal Signal isn’t merely satisfied with holding its leading position in these niche markets.

By acquiring high-caliber companies in related verticals, Federal Signal has transformed into a 13-bagger since 2011. With its stock price recently dropping 14% from its peak, here’s why it might be an opportune moment to consider investing.

Contents

- 1 Introducing Federal Signal

- 2 1. Environmental Solutions Group (83% of sales): This segment includes products like vacuum trucks (also referred to as “safe digging” trucks), street sweepers, industrial cleaning equipment, dump truck bodies and trailers, multipurpose maintenance vehicles, road marking, metal extraction support, and aftermarket services. Management asserts that it holds the top market share in North America in all these categories, except for industrial cleaning, where it ranks second.

- 3 2. Safety and Security Systems Group (17% of sales): This smaller division offers products such as public safety equipment (e.g., police car lights), signaling, and warning systems. Once again, the company maintains either a No. 1 or No. 2 market share in each category.

- 4 Strategic Acquisitions Fuel Federal Signal’s Expansion

- 5 A Dividend Grower at a Reasonable Valuation

- 6 Buy Alert: Double Down on These Stocks Today

- 7 – Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $308,807!*

- 8 – Netflix: A $1,000 investment when we doubled down in 2004 would be worth $375,918!*

- 9 – Apple: A $1,000 investment when we doubled down in 2008 would be worth $42,091!*

Introducing Federal Signal

To gain a clearer perspective on Federal Signal’s specific product offerings, consider its two main business segments:

While 41% of Federal Signal’s sales come from the cyclical industrial sector, the company mitigates these fluctuations because a larger portion, 51%, of its revenue is derived from publicly funded sources, like government contracts.

Adding to the company’s resilience is its largest business line, the aftermarket vertical, which makes up 27% of its revenue. This segment includes parts and services, rental options, and sales of used equipment, providing valuable recurring maintenance revenue and equipment-as-a-service for customers not ready to purchase new products.

Additionally, the second-largest unit, vacuum trucks, which contributes 22% of sales, is thriving due to the growing adoption of safe digging practices across North America. As of 2020, only 19 states had embraced safe digging as a best practice, with more expected to follow. This method employs vacuum excavation using pressurized air or water instead of backhoes, shovels, or mechanical excavators, making it more environmentally friendly, less harmful to infrastructure, and safer.

Despite the promising nature of its two largest sub-segments, Federal Signal continues to expand, having made 11 acquisitions since 2016, as it broadens its reach into new verticals.

Strategic Acquisitions Fuel Federal Signal’s Expansion

Embracing its acquisitive strategy, Federal Signal targets reasonably priced, niche-market leaders—whether by product, geography, or end market—that can provide “through-cycle margins in line or higher than the company’s current target.”

A prime example of this growth strategy through mergers and acquisitions (M&A) was the purchase of Ground Force Worldwide for $45 million in 2021 and the acquisition of TowHaul in 2022 for $46 million. These additions positioned Federal Signal as the leader in metal-extraction and support-equipment niches, poised for rapid growth thanks to the ongoing shift toward electric vehicles (EVs). Given that EVs require six times the mineral inputs of traditional vehicles, the company is unlikely to face a dearth of business from this new adjacent business line.

Similarly, Federal Signal’s most recent acquisition of Trackless Vehicles for $54 million last year expanded its footprint into another complementary sub-segment focused on snow and ice equipment, tree care, and vegetation management.

Currently, Federal Signal generates a return on invested capital (ROIC) of 15% against a weighted-average cost of capital (WACC) of 10%, creating shareholder value by generating significant profits relative to its debt and equity. With 51% of its operational cash flow allocated to M&A since 2021, the company demonstrates its proficiency as an acquirer.

With sales experiencing a 10% annual growth rate over the past decade—and management aiming for low, double-digit growth moving forward—Federal Signal is likely to continue its successful M&A strategy.

A Dividend Grower at a Reasonable Valuation

Federal Signal has quadrupled its dividend payments since 2014, solidifying its status as a promising dividend-growth story. Despite offering a modest dividend yield of 0.5%, its payout ratio stands at only 15%, suggesting it could triple its dividends and still have ample room for further M&A activities.

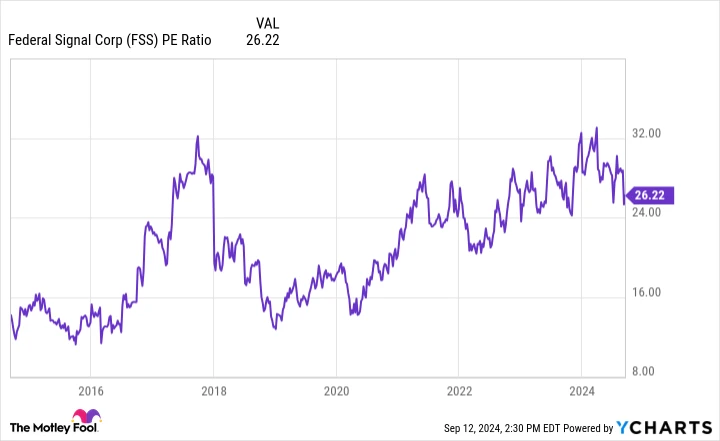

While Federal Signal’s price-to-earnings (P/E) ratio has climbed since the pandemic, it currently sits at 26, roughly on par with the S&P 500’s average of 27.

Following a 14% decline in its stock price, this market-average valuation appears reasonable for a company with a proven track record of achieving multibagger returns through its M&A focus on niche industries. Investing in Federal Signal presents a promising long-term opportunity, offering a small but rapidly growing dividend.

Buy Alert: Double Down on These Stocks Today

The Motley Fool Stock Advisor service has outperformed the S&P 500 more than fourfold since its inception in 2002*, and the analyst team excels at identifying when to double down. They’ve re-recommended select stocks in the past, some of which have delivered exceptional returns.

– Nvidia: A $1,000 investment when we doubled down in 2009 would be worth $308,807!*

– Netflix: A $1,000 investment when we doubled down in 2004 would be worth $375,918!*

– Apple: A $1,000 investment when we doubled down in 2008 would be worth $42,091!*

Opportunity is knocking once more. Ready to seize it?

Explore 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/15/2024