The U.S. Federal Reserve has a responsibility to implement measures that ensure the Consumer Price Index (CPI) inflation rate maintains an annualized growth of 2%. When this rate strays significantly from the target, the Fed modifies the federal funds rate (overnight interest rates) to steer economic activity.

In 2021, the CPI began its ascent, peaking at 8% in 2022, marking the swiftest increase in four decades. In reaction, the Federal Reserve initiated its most forceful interest rate hike campaign ever. Fortunately, this strategy proved effective, leading to a substantial cooling of the CPI.

Recently, emerging economic data suggests the Fed might need to recalibrate its approach, albeit this time in the opposite direction. Consequently, the Fed has indicated its intention to lower interest rates at the conclusion of its upcoming two-day meeting, scheduled for September 17 and 18.

Should this rate cut occur, it would be the first since March 2020. Historical patterns suggest that such a cut might precede a significant movement in the S&P 500 stock market index, though possibly not in the anticipated direction.

Contents

How We Arrived Here

Various factors can instigate a notable surge in inflation, including:

– Periods of increased government expenditure.

– A relaxed monetary policy characterized by extremely low interest rates.

– A swift expansion of the money supply.

– Product shortages that disrupt the supply-demand balance, leading to significantly higher prices.

During the peak of the COVID-19 pandemic in 2020 and 2021, all these factors were present to varying degrees. The U.S. government injected substantial stimulus funds into the economy to bolster consumer spending, while the Fed reduced the federal funds rate to a historic low of 0% to 0.25% and infused trillions of dollars into the financial system through quantitative easing (QE). Simultaneously, global factory shutdowns aimed at curbing the virus spread led to shortages of numerous products.

To address the resulting inflation surge, the Fed incrementally increased the federal funds rate over 18 months to a range of 5.25% to 5.50%, the highest in 23 years.

Presently, this rate persists, but the CPI has decelerated to an annualized increase of just 2.5% in the latest report (released Tuesday) and is clearly aligning with the Fed’s 2% target. Thus, an interest rate reduction is the anticipated outcome of the upcoming monetary policy meeting.

Typically, the Fed adjusts the federal funds rate in 25 basis point increments. However, according to the CME Group’s FedWatch tool, there is a 27% probability of a 50 basis point cut next week. Regardless of the official decision, FedWatch projects additional cuts in both November and December.

Lower Rates and Their Impact on Stocks

Over the long term, declining interest rates generally benefit stocks. They enable companies to borrow more extensively to support growth, and reduced interest payments can directly boost earnings. Moreover, lower rates diminish the yield on risk-free assets such as cash and Treasury bonds, thereby encouraging investment in growth assets like stocks.

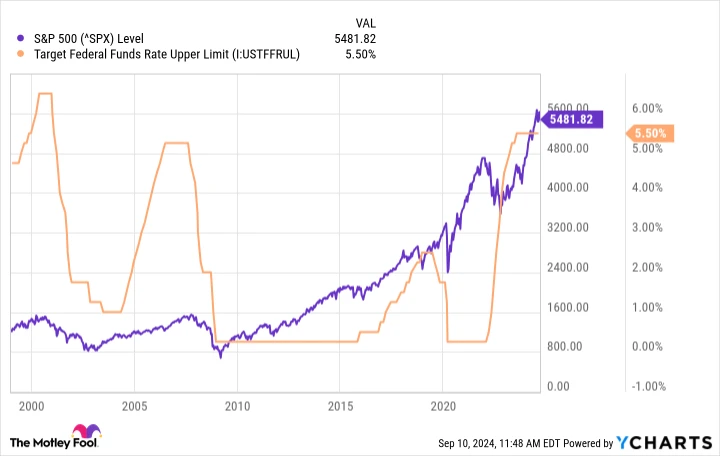

Despite this, the commencement of a rate-cutting cycle has historically coincided with a decline in the S&P 500 in the last three instances:

^SPX data by YCharts

The chart illustrates that while the S&P 500 has trended upward over time, investors should not be alarmed by potential short-term declines. Furthermore, the Fed’s rate cuts on these occasions were necessitated by significant economic shocks, which were likely the primary drivers of market downturns rather than the rate adjustments themselves.

The early 2000s rate-cutting cycle was prompted by the dot-com bubble burst, which resulted in an economic recession. In 2008, the Fed was compelled to lower rates due to the global financial crisis. Most recently, in 2020, the central bank reduced rates to mitigate the economic impact of the pandemic.

No Signs of a Looming Crisis

Currently, there are no indications of an impending crisis, although the U.S. economy appears to be decelerating. The unemployment rate has increased to 4.2% from 3.7% at the year’s start, and if this trend persists, it could affect consumer spending, heightening recession risks. Alongside its mandate to control inflation, the Federal Reserve is also tasked with maintaining manageable unemployment levels.

A recession could lead to a decline in the S&P 500, as investors might revise their future corporate earnings forecasts downward. In such a scenario, the stock market may decline concurrently with the Fed’s rate cuts, creating the perception that rate reductions are associated with falling stock prices.

However, given the historical tendency of the S&P 500 to reach new highs over time, any market weakness is likely to present a buying opportunity for long-term investors.

At last month’s Jackson Hole Economic Symposium, Fed Chair Jerome Powell stated, “the time has come for policy to adjust.” He acknowledged the diminishing risk posed by inflation while highlighting the increasing risk to the labor market. Next week’s meeting will provide Powell the first chance to act on that statement, and it’s widely expected that he will announce the first rate cut since March 2020.

Seize This Second Chance for a Potentially Profitable Opportunity

Do you ever feel like you’ve missed the chance to invest in the most successful stocks? Here’s your opportunity to change that.

Occasionally, our team of analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about missing your investment window, now is the ideal time to buy before it’s too late. The numbers speak for themselves:

– Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

– Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

– Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and such opportunities may not arise again soon.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/12/2024