Contents

Boost for Companies as Federal Reserve Cuts Rates

The Federal Reserve has recently reduced the federal funds rate by 50 basis points, offering a significant advantage to companies seeking to raise capital. This move is anticipated to make both debt interest rates and the cost of equity more accessible for almost every business. The market has largely responded positively to this news. However, one AI stock, in particular, might find itself in a weakened position due to this rate cut.

Intensifying AI Competition

The AI industry has been experiencing explosive growth. As per Statista, the AI market size has surged from $93 billion in 2020 to approximately $184 billion today, effectively doubling in just five years. Yet, this is merely the beginning. By 2030, the market is projected to surpass $800 billion, essentially quadrupling its current size.

The race for AI infrastructure, encompassing everything from critical hardware components like GPUs to the software models themselves, is intensifying. Both major tech companies and small startups are heavily investing resources to stay competitive. The Federal Reserve’s rate cut is likely to further fuel this momentum, particularly benefiting the largest players who can afford to invest more. Giants like IBM, Apple, and Alphabet, already spending billions on AI annually, are expected to amplify their investments now that capital is cheaper, especially with more rate cuts anticipated.

SoundHound Faces Challenges Amidst Rate Cuts

While the rate cuts are generally expected to accelerate innovation in the AI sector, this development poses challenges for companies like SoundHound AI (-0.80%) that have not demonstrated a strong commitment to substantial research and development investments.

SoundHound specializes in voice AI, integrating its technology into consumer interactions, such as with vehicle entertainment systems or fast-food drive-thrus, simulating human-like conversations. Despite having an impressive portfolio of AI patents and a growing customer base, SoundHound remains a relatively small player, with a market capitalization of $1.7 billion and annual revenue of $55 million.

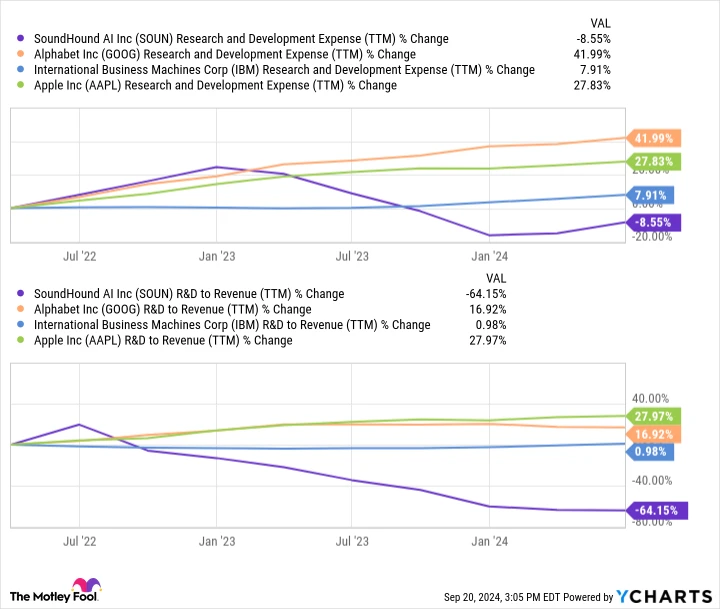

SoundHound has faced significant capital constraints, especially evident in its recent quarterly loss, the largest in years. Over the past three years, its research and development spending has decreased from $60 million annually in early 2022 to $55 million today, even as sales have surged by 155%.

In contrast, SoundHound’s larger competitors in the tech industry have been increasing their research and development spending. Technologies like Google’s Bard, Apple’s Siri, and IBM’s Watson are direct competitors to SoundHound’s AI platform, and these tech giants’ increased innovation spending will impact SoundHound’s long-term competitiveness. Since early 2022, IBM has boosted its research and development budget by about 8%, while Google and Apple have raised theirs by 42% and 28%, respectively. Although not all of this increased spending is dedicated to AI, it highlights the stark difference in capital allocation strategies compared to SoundHound.

Another perspective on this disparity is examining each company’s research and development spending as a percentage of overall sales. IBM, Google, and Apple have all increased their research and development budgets alongside growing sales, whereas SoundHound has reduced its spending despite rising sales.

SOUN Research and Development Expense (TTM) data by YCharts.

Implications for SoundHound

The data suggests that larger tech companies, which are likely SoundHound’s most significant long-term competitors, have been willing to aggressively increase research and development spending even when interest rates were high. With falling rates and cheaper capital, their innovation spending is expected to grow even more. Although SoundHound might be able to enhance its research and development budget, it will likely be outpaced by the larger tech giants.

While the rate cuts could theoretically benefit SoundHound by reducing its cost of capital and potentially allowing it to boost its innovation budget, it will continue to face stiff competition from well-funded peers who have already demonstrated a willingness to invest aggressively, even at high rates. As rates decrease, SoundHound may struggle to invest sufficiently to maintain its competitive edge in the long run.

Investment Consideration for SoundHound AI

Before considering an investment in SoundHound AI, reflect on this:

The Motley Fool Stock Advisor analyst team has recently identified what they consider the 10 best stocks for investors to buy now, and SoundHound AI was not among them. These 10 stocks have the potential to deliver substantial returns in the coming years.

Recall when Nvidia made this list on April 15, 2005. An investment of $1,000 at that time would now be worth $710,860!*

Stock Advisor provides investors with a straightforward blueprint for success, offering guidance on portfolio building, regular analyst updates, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 more than fourfold since 2002*.

Explore the 10 stocks ›

*Stock Advisor returns as of September 17, 2024