ExxonMobil ( XOM 0.61% ) Exxon, the energy company with the highest market capitalization in the United States, has been a consistent dividend-paying stock for many years. Despite the fluctuations in oil and gas prices, Exxon has remained dependable. The company has consistently increased its dividend for 42 years in a row.

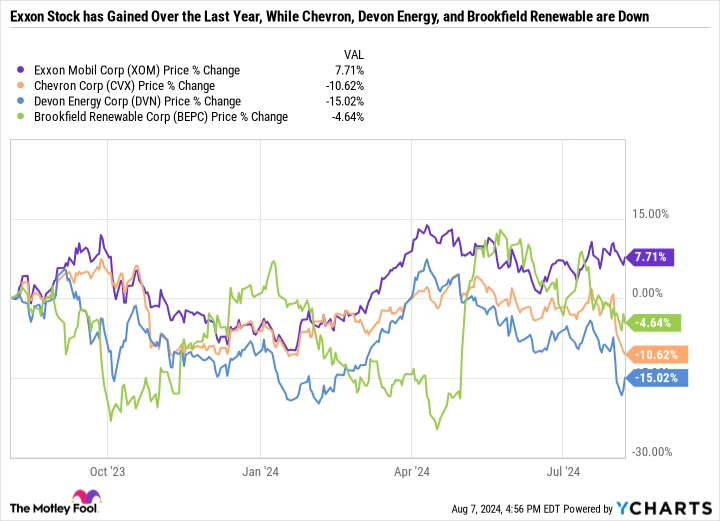

Exxon is approaching a record high, while stock prices of other companies in the oil, gas, and renewable energy sectors have fallen. Let’s explore the reasons behind this disparity. Chevron ( CVX -0.02% ) , Devon Energy ( DVN -0.25% ) , and Renewable energy from Brookfield ( BEPC -0.11% ) ( BEP -1.07% ) distinguish oneself as a leading high-yield option stocks that pay dividends to buy now.

Picture credit: Getty Images.

Similar to Exxon, Chevron has consistently been a strong source of passive income.

Daniel Foelber (Chevron): In a vacuum, Chevron had a strong quarter. However, not in comparison to ExxonMobil, its U.S. counterpart.

Exxon is currently experiencing success in all aspects, which could explain why it has performed better than Chevron in the past year.

Exxon has recently announced its The most impressive second-quarter performance in more than ten years. The purchase of Pioneer Natural Resources turned out to be successful, in contrast to Chevron’s acquisition of a company of similar size. Hess is filled with a great deal of uncertainty.

Hess, Exxon, and CNOOC have joined forces as a group to explore drilling activities in the sought-after Stabroek Block off the coast of Guyana. Chevron’s interest in acquiring Hess stemmed from the attractive combination of low production costs and abundant reserves. Nevertheless, Exxon and CNOOC are opposing the acquisition and have opted to escalate the matter to arbitration.

On the earnings call Chevron expressed its belief that the agreement will be finalized, mainly relying on its shareholders’ approval. Chevron’s CEO, Michael Wirth, stated during the second-quarter earnings call that without Hess, they anticipate a 10% increase in free cash flow. The company has upcoming projects in various global basins and their chemicals sector, aiming to generate value. Wirth mentioned that while their primary focus is on these projects, they remain open to exploring other appealing opportunities if they arise.

Chevron has been advocating for the acquisition of Hess for a while now, emphasizing its compatibility, even though Hess continues to succeed independently. However, the uncertainty surrounding the pending $53 billion deal is unsettling for the market. This unresolved situation might sway some investors towards choosing Exxon over Chevron at present. It has been almost 10 months since Chevron initially revealed its intention to acquire Hess. Integrating an acquisition like this requires time, raising the possibility of whether Chevron should consider abandoning this deal and pursuing another exploration and production company instead.

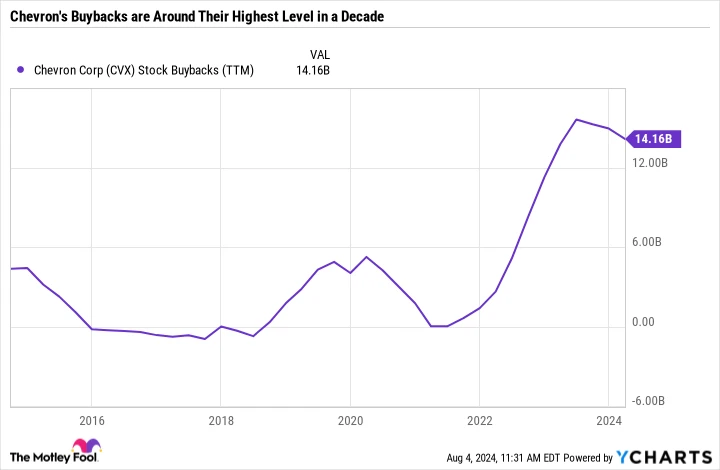

Essentially, Chevron is increasing the speed of its buyback activities, as shown in the graph where it is currently buying three times more stocks compared to before the pandemic.

CVX Stock Repurchases (Trailing Twelve Months) data by YCharts

Businesses acquire other companies to enhance their profits. However, stock repurchases achieve a similar objective, albeit through a different method. Instead of raising the earnings per share, buybacks decrease the total number of shares in circulation. This results in higher earnings per share due to the reduced number of shares available.

Chevron has an an extremely profitable business In the event that the Hess agreement does not go through, it might be a wise decision to consider conducting a substantial stock repurchase. Chevron’s stock is not excessively valued and could be seen as a favorable investment compared to more uncertain options in the oil industry.

With Dividends have been increased for 37 years in a row. With a dividend yield of 4.5%, Chevron is a standout option to consider for dividend stock investment at the moment.

An oil and gas stock that generates cash flow and is worth purchasing.

Lee Samaha Devon Energy is a company that specializes in the exploration, production, and development of oil and natural gas resources. Predicting the exact dividend amount Devon Energy will pay out this year is difficult due to its adaptable approach to returning capital to shareholders. The company aims to return 70% of its profits to investors, which contributes to the uncertainty surrounding dividend payments. free cash flow A portion of the profits is distributed to shareholders through a set dividend of $0.22 per share every quarter, along with a flexible dividend payment and strategic repurchases of company shares. The remaining 30% of the profits is used to enhance the financial position, which includes a plan to reduce debt by $2.5 billion following the acquisition of Grayson Mill for $5 billion, expanding the company’s assets in the Williston Basin in North Dakota.

In the worst-case scenario where only the fixed dividend of $0.88 per year is considered, the dividend yield stands at 2.1% based on the current price. On the other hand, when the total dividend, including the variable dividend, is taken into account at $2.05, the dividend yield increases to 4.95%.

Predicting Devon’s expenditures for the year is challenging, especially with the recent decrease in the stock price prompting a higher interest in share repurchases. However, the company’s management is confident that there will be a substantial amount of free cash flow generated in the upcoming year.

For instance, using an oil price of $70 per barrel as a basis, management projected a 9% free cash flow (FCF) yield when the Grayson Mill deal was announced. Given that the share price was approximately $47 back then, and the current share price stands at $41.34, estimating the figures indicates a 10% FCF yield at the present price.

Assuming that 70% of free cash flow is being used for cash returns, Devon could potentially have a dividend yield of 7%. Although it is improbable that share buybacks won’t be conducted, there should still be enough cash remaining for a very appealing dividend, as long as the oil price remains stable.

Brookfield Renewable’s high-yield dividend is backed by consistent cash flows.

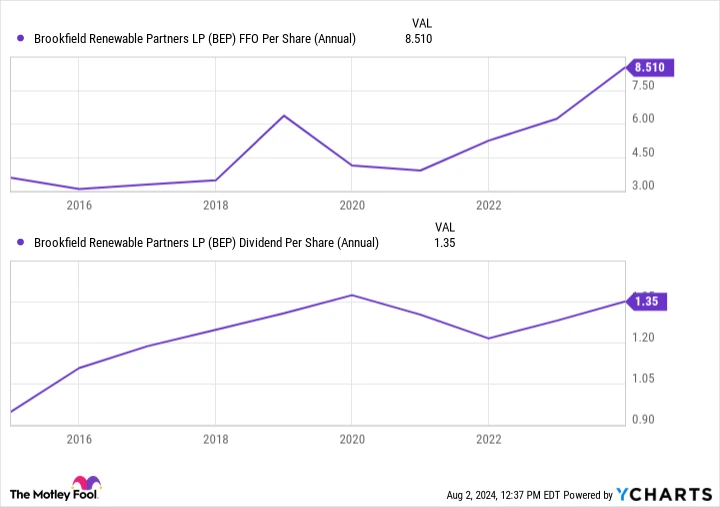

Scott Levine (Brookfield Renewable is the company) ): The attraction of high-yield dividend stocks is certainly strong. However, a top company that offers substantial passive income to investors? That is much more appealing. This is exactly what green energy giant Brookfield Renewable does. By managing a diverse set of renewable energy projects worldwide, Brookfield Renewable ensures stable cash flow from its extended power purchase deals with clients. This steady income stream supports its dividend, which currently offers a yield of 5.1% for the future.

Brookfield Renewable benefits from an average contract duration of 13 years, which provides valuable information about upcoming cash flows. This advantage allows the company to effectively strategize for financial commitments like purchases and dividends. The strong relationship between the company’s funds from operations and dividends in the past clearly demonstrates this capability.

Earnings Per Share (EPS) for the full year data by YCharts .

Moving forward, the management intends to continue their prudent dividend approach. They aim for a 10% growth in annual funds from operations per share while also planning to increase the dividend payout by 5% to 9% every year. To address concerns from conservative investors regarding Brookfield Renewable’s financial stability due to its high dividend, the company’s investment grade balance sheet, rated BBB+, could provide reassurance. Standard & Poor’s can be rephrased as S&P. .

It includes both income investors and others as well. sustainable sources of power Fans of Brookfield Renewable may be interested in the company at the moment. The current stock price, which is 4.4 times the operating cash flow, is lower than the average cash flow multiple of 5.7 over the past five years. This could attract investors looking for good value to consider adding Brookfield Renewable to their portfolios.