Contents

Exploring Alternatives to Coca-Cola for Investors

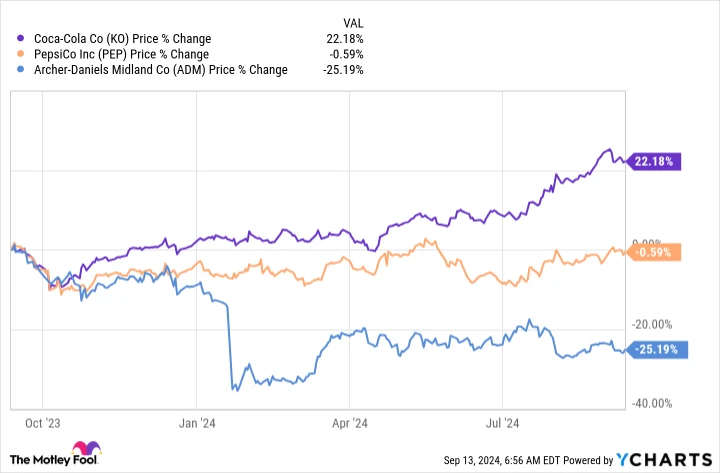

Coca-Cola (-0.07%) has undeniably been a star performer, with its stock appreciating by over 20% in the past year. While this surge is impressive, some investors might find its current valuation a bit steep and may look for more affordable options. If Coca-Cola seems too pricey, consider exploring other stocks with strong growth potential. Two such contenders are PepsiCo (-0.94%) and Archer-Daniels-Midland (0.12%). Let’s delve into why these stocks could be promising investments.

Why Coca-Cola Stands Out

Coca-Cola boasts a devoted following on Wall Street, with one of its biggest admirers being Warren Buffett, CEO of Berkshire Hathaway. Buffett has held Coca-Cola shares for decades, valuing its globally recognized brand, exceptional marketing prowess, and extensive distribution network. Coca-Cola’s ability to acquire emerging competitors to expand its portfolio further strengthens its market position.

A testament to Coca-Cola’s enduring success is its status as a Dividend King, having consistently increased dividends for over six decades. Achieving such an elite status requires robust performance in both prosperous and challenging times.

Recently, Coca-Cola has continued to thrive, with annualized revenue growth of approximately 7.5% and earnings growth exceeding 10% over the past five years. Given these factors, the 20% increase in stock price over the past year is not surprising. However, with its price-to-sales (P/S) and price-to-earnings (P/E) ratios slightly above their five-year averages, Coca-Cola’s stock may appear expensive to value-conscious investors.

PepsiCo: A Strong Competitor

PepsiCo, like Coca-Cola, is a household name in the beverage industry. Although it trails Coca-Cola in the soda market, PepsiCo remains a formidable company. Beyond beverages, it dominates the salty snack sector with its Frito-Lay division and produces popular packaged foods through Quaker Oats. PepsiCo’s diversified business model may appeal to investors seeking variety.

PepsiCo matches Coca-Cola in distribution, marketing, and business scale, making it a reliable partner for retailers worldwide. Like Coca-Cola, PepsiCo is a prestigious Dividend King. However, its financial performance hasn’t been as robust lately, with earnings declining over the past five years. Consequently, PepsiCo’s stock has remained relatively flat over the past year, presenting a potential buying opportunity for long-term income investors.

PepsiCo offers a dividend yield of 3%, slightly higher than Coca-Cola’s 2.7%. Additionally, its P/S and P/E ratios are below their five-year averages, indicating it may be undervalued. Despite current challenges, PepsiCo’s track record of over 50 years of dividend increases suggests it will navigate this rough patch successfully, rewarding investors who are patient.

Archer-Daniels-Midland: On the Brink of Dividend King Status

Archer-Daniels-Midland (ADM) offers an appealing dividend yield of 3.3%, surpassing both Coca-Cola and PepsiCo. Although not yet a Dividend King, ADM is close, with 49 consecutive years of dividend increases. Unlike Coca-Cola and PepsiCo, ADM operates as a supplier, providing essential commodities like oilseeds, corn, and wheat to food product manufacturers.

ADM’s stock has declined by approximately 25% in the past year, reflecting recent financial struggles as revenue and earnings have trended downward. However, given its commodity-based business, such volatility is not unexpected, particularly following recent inflation spikes.

For long-term dividend investors, this dip presents an opportunity. ADM’s P/S and P/E ratios are below their five-year averages, making it an attractive option for those willing to endure short-term uncertainty. With its long history of annual dividend increases, ADM has demonstrated resilience in navigating commodity cycles while continuing to reward investors.

Conclusion: Consider PepsiCo and Archer-Daniels-Midland

While Coca-Cola remains a solid business, its current stock valuation may deter value-focused investors. If you’re seeking alternatives, PepsiCo and Archer-Daniels-Midland offer compelling options with strong dividend histories. Although neither currently matches Coca-Cola’s financial performance, their consistent dividend payouts suggest they will rebound in due course, providing investors with attractive returns during the wait.

Investment Opportunity: Don’t Miss the Chance

The Motley Fool Stock Advisor boasts an impressive average return of 755%, significantly outperforming the S&P 500’s 165% since 2002. Their analyst team excels at identifying opportune moments to double down on stocks, yielding remarkable gains in the past.

Investors who acted on their double-down alerts for stocks like Nvidia, Netflix, and Apple have reaped substantial rewards. Now, the team is issuing “Double Down” alerts for three exceptional companies, offering a rare opportunity to capitalize on promising investments.

Stock Advisor returns as of 09/19/2024