Contents

High-Yield Dividend Stocks: A Closer Look at AGNC Investment and EPR Properties

AGNC Investment, with a dividend yield of 1.16%, is a standout among dividend stocks, especially given its focus on mortgage-backed real estate. The real estate investment trust (REIT) is currently offering a dividend yield exceeding 13%, which is notably ten times the yield of the S&P 500. Investors of AGNC benefit from monthly dividend payments, creating a lucrative stream of passive income.

AGNC Investment: Stability Over Growth

Despite the attractive dividend, AGNC Investment does have its limitations. A significant drawback is the REIT’s lack of dividend growth. Investors primarily rely on the stable monthly dividend for returns, without the expectation of dividend increases.

For investors seeking more dynamic growth, EPR Properties, another REIT, presents an interesting alternative. EPR Properties provides a high-yield monthly dividend of over 7%, with potential for growth as it expands its portfolio and increases cash flow per share.

The Income Formula of AGNC

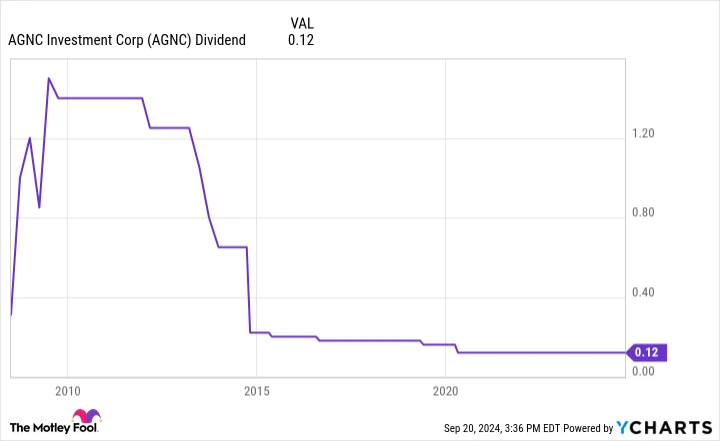

AGNC Investment currently pays its investors $0.12 per share each month, amounting to $1.44 annually. This payout has remained consistent since the REIT reduced its dividend during the pandemic. Historically, AGNC has adjusted its dividends in response to economic factors:

AGNC’s strategy involves investing in mortgage-backed securities (MBS) supported by government agencies. The REIT faces challenges from interest rate fluctuations and other economic factors affecting earnings. For instance, when interest rates fall, borrowers often refinance their mortgages, decreasing AGNC’s interest income and impacting earnings per share, which can lead to dividend cuts.

Despite these challenges, AGNC has managed to deliver solid returns. Though its stock price has declined by 45% since its 2008 launch, the REIT has achieved a total return of 450%, translating to an annualized return of 11%, solely from dividends.

AGNC’s dividend is considered stable for the time being, aided by recent interest rate reductions from the Federal Reserve, which should lower borrowing costs. However, investors should not expect significant stock price appreciation as AGNC continues issuing shares to fund new MBS investments.

EPR Properties: A Potential for Exciting Returns

EPR Properties is a specialty REIT that focuses on experiential real estate, including movie theaters, attractions, lodging, and other entertainment venues. The REIT leases these properties to operating companies under long-term net leases, where tenants cover operating costs like maintenance, insurance, and taxes. EPR’s leases often include rental escalators, typically increasing rents by 1.5% to 2% annually or 7.5% to 10% every five years.

These leases provide EPR Properties with a steady stream of rising rental income, laying the foundation for potential dividend increases. EPR also pursues growth through strategic investments, planning to allocate $200 million to $300 million for new ventures this year. In the first quarter alone, the REIT invested $85 million, including $33.4 million in an attraction property and $14.7 million for land acquisitions and financing for two build-to-suit projects. In the second quarter, EPR continued its momentum, investing $46.9 million primarily in experiential developments.

These initiatives position EPR to expand its funds from operations (FFO) by an estimated 3.2% at the midpoint this year. This growth enabled a 3.6% dividend increase earlier. EPR anticipates sustaining FFO growth with investments funded through post-dividend free cash flow, capital recycling, and its robust balance sheet. As interest rates decrease and capital costs lower, EPR could accelerate growth with external funding, potentially boosting its investment capacity. Even with modest growth, EPR’s strategy supports potential share price appreciation, with total returns potentially exceeding 10% annually. Since its inception in 1997, EPR has delivered a remarkable total return of over 1,300%.

Conclusion: Choosing Between Stability and Growth

AGNC Investment offers investors a stable, lucrative monthly dividend, acting as a fixed-income investment. However, the lack of growth potential means dividends will likely account for the entire return.

For those seeking greater excitement and upside potential, EPR Properties is an appealing choice. In addition to a high monthly dividend, EPR is positioned to grow its income and dividends, offering potential stock price appreciation and lucrative dividends. This makes EPR a compelling option for investors aiming to increase their wealth and income.

Investment Opportunity: Double Down on High-Performing Stocks

The Motley Fool Stock Advisor has achieved a total average return of 762%, significantly outperforming the S&P 500’s 167% since 2002. The analyst team has a proven track record of identifying opportunities to double down on high-potential stocks, resulting in impressive returns.

– Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $301,443!

– Netflix: A $1,000 investment when we doubled down in 2004 would have grown to $380,400!

– Apple: A $1,000 investment when we doubled down in 2008 would be valued at $42,842!

Currently, we’re issuing “Double Down” alerts for three exceptional companies. Opportunities like these are rare, so take advantage of this chance.

See the stocks ›

Stock Advisor returns as of 09/25/2024