Snowflake (1.85%) investors faced an increasingly challenging year as the cloud-based data warehousing company’s second-quarter results failed to meet expectations, further exacerbating the situation. Following the earnings announcement, the stock plummeted 15% in the subsequent trading session and has declined over 40% throughout the year.

Let’s delve deeper into the company’s Q2 earnings report to determine whether investors should consider capitalizing on the stock’s dip.

Solid Growth, But Falling Short

Snowflake’s stock performance has been hindered partly due to its involvement in a cybersecurity breach, which allowed hackers to access client data. The company had hoped its Q2 results would alleviate investor concerns about the incident’s potential impact on its business, but these hopes were not realized.

Despite these challenges, Snowflake’s Q2 results were robust, with revenue increasing by 29% to $869 million, surpassing the analyst consensus of $851 million. Product revenue also saw a 30% rise, reaching $829 million.

However, the company’s loss per share widened from $0.69 to $0.95 during the quarter. Furthermore, the revenue beat was less impressive than in Q1, and product revenue growth slowed from 34% in the previous quarter.

Management noted an acceleration in its innovation pipeline, claiming it had launched more products in the first half of the year than in the entire year of 2023. Additionally, it reported that over 2,500 accounts utilized Snowflake AI on a weekly basis.

During the quarter, Snowflake spent $400 million on stock buybacks and ended the period with $3.9 billion in cash, alongside short-term and long-term investments, and no debt. It has a $2.5 billion repurchase program authorized through March 2027.

Looking forward, Snowflake has guided for full-year product revenue of approximately $3.36 billion, indicating a 26% year-over-year increase, up from a previous outlook of $3.3 billion. The company maintains expectations for product gross margins of 75%, operating margins of 3%, and adjusted free cash flow margins of 26%.

Regarding the cybersecurity breach, Snowflake stated that the issue originated from the customers’ side and not theirs. Consequently, they reported no impact on consumption or financial results. Moving forward, the company will mandate multi-factor authentication for all users.

Should You Consider Buying the Dip?

There are several reasons for Snowflake’s struggles. The cybersecurity incident, regardless of fault, certainly didn’t help. Moreover, the company’s valuation had surged too high. Perhaps most significantly, there’s a belief that artificial intelligence (AI) could disrupt the data warehousing sector, as AI is increasingly used to analyze structured data.

However, data warehousing is likely to remain a cost-effective approach, with AI serving as an adjunct opportunity for the company. Until this is conclusively demonstrated, it may continue to weigh on the stock.

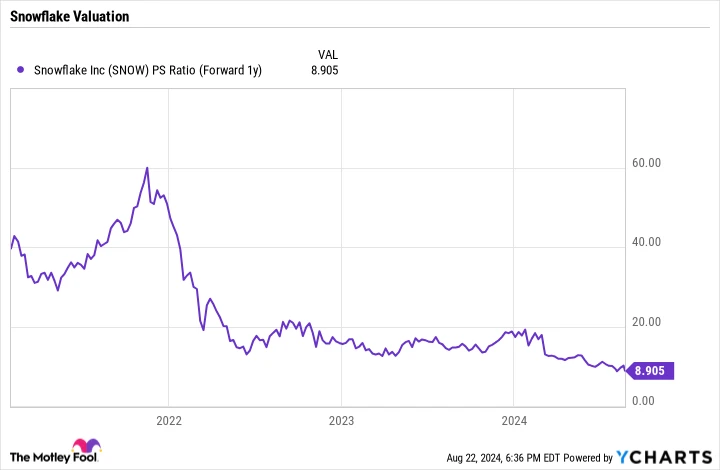

From a valuation perspective, Snowflake now trades at a more reasonable price. Its forward price-to-sales (P/S) ratio, based on next year’s estimates, has decreased from around 20 times at the start of the year to under 9 times now.

For a high-margin business growing at a rate of 25% to 30% annually, this is an appropriate multiple. However, the company must sustain this growth rate to maintain that multiple.

Currently, Snowflake seems fairly valued. Nonetheless, given the stock’s struggles this year, I would prefer to purchase the shares at a bargain price, and despite the recent sell-off, they haven’t quite reached that level yet.