Contents

A Deep Dive into Enterprise Products Partners

Overview of Energy Sector Yields

In the realm of energy stocks, the average yield stands at 3.2%, while the broader S&P 500 offers a modest yield of 1.2%. However, Enterprise Products Partners, a titan in the midstream energy sector, boasts an impressive yield of 7%. This figure is more than double that of the average energy stock and over five times greater than the S&P 500. With a unit price hovering around $30, investors can enter the market with a relatively small investment, potentially less than $500.

Resilience of Enterprise Products Partners

The Role of Midstream Infrastructure

Midstream companies like Enterprise are integral to the energy sector, owning substantial infrastructure such as pipelines, storage facilities, and transportation assets. These assets are crucial and challenging to replace, ensuring their lasting relevance. Nevertheless, the capital-intensive nature of these assets means that companies in this sector often operate with high leverage.

Impact of Interest Rates on Midstream Sector

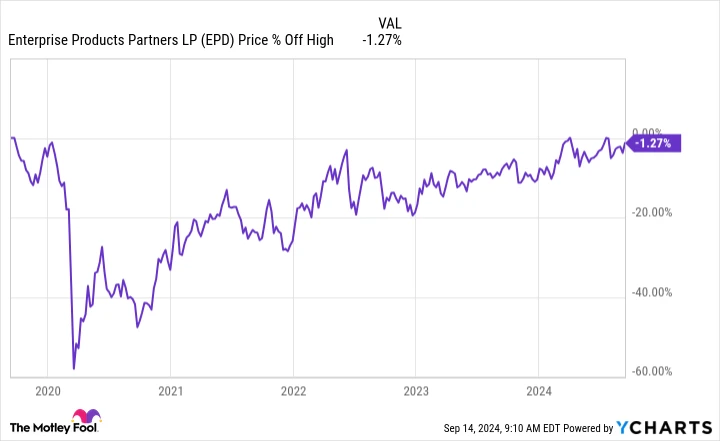

Rising interest rates have historically burdened the midstream sector, leading to increased operational costs. This was particularly evident during the initial stages of the COVID-19 pandemic when Enterprise’s unit price suffered due to fears of declining energy demand. However, the majority of Enterprise’s revenue is derived from fees for using its infrastructure, rather than being directly tied to fluctuating energy prices.

Energy demand remains robust, even when oil prices dip, due to the essential nature of oil, natural gas, and their derivatives in the global economy. As interest rates are expected to decrease, investors are recognizing Enterprise’s resilience, with its shares nearly rebounding to pre-pandemic levels.

Enterprise’s Yield and Financial Stability

High Yield Without Weakness

Despite its significant yield, Enterprise’s performance should not be misconstrued as a sign of instability. The high yield is a characteristic of the midstream sector and the master limited partnership (MLP) structure, designed to distribute income directly to unitholders. The recovery of Enterprise’s unit price further enhances its appeal as a high-yield investment.

Consistency in Cash Flows and Financial Strength

Enterprise’s operations generate steady cash flows throughout the energy cycle. The company boasts an investment-grade balance sheet and maintains a conservative leverage ratio, consistently ranking low on the debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) scale.

Enterprise’s management philosophy extends to its distribution strategy, with distributable cash flow covering distributions by a factor of 1.7. This cushion allows the company to weather financial storms without cutting distributions. Furthermore, Enterprise has a remarkable track record of increasing its distribution annually for 26 consecutive years, a feat given the volatile nature of the energy sector.

Why Enterprise Products Partners Appeals to Income Investors

While there might be other energy stocks or midstream investments with more enticing growth prospects, Enterprise stands out for those prioritizing a robust yield. The company offers consistent payouts in both prosperous and challenging times, making it a compelling choice for income-focused investors. Although the yield is likely to constitute a significant portion of long-term returns, Enterprise remains a top pick for maximizing portfolio income.

Considerations Before Investing

Expert Opinions on Enterprise Products Partners

Before deciding to invest in Enterprise Products Partners, it’s worth noting that the analyst team at The Motley Fool Stock Advisor has identified 10 stocks they believe are better positioned for future growth. While Enterprise didn’t make this list, the selected stocks could yield substantial returns in the coming years.

For instance, if you had invested $1,000 in Nvidia when it was recommended on April 15, 2005, your investment would have grown to $722,320 by now. The Stock Advisor service offers a strategic approach to investing, complete with portfolio-building guidance, regular analyst updates, and two new stock recommendations each month. Since 2002, the service has more than quadrupled the S&P 500’s returns.

Explore the 10 stocks ›

Stock Advisor returns as of September 17, 2024