Contents

Discovering the Future Millionaire-Maker Stocks

Nvidia, despite its recent dip of 1.59%, has been a standout performer over the past five years, minting numerous millionaires along the way. However, as its impressive returns remain a part of the past, investors might find it beneficial to scout for the next big winners in the tech industry. Here are three smaller tech companies with significant potential to soar in the coming years.

1. SoundHound AI

SoundHound AI, which saw a recent decline of 0.80%, gained attention after Nvidia invested in it. The company leverages an innovative artificial intelligence (AI) voice platform equipped with speech-to-meaning and deep-meaning-understanding technologies. This enables real-time speech processing, comprehension of speaker intent, and responses to intricate queries and requests.

Initially, SoundHound carved a niche in the automotive industry, with several automakers integrating its technology into their vehicles’ voice assistants. It has since expanded into the restaurant sector, collaborating with operators and fintech companies like Toast and Olo.

SoundHound’s recent acquisition of Amelia, a conversational and generative AI platform, marks its entry into sectors like healthcare, retail finance, and insurance. This strategic move promises cross-selling and upselling opportunities.

While investing in SoundHound is speculative, its potential to become a standard in AI voice technology positions it as a possible millionaire-maker stock.

2. SentinelOne

SentinelOne, a cybersecurity firm with a recent drop of 2.75%, specializes in endpoint security, which protects networks and their devices like smartphones and computers. Its Singularity Platform employs AI agents to monitor, predict, and eliminate threats. Notably, it can “rewind” systems to their pre-attack state, sparing clients the hassle of manual incident recovery.

The company is poised to capitalize on a significant global IT outage caused by a flawed software update from industry giant CrowdStrike earlier this year. Being smaller in size, SentinelOne doesn’t need to capture a vast market share to emerge as a major beneficiary.

Recently, SentinelOne secured a multiyear partnership with Lenovo, an enterprise PC vendor, to provide endpoint security across new PCs and offer existing users the option to upgrade to the Singularity Platform. Lenovo also plans to use the platform to develop a new managed detection and response (MDR) service.

With revenues growing rapidly, including a 33% year-over-year increase in Q2, deals like the one with Lenovo could further accelerate growth. Trading at a forward price-to-sales ratio of 7.5 based on next year’s analyst estimates, the stock appears to be a bargain compared to its larger peers, hinting at its potential as a millionaire-maker.

3. AppLovin

Despite its playful name, AppLovin, which rose by 1.69%, has emerged as a significant player in the AI revolution beyond Nvidia. Its Axon 2 AI-based advertising solution has propelled the company’s software platform revenue to new heights.

Traditionally, AppLovin focused on mobile gaming companies, helping them attract new customers and monetize their games. Since Axon 2’s launch, mobile app companies have gravitated toward its solution, seemingly at the expense of competitor Unity Software, whose ad business has faltered while AppLovin’s revenue soared. Notably, in Q2, AppLovin’s software platform revenue surged by 75%, whereas Unity’s dropped by 9%.

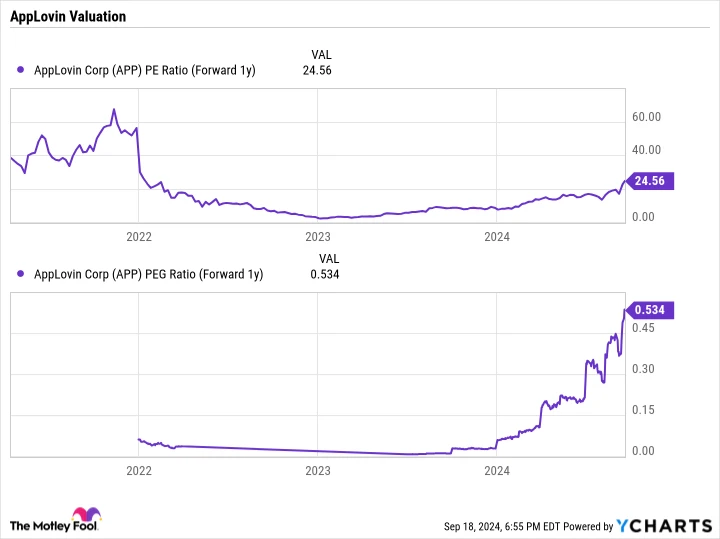

Trading at a forward P/E ratio of 24.5 and a price/earnings-to-growth (PEG) ratio of 0.5, the stock is considered undervalued. Typically, a PEG under 1 is a sign of undervaluation, placing AppLovin in the bargain category.

For AppLovin to fulfill its millionaire-maker potential, it needs to expand its solution beyond the mobile gaming market. If successful, its rapid revenue growth could continue, making the sky the limit for the stock.

Investment Considerations: Should You Invest in SoundHound AI?

Before diving into SoundHound AI, consider this: The Motley Fool Stock Advisor analysts have identified what they believe are the 10 best stocks for investors to buy now, and SoundHound AI wasn’t on the list. These 10 stocks could yield substantial returns in the upcoming years.

Reflect on Nvidia’s inclusion in this list back on April 15, 2005. An investment of $1,000 at that time would have grown to $710,860!

The Stock Advisor service provides a robust blueprint for success, offering guidance on portfolio building, regular analyst updates, and two new stock picks monthly. Since 2002, the service has more than quadrupled the return of the S&P 500.

Explore the 10 stocks ›

Stock Advisor returns as of September 17, 2024