In recent years, the pharmaceutical sector has witnessed a rise in the popularity of glucagon-like peptide-1 (GLP-1) agonists. While you may not be familiar with this specific term, you probably recognize medications for diabetes and obesity like Ozempic, Wegovy, and Mounjaro, all of which belong to the class of GLP-1 drugs.

Currently situated in Denmark. Novo Nordisk ( NVO -1.58% ) Novo Nordisk is a major player in the GLP-1 market, leading with a variety of treatments such as Ozempic, Wegovy, Rybelsus, and Saxenda. Despite this dominance, it’s crucial not to underestimate Novo Nordisk’s main competitor in the weight loss sector.

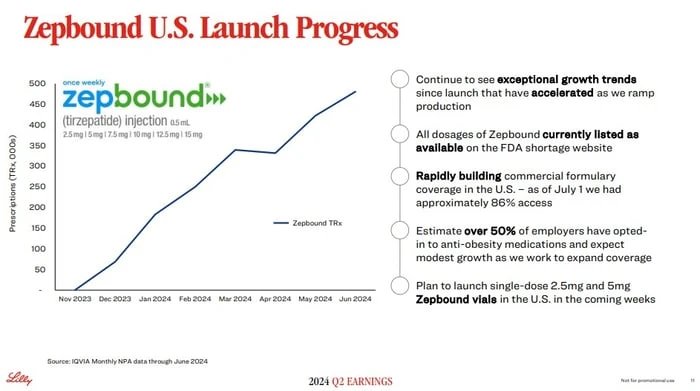

Eli Lilly ( LLY -1.01% ) Mounjaro’s developer has demonstrated its ability to rival Novo Nordisk effectively. Additionally, the company’s new product, Zepbound, a related treatment to Mounjaro, has experienced a strong launch since receiving approval in November to assist with weight loss. Achieving sales exceeding $1.2 billion in the quarter ending in June, Zepbound has quickly earned the esteemed “blockbuster drug” designation reserved for medications generating over $1 billion in annual sales.

It’s just about sufficient to make someone “overlook” Mount Kilimanjaro.

Let’s analyze how Zepbound is contributing to the transformation of Lilly and consider what potential outcomes could arise in the future.

Zepbound appears to be unbeatable.

Frequently, when a new medication is approved by the FDA, it is authorized for the treatment of a single specific condition.

Ozempic is officially indicated for diabetes treatment, although weight loss is commonly seen as a side effect of using diabetes medications. Despite this, Ozempic is not officially endorsed for long-term weight control, so Novo Nordisk introduced a distinct medication called Wegovy that focuses on addressing obesity. It is significant to highlight that both Ozempic and Wegovy contain the identical main ingredient, semaglutide.

Eli Lilly has adopted a comparable approach to Novo Nordisk by introducing Mounjaro as a competing product to Ozempic for the treatment of diabetes.

In 2023, Mounjaro completed its inaugural full year on the market. This diabetes drug generated $5.2 billion in annual revenue for Lilly, establishing it as the company’s second-highest revenue-generating product. revenue .

Although Mounjaro has clearly been a significant achievement, Lilly was simultaneously involved in another project. In a similar fashion to Novo Nordisk, Lilly created a different form of its diabetes medication called Zepbound, designed to address obesity. Zepbound also contains the same key component, tirzepatide, as Mounjaro.

Zepbound was granted approval by the FDA in November 2023 and has been extremely successful since it was introduced.

Picture credit: Eli Lilly.

In the initial three months of 2024, Zepbound achieved sales of $517 million, positioning it for an annual revenue milestone. run rate With a valuation of around $2 billion, Zepbound has exceeded its projected revenue performance as per Lilly’s earnings report for the second quarter.

Zepbound reported sales of $1.2 billion for the quarter ending on June 30, positioning it as a significant financial result. a highly successful and popular medication having been on the market for under a year.

The most exciting aspect is that the journey appears to be in its early stages.

The journey is only starting

As per the findings presented in the research… Goldman Sachs , the the complete market size that can be potentially reached by a product or service The cost of medications for treating obesity could potentially increase to $100 billion by the year 2030. Considering that the World Health Organization (WHO) has reported over 1 billion individuals worldwide are affected by obesity, I believe this projection might be on the lower side.

Given the fragmented nature of the obesity care market, with Novo Nordisk and Eli Lilly as the primary competitors, Lilly shows strong potential for growth in the coming years.

Additionally, Lilly’s leadership has taken significant steps to guarantee that The relationship between the availability of a product or service and the desire for it. Dynamics do not cause any interruptions. Specifically, Lilly purchased a production plant from Nexus Pharmaceuticals. Earlier this year, measures were taken to address potential shortages of their weight loss medications. I believe this was a smart move that sets Lilly up for success in the long run.

Picture credit: Getty Images

Should I invest in Eli Lilly stock?

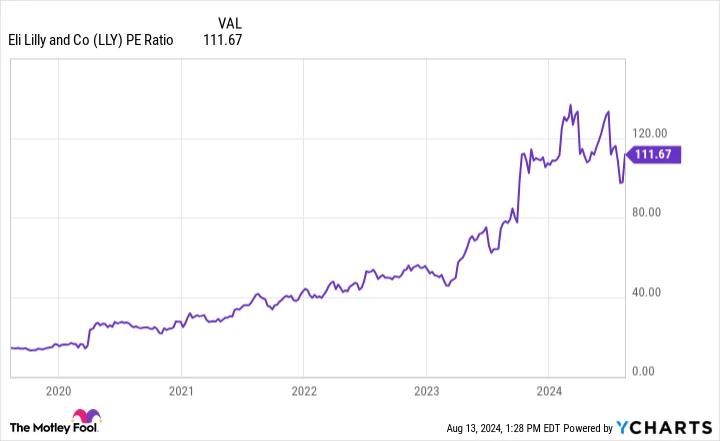

The diagram provided below shows Lilly’s. The ratio of a company’s stock price to its earnings per share is referred to as the price-to-earnings ratio. The price-to-earnings ratio has been observed to fluctuate over the past few years for Lilly, indicating significant changes in the company’s performance. increasing the value , particularly in the past year and a half.

LLY PE Ratio data by YCharts .

Although it may appear that Lilly stock is priced too high, I believe there are additional factors to consider. S&P 500 Since January 2023, the stock has increased by more than 40%. Despite Lilly’s strong financial performance, I believe the stock’s surge may be partially attributed to overall market trends.

Moreover, Lilly has recently obtained authorization for a new treatment for Alzheimer’s disease. Known as donanemab, it is possible that some of the excitement surrounding the potential approval of donanemab was already factored into the stock price.

Even though Eli Lilly is considered expensive, I believe it presents a great investment opportunity for investors looking for long-term gains. The drugs Mounjaro and Zepbound are already very successful. Given the market potential of over $100 billion and the lack of strong competitors, it is unlikely that Lilly will face major challenges in the weight loss market.

Given the ongoing developments in the diabetes and obesity care sectors, I believe it would be advantageous for investors with a focus on long-term gains to contemplate investing in Eli Lilly.