At the beginning of 2024, e.l.f. Beauty ( ELF 5.28% ) achieved a 1,000% return in the past five years, reaching a record high. However, it has since decreased by 29%. Following the announcement of its recent quarterly earnings, investors chose to sell the stock because of unsatisfactory future revenue forecasts. The overall market hasn’t been supportive either, as growth stocks have been declining this summer.

Looking at the bigger picture, e.l.f. Beauty has experienced rapid sales growth over the past few years and stands out as one of the few major brands in the beauty industry that has increased its market share, attracting customers away from established companies. With the stock currently below its peak levels, should you consider buying or selling e.l.f. Beauty today? Here are my thoughts on what the future holds.

Contents

Robust increase in revenue, global expansion

In the first quarter of fiscal 2025, which concluded on June 30, e.l.f. Beauty continued its trend of impressive revenue growth. The company’s total revenue increased by 50% compared to the previous year, reaching $324.5 million, with international markets experiencing a 91% growth. The brand has significantly expanded its market share in North America and is now applying its successful low-cost, high-quality marketing strategy in Europe and other regions. Notably, e.l.f. Beauty ranks as the fourth largest brand in the U.K.

By offering lower prices than traditional competitors, e.l.f. Beauty once again captured market share from brands such as Covergirl and Maybelline in the last quarter. The company has shown consistent strong revenue growth, with a total sales increase of 316% over the past five years. This positions e.l.f. Beauty as one of the fastest-growing public companies globally.

Rapid expansion indicates that Wall Street has high hopes for the future. Although the company increased its full-year sales forecast to between $1.28 billion and $1.3 billion, this still fell short of what investors anticipated. Not meeting these expectations is a major factor contributing to the decline in the stock’s value.

Worries about shrinking profit margins

Another cause for worry regarding e.l.f. Beauty is the decline in profit margins. Over the past year, its operating margin has decreased to 12%, down from a high of over 16%, and net income has actually declining in the last quarter, despite a 50% increase in sales over 2023.

Margins are decreasing since e.l.f. Beauty is choosing to boost its marketing expenses. In the first quarter of fiscal 2025, marketing expenses accounted for 23% of revenue, up from 16% in the same quarter the previous year. What does this imply? To maintain revenue growth, e.l.f. Beauty is investing more heavily in advertising, which is affecting its net profits.

The management asserts that it is ramping up marketing efforts to boost awareness of the e.l.f. Beauty brand, which is expected to lead to long-term revenue growth and, ultimately, profits. However, at present, the heightened marketing expenses are causing profit margins to shrink, a development that Wall Street finds unfavorable. This is another factor contributing to the significant decline in the stock’s value this summer.

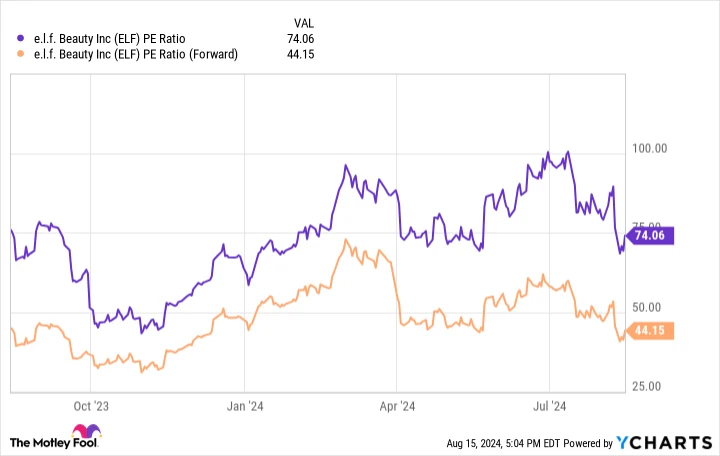

ELF PE Ratio data by YCharts

Is the stock priced low?

Following its recent decrease, e.l.f. Beauty’s market value is now $8.77 billion. This results in a trailing price-to-earnings (P/E) ratio of 74. Looking ahead and considering anticipated earnings growth, analysts predict that the stock will have a forward P/E ratio of 44 at the current price. Even with this forward P/E estimate, e.l.f. Beauty shares appear to be overpriced. The S&P 500 is currently trading with a trailing price-to-earnings ratio of 28, for comparison.

Some might contend that a company expanding at such a rapid pace merits a premium valuation. Let’s crunch some numbers to highlight the significant expectations for earnings growth at e.l.f. Beauty. For the fiscal year concluding in March 2025, the management anticipates approximately $1.3 billion in revenue. Assuming e.l.f. Beauty could double its sales to $2.6 billion in the three years following fiscal 2025, and maintaining its current 12% operating margin, this would result in $312 million in operating earnings within three to four years.

In four years, e.l.f. Beauty is expected to have a price-to-earnings (P/E) ratio of 28 if the market cap remains the same. To put it differently, it will require four years e.l.f. Beauty needs to achieve higher-than-average revenue growth just to maintain a P/E ratio equivalent to that of the S&P 500 at present. These are exceedingly ambitious expectations, making it challenging for e.l.f. Beauty to exceed them (which is necessary for the stock to increase in value).

I anticipate that e.l.f. Beauty stock will likely let down shareholders who purchase it now, owing to its high price-to-earnings ratio and the expectations already factored into its price. Although the stock might not decline any further, I believe that investors will be less than impressed with the returns over the next five years. The cost of acquiring a company is important, and even after its price drop in the summer of 2024, e.l.f. Beauty still doesn’t appear to be a bargain.

Make sure you don’t overlook this second opportunity for a potentially profitable venture.

Do you ever get the sense that you didn’t invest in the most profitable stocks in time? If so, you’ll want to pay attention to this.

Every once in a while, our skilled team of analysts releases a “Increase Your Investment in a Stock” suggestions for companies that are expected to rise significantly soon. If you’re concerned that you’ve already missed your opportunity to invest, now is the ideal time to purchase before it’s too late. The statistics clearly support this:

- Amazon: if you had invested $1,000 when we increased our commitment in 2010, you would possess $20,146 !*

- Apple: if you put $1,000 into an investment when we intensified our efforts in 2008, you would possess $42,850 !*

- Netflix: had you invested $1,000 when we intensified our efforts in 2004, you would possess $376,717 !*

At the moment, we’re sending out “Double Down” alerts for three amazing companies, and opportunities like this might not come around again for a while.

Check out these three stocks considered as “Double Down” investments.

*As of the current date, Stock Advisor’s returns are 08/21/2024