Intel ‘s ( INTC -3.81% ) The stock market has experienced significant declines so far this month, with the company’s stock dropping by 34% since July 30 due to a widespread sell-off. Concerns about a potential recession and disappointing financial results from Intel have caused panic among investors.

Although I am a strong believer in holding onto investments during a market decline instead of selling, such as with a technology company like Intel, it doesn’t automatically indicate that it is the right moment to increase your position.

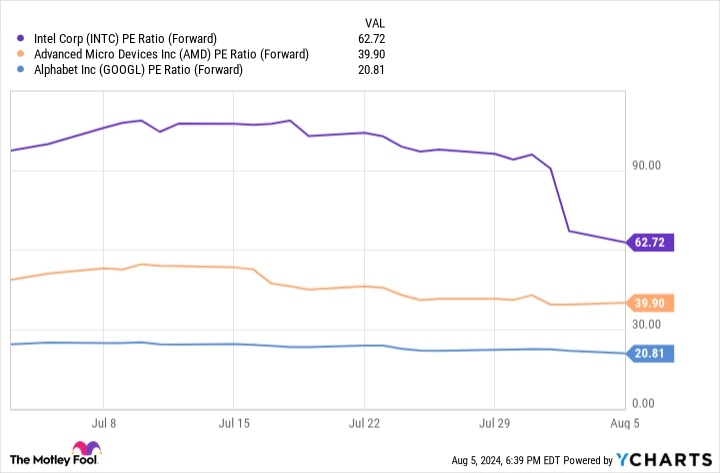

Data by YCharts.

The chart above illustrates that even though there have been recent decreases, Intel’s future price-to-earnings (P/E) ratio is notably greater compared to other technology stocks. AMD ( AMD -1.50% ) and Alphabet ( GOOGL 1.01% ) ( GOOG 0.95% ) Provide comparable opportunities in emerging sectors such as artificial intelligence (AI) and cloud computing, while being priced more attractively than Intel.

Not only is Intel’s stock undervalued, but it also fell short of revenue and earnings-per-share (EPS) forecasts in the second quarter of 2024. On the other hand, AMD and Alphabet’s recent earnings demonstrate a promising growth trend.

Don’t pay attention to Intel and think about investing in these two stocks that have the potential to make you a millionaire instead.

1. AMD

The value of AMD’s shares has dropped by 24% in the past month along with other technology stocks. Despite this recent decline, the company has a track record of significant growth, making numerous millionaires, as its stock has increased by over 3,000% since 2014.

The company has experienced significant achievements over time, playing a vital part in the chip market. AMD’s technology drives various products in the technology industry, such as gaming consoles. Sony From PlayStation 5 to custom-built personal computers, notebooks, server farms, and other computing facilities. AI models Therefore, AMD is considered one of the top stocks for investing in various technology sectors.

The main rivals of AMD are Nvidia Intel, along with the three companies, are strong competitors in the market. AI chips Nvidia is currently the leader in the industry, with Intel still struggling to make significant progress. Despite this, recent financial reports suggest that AMD’s AI sector is showing promising growth and is catching up to Nvidia.

AMD’s revenue in the second quarter of 2024 exceeded expectations by $120 million, increasing by 9% compared to the previous year. Earnings per share were $0.69, surpassing estimates by $0.01. The growth in revenue was driven by a 115% year-over-year increase in the AI-focused data center segment and a 49% rise in client sales.

The gaming division of AMD saw a significant decline in sales of semi-custom chips, leading to a 59% drop in revenue. Despite this, the company managed to achieve strong growth in the quarter by shifting its focus towards AI. In the same period, the operating income reached $269 million, marking a substantial improvement from the $20 million loss recorded a year earlier.

AMD demonstrated strong financial performance in the second quarter of 2024, showcasing significant profits from its substantial investment in artificial intelligence and making strides in the market. free cash flow AMD’s stock has increased by 81% since the beginning of the year, giving it more purchasing power. With its strong value and performance, AMD is currently a clear choice over Intel for investors.

2. Alphabet

Alphabet’s stock price has dropped by 17% since the beginning of July, following the general decline in the technology sector. Nonetheless, the price-to-earnings ratio based on future earnings With a price-to-earnings ratio of 21, this stock is considered one of the most cost-effective options in the technology sector and should not be overlooked. Additionally, similar to AMD, the latest earnings suggest a promising outlook for this tech company.

In late July, Google announced its financial results for the second quarter of 2024, revealing a 14% increase in revenue to $85 billion compared to the previous year. The company experienced significant growth in advertising, with sales going up by 11%. Google Cloud was the standout performer, achieving a remarkable 28% year-over-year revenue growth, surpassing its industry rivals. Amazon Services provided over the internet Microsoft Cloud computing has experienced growth during the specified period.

Alphabet appeared to lag behind at the beginning of the year. its competitors in cloud computing Despite being a latecomer in the cloud computing industry, Google Cloud is showing significant progress by rapidly increasing its earnings. Notably, the operating income of Google Cloud has almost tripled, surpassing $1 billion for the first time. This success in cloud computing is encouraging for Alphabet as it helps in expanding its revenue sources beyond advertising and establishes a strong position in the field of artificial intelligence.

Alphabet has a rich history of generating wealth and has definitely produced several millionaires, as its stock has increased by 470% in the past ten years. With its affordable price, Alphabet’s stock is a better choice compared to Intel and presents a great opportunity for investing in the technology sector.