There has been plenty of discussion about artificial intelligence (AI) in the last couple of years. Some might even say that it has been a topic of extensive conversation. too AI has been a widely discussed topic in various platforms such as social media, company financial reports, and financial news. It has become one of the most popular subjects in the technology and business industries.

AI offers companies the potential to enhance productivity and foster creativity. For investors, AI provides a distinctive chance to benefit from the expansion of this technology. If you belong to this investor category and have $3,000 ready to invest, allocating $1,000 into each of these three stocks could yield significant returns over time.

1. Microsoft

Microsoft ( MSFT 0.26% ) has adopted an intelligent strategy towards AI by forging a strategic alliance with OpenAI The creator of the widely used ChatGPT is the developer. The collaboration between them includes a mutual agreement where OpenAI is granted permission to utilize Microsoft’s services. cloud platform Azure benefits from its infrastructure and computing capabilities, while Microsoft gains the opportunity to incorporate OpenAI’s AI models into its offerings.

The choice between outsourcing and keeping operations in-house is wise as it prevents Microsoft from allocating a significant amount of resources (such as skilled personnel and funds) to development. big models for language OpenAI has established itself as a frontrunner in AI research and development, thanks to significant investments of billions of dollars and years of effort.

While Microsoft certainly has the resources and expertise to create AI internally, this collaboration seems to offer a more streamlined approach. It enables Microsoft to focus on incorporating these AI algorithms into its existing top-notch products and services, rather than investing time and resources into developing them from scratch.

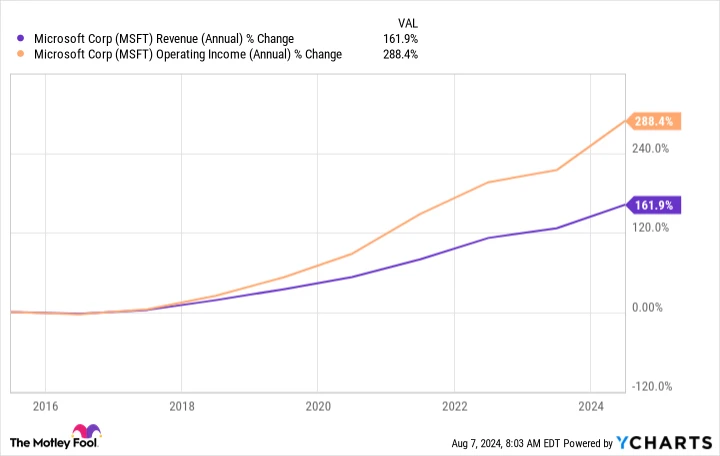

Many businesses and individuals rely on Microsoft’s Office suite (including Excel, Teams, PowerPoint, etc.) and devices. Introducing artificial intelligence features is expected to enhance its performance. advantage over competitors and strive to maintain the positive financial trajectory it has been experiencing for an extended period of time.

Annual revenue of Microsoft Corporation. data by YCharts

2. Apple

Numerous technology companies appeared to be in a competition to create and demonstrate their latest AI features. Apple ( AAPL -0.07% ) Adopted a more patient position. Certain investors criticized this strategy, arguing Apple I believe the company was not keeping up with the pace, but I would say that this aligns with its image of being deliberate and thoughtful in its strategies.

Apple has just introduced its own version of artificial intelligence called Apple Intelligence. This new AI technology is created to smoothly work with Apple’s advanced hardware devices such as iPhones, iPads, and Macs, with the aim of improving the overall user experience.

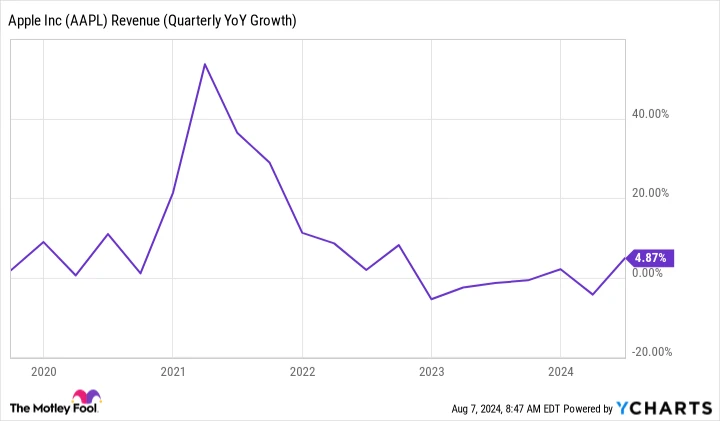

Apple primarily relies on hardware sales, which made up around 72% of its revenue in the most recent quarter. However, due to a decrease in the smartphone market, Apple’s revenue growth has significantly slowed compared to previous years. The fact that the iPhone contributes to about 46% of Apple’s revenue clearly explains this connection.

Quarterly Percentage Increase in AAPL’s Revenue Compared to the Same Quarter of the Previous Year data by YCharts

Apple Intelligence will be exclusive to Apple’s upcoming products launching this autumn. The expectation is that the appeal of these new AI-enhanced products will drive an increase in Apple’s financial performance, as consumers purchase new devices to benefit from these advanced features.

3. CrowdStrike

I believe we can confidently refer to it as a cybersecurity firm. CrowdStrike ( CRWD 1.83% ) The situation has deteriorated. Following a defective software update that caused the most significant worldwide IT disruption ever, investors lost confidence in CrowdStrike and caused a sharp drop in the stock price. The stock has plummeted by more than 40% in the last month.

Even though the company experienced its largest mistake ever, the positive aspect is that the issue wasn’t due to CrowdStrike’s product failing to work properly. While software updates can sometimes go wrong, it is a much more serious situation for a top cybersecurity firm to be targeted in a cyberattack. Fortunately, it appears that the former scenario is the case here.

CrowdStrike is a leading provider of cybersecurity solutions that leverage artificial intelligence technology. Its effectiveness has led to the attraction of numerous prominent clients. The company was ranked at the top for its performance in protecting endpoint devices such as smartphones, computers, and smart devices. This position remains unchanged despite a recent software update incident.

There are uncertainties in the short term regarding CrowdStrike, such as the number of customers who may switch to other options, although it is unlikely that many will do so. Nevertheless, the stock appears to offer significant value for investors with a long-term perspective. This is particularly evident as the stock is currently priced at its lowest level since December 2023, presenting investors with a more appealing opportunity to enter the market.

The The entire potential market size that a company can target. The demand for cybersecurity is substantial, and CrowdStrike is expected to be a key player in the industry for a long time.