It cannot be denied McDonald’s McDonald’s continues to dominate the restaurant industry with its 40,000 stores, which generated $119.8 billion in sales, resulting in $25.5 billion in revenue and $8.5 billion in net income. No other restaurant brand comes close to achieving such impressive figures.

When looking at it from an investor’s perspective, the size of a business is not the most important factor. In fact, being too large can be a disadvantage as it can hinder further growth. For example, in certain situations, a new McDonald’s branch may face competition from an existing nearby McDonald’s outlet.

If you are seeking a better option for investment in the fast-food restaurant industry, you may want to consider. Cava Group ( CAVA 7.51% ) instead.

What’s Cava?

Although Cava currently has only 323 restaurants, it is not as widely recognized as McDonald’s. However, in areas where Cava has been established for a while, customers greatly appreciate its Mediterranean cuisine. The pita wraps and bowls offered by Cava align well with the fast-casual concept and cater to the changing preferences of consumers.

The hamburger has been the prevailing choice. fast food restaurant After dominating the food industry for many years, the negative effects on health of enriched bread in hamburger buns and highly processed red meats are now becoming apparent. These products are losing popularity, as consumers are more inclined to spend a little extra for fresh, organic ingredients similar to those used by Cava.

Nevertheless, the main attraction is the food itself. Many American consumers have yet to explore it, but those who do often develop a taste for it. The added advantage of its health benefits makes it even more appealing to the market.

Put differently, this could be the new offering that customers have been anticipating from the fast-casual dining sector.

Cava has the evidence to back it up.

Cava’s numbers support the assertion.

For instance, consider the financial performance of Cava in the first quarter. In the three-month period ending on April 21, the company increased its revenue by 30.3% compared to the previous year, reaching $256.3 million. Additionally, the sales from stores that have been open for at least a year grew by 2.3%, which was a challenging comparison to the 28.3% growth seen in the same period last year.

Furthermore, Cava Group is becoming more profitable despite being a young and small company. In the first quarter, the earnings before interest, taxes, depreciation, and amortization (EBITDA) showed an increase. EBITDA The revenue of $33.3 million increased twofold compared to the previous year, and the net profit of $14.0 million completely offset the loss of $2.1 million from the previous year. Despite opening 14 new restaurants during the quarter, Cava achieved this level of profitability.

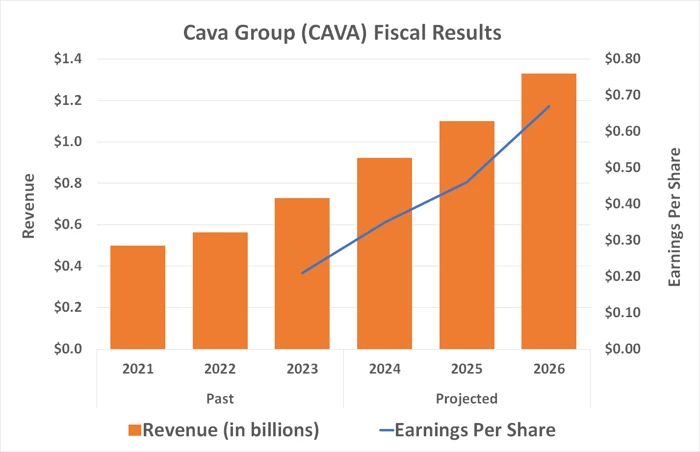

In general, the financial results for the first quarter continue the ongoing patterns that are anticipated to continue into the next year. In May, the company adjusted its projected full-year EBITDA upwards from a previous estimate of $86 million to $92 million to a new estimate of $100 million to $105 million. Forecasts for growth in sales from existing stores were also increased. Analysts are predicting a minimum of 20% growth in revenue for both this year and next year, while per-share earnings are forecasted to more than double over the next two years. These positive indications suggest a strong supporting force for the company’s performance.

Information obtained from StockAnalysis.com. Graph created by the writer.

The interesting fact is that Cava Group has very little debt. By April, the company only had long-term commitments related to operating lease agreements, mainly for the rent payments to landlords. restaurant Based on the data provided, it is evident that Cava restaurants generally start off by operating at a profit.

Of greater significance to potential investors, Cava has the advantage of having financial freedom as it is not obligated to bondholders who anticipate receiving consistent interest payments, regardless of whether it benefits the organization at that moment.

The benefits outweigh the potential downsides.

Is Cava a sure bet for success? Not at all, particularly in a highly competitive industry like restaurants. Additionally, the stock is quite pricey compared to its earnings. It’s worth noting that young growth stocks, including Cava Group, often experience significant volatility.

However, the potential gain outweighs the risk for investors who are comfortable with taking risks. Cava has significant opportunities for growth in the future, and there are numerous factors indicating that it will be successful in doing so.