Intel ( INTC 3.12% ) It suffered greatly in a recent technology market downturn, experiencing a 42% decrease in its stock value in the past month. Concerns about a potential economic downturn led to hesitation among technology investors, resulting in a drop in the stock prices of many companies. Market instability, along with disappointing quarterly earnings from Intel, led to a substantial decrease in the company’s shares.

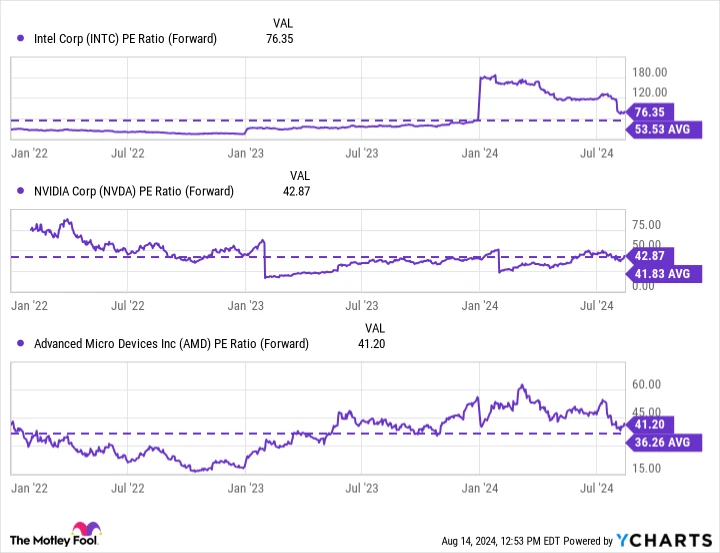

Typically, a significant decrease in price like this would result in the stock being considered a good deal. However, the graph provided indicates that Intel’s future price-to-earnings (P/E) ratio is still significantly greater than that of its top two chip competitors. Nvidia ( NVDA 4.35% ) and AMD ( AMD 4.52% ) .

Data by YCharts PE ratio is equal to the price-to-earnings ratio.

The chart illustrates that Intel not only has the highest forward P/E ratio compared to these companies, but its value for this measure is also significantly higher than its average since 2022. In contrast, AMD’s and Nvidia’s forward P/Es are close to their historical averages, indicating that they are more attractively priced compared to Intel.

Additionally, the most recent financial results indicate that Intel faces a less stable position in the growing artificial intelligence (AI) market compared to its competitors. In the second quarter of 2024, the company fell short of earnings-per-share projections by $0.08 and revenue by $150 million. Recent obstacles have caused Intel’s quarterly free cash flow to plummet by almost 5,000% in the past year, reaching a negative $3 billion.

On the other hand, Nvidia and AMD are considered to have more well-established positions in the field of AI and have shown significant financial growth due to the growth of the industry. Therefore, it may be wise to overlook Intel and instead focus on investing in these superior AI stocks following a decrease in their value.

1. Nvidia

Nvidia’s stock has experienced a drop of approximately 10% in the past month due to a decline in the technology sector. The most significant decrease saw the share price fall by 25% from July 10 to August 5. Despite this, signs of a rebound are emerging, indicating that investing sooner rather than later may be advisable.

In just the past week, the company’s stock has increased by 18%, resulting in a market value gain of over $420 billion. This rise is consistent with Nvidia’s recent upward trend in growth. significant impact in artificial intelligence .

Nvidia is responsible for approximately 70% to 95% of AI accelerators due to their dominance in the market. the achievement of its GPUs These chips play a vital role in the construction and operation of AI models due to their ability to perform numerous tasks simultaneously. This allows GPUs to effectively manage the demanding tasks required for creating extensive language models such as OpenAI’s ChatGPT and other artificial intelligence systems.

The company’s significant influence in the field of AI has established it as the leading chip provider for many organizations. Among its major clients are industry leaders such as tech giants like Amazon Amazon Web Services (AWS), Meta Platforms , Microsoft , and Alphabet In the meantime, the company provides its chips for products aimed at consumers. Tesla technology that drives itself Nintendo Nintendo’s gaming system called the Switch.

Moreover, Nvidia has teamed up with the state of California in a program supported by Governor Gavin Newsom to educate its population about AI technology. CEO Jensen Huang mentioned that this partnership aims to boost employment opportunities and prepare 100,000 individuals, including students, professors, developers, and data experts, to utilize this technology effectively.

Nvidia is expected to release its second-quarter financial results for the fiscal year 2025 on August 28th. Over the past year, the company has seen a 44% increase in quarterly revenue and a 63% rise in operating income, outperforming expectations consistently. Following recent patterns, it is anticipated that the upcoming earnings report will continue this trend. Due to this, investors may find Nvidia’s stock appealing after a decline, making it a more attractive choice compared to Intel.

AMD

Following a decrease in the market, AMD’s stock has fallen by 22% over the past month. Despite this, its stable financial progress and increasing involvement in artificial intelligence indicate that its shares should not be overlooked.

The technology company released its financial results for the second quarter of 2024 at the conclusion of the previous month. It showed a 9% growth in revenue compared to the previous year, surpassing the predictions of financial analysts by $120 million. AMD achieved significant success in its data center division focused on artificial intelligence, experiencing a remarkable 115% revenue surge from the previous year and a more than 400% increase in operating income.

During the second quarter of 2024, AMD showed significant progress in the field of artificial intelligence (AI) with a notable rise in sales of AI GPUs, resulting in substantial financial advancement. Additionally, the company experienced a significant increase in its market share of server central processing units (CPUs), reaching its highest level in many years. According to Mercury Research, AMD’s share of the server market increased by 5.6 percentage points compared to 2023, reaching a share of 24.1%.

The increase in sales of server CPUs indicates that the company is closing in on Intel’s market dominance. Intel has been the leading CPU manufacturer for a long time, with AMD slowly reducing its market share. However, AMD has been able to significantly increase its profitability. According to Tom’s Hardware, Intel made $3.0 billion from selling 75.9% of data center CPUs, while AMD made $2.8 billion from selling 24.1% of server CPUs. This significant difference in revenue supports the optimistic outlook for AMD’s stock.

AMD’s cash flow generated on a quarterly basis Year-to-date, AMD’s revenue has increased by 81% to $439 million, whereas Intel has experienced a decrease to a negative $3 billion. These numbers indicate that AMD is in a stronger financial position, with greater cash reserves to support its growth. In addition, with a more attractive stock valuation, AMD is currently a clear choice for investors interested in AI stocks.