Contents

CrowdStrike Holdings: A Potential Investment Opportunity?

CrowdStrike Holdings has seen a significant 56% increase in its stock value over the past year. However, this upward trajectory halted abruptly following a software update that disrupted numerous global IT systems on July 19. As a result, the company’s stock plummeted by 34% from its 52-week high in early July. Despite this setback, the cybersecurity firm has recently shown signs of recovery, aided by its fiscal 2025 second-quarter results (for the period ending July 31) that have seemingly reassured investors.

Should Investors Consider Buying CrowdStrike Stock?

Wall Street’s Optimism

Wall Street analysts remain optimistic about CrowdStrike’s prospects. Among 51 analysts covering the stock, a substantial 82% rate it as a buy, while a mere 2% advise selling. The stock’s 12-month median price target stands at $315, suggesting a potential 21% increase from current levels. The highest price target, at $540, implies an impressive 108% rise.

This positive outlook persists despite the recent IT outage, which reportedly caused a $5.4 billion loss at Fortune 500 companies, according to Parametrix, a cloud monitoring and insurance services provider. The optimism is partly due to CrowdStrike’s modest reduction in fiscal 2025 revenue guidance, now set between $3.89 billion and $3.9 billion, down from the previous $3.98 billion to $4.01 billion. This represents a 2.5% decrease at the midpoint.

Revenue and Profitability Outlook

CrowdStrike anticipates a 27.5% growth in its top line for the current fiscal year. However, the company acknowledged that compensation packages to offset the outage’s impact would reduce subscription revenue by $60 million and professional services revenue in the “high single-digit million dollars” range in the latter half of FY ’25.

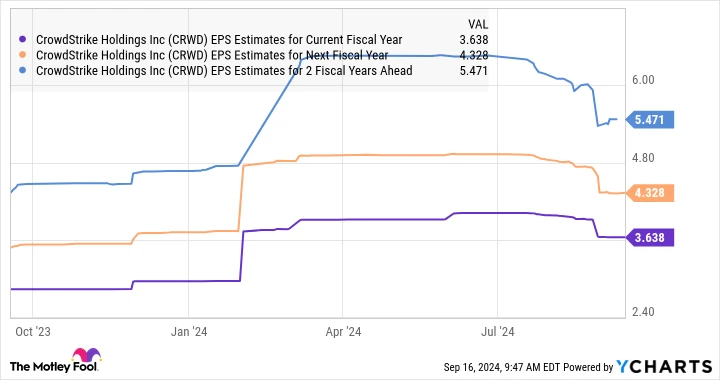

These compensation packages, which include additional cybersecurity modules, flexible payment terms, and extended customer contracts, are expected to negatively affect profitability. Consequently, CrowdStrike adjusted its earnings per share guidance for fiscal 2025 to $3.63, down from $3.98.

Despite these challenges, CrowdStrike expects operating margins to improve in the second half of fiscal 2026 as the effects of the outage diminish. The company also highlights its strong cash position and insurance policies intended to mitigate potential claims.

The updated earnings guidance projects a 17% increase in the company’s bottom line this fiscal year. While consensus earnings expectations for the next few years have dipped, the company anticipates accelerated bottom-line growth after this period.

Can CrowdStrike Maintain Its Momentum?

While Wall Street’s price targets indicate potential upside for CrowdStrike in the coming year, short-term pressure may persist as the company navigates the post-outage landscape. However, any further stock declines could present buying opportunities for investors, given CrowdStrike’s robust revenue pipeline and substantial market potential.

Expanding Market Opportunity

CrowdStrike estimates its total addressable market (TAM) will reach $100 billion in 2024, expanding to $225 billion by 2028. The company’s success in capitalizing on this opportunity is evident from the 50% year-over-year growth in remaining performance obligations (RPO) last quarter, totaling $4.9 billion. RPO represents the future contract value yet to be fulfilled.

This RPO growth suggests a promising future, indicating sustained revenue growth in the long term. If future results and guidance exceed expectations, CrowdStrike could regain investor confidence and potentially achieve the steady gains analysts anticipate over the next year.

Seizing the Opportunity

Savvy investors may consider accumulating shares of this cybersecurity stock if it experiences further corrections, presenting a more attractive valuation. CrowdStrike’s prospects for the coming year and beyond appear bright.

Don’t Miss a Second Chance at a Potentially Lucrative Opportunity

Ever feel like you’ve missed the boat on the most successful stock investments? Here’s your chance to catch up.

Occasionally, our expert analysis team issues a “Double Down” recommendation for companies they believe are poised for substantial growth. If you’re concerned about missing investment opportunities, now might be the ideal time to act before it’s too late. Consider these examples:

– Amazon: Investing $1,000 when we doubled down in 2010 would have grown to $21,047!*

– Apple: A $1,000 investment in 2008 during our double down would now be worth $41,011!*

– Netflix: A $1,000 investment in 2004 would have soared to $381,230!*

Currently, we’re issuing “Double Down” alerts for three incredible companies, and such opportunities may not arise again soon.

See 3 “Double Down” Stocks

Stock Advisor returns as of 09/19/2024