Palantir Technologies is a software company that specializes in data analysis and integration for various industries. ( PLTR 0.71% ) and Microsoft ( MSFT 1.18% ) Two stocks have had different outcomes on the stock market in 2024. One has seen substantial increases in value, while the other has had a lackluster performance.

In particular, the value of Palantir shares has increased by 75% in 2024. In contrast, Microsoft has only risen by 8% this year, as the company’s stock has declined over the last month after a strong performance in the first half of the year.

It is important to mention that both Palantir and Microsoft have been relying on. AI refers to machines being able to perform tasks that typically require human intelligence. Both companies have experienced a boost in their business due to the increasing use of this technology, which is advantageous for their growth. Nevertheless, if investors need to select one of these AI investments for their portfolios at this moment, which one should they invest in?

Let’s discover.

The argument in favor of Palantir Technologies

Palantir Technologies is assisting governments and businesses worldwide in incorporating AI into their activities through its Artificial Intelligence Platform (AIP), which has been well-received by clients. The significant increase in Palantir’s expansion during the second quarter of 2024 clearly demonstrates this.

In comparison to the 21% growth reported in the previous quarter, the company’s revenue surged by 27% year-on-year to reach $678 million. Further examination of various revenue indicators suggests that Palantir’s growth trajectory may continue to improve in the upcoming quarters. One notable metric is Palantir’s remaining deal value (RDV) which climbed by 26% year over year in Q2, totaling $4.3 billion. RDV represents the overall worth of Palantir’s contracts that are still outstanding at the conclusion of a given period.

The significant increase in RDV, almost equivalent to Palantir’s substantial revenue growth, shows that more people are starting to use its software platforms. It is important to highlight that Palantir gained a lot of new customers in the last quarter. The total number of customers for the company rose by 41% compared to the previous year, reaching 593 in Q2.

Furthermore, Palantir has seen an increase in the size of deals signed by its customers. In the last quarter, the company closed 96 deals valued at $1 million or higher. Among them, 33 deals were worth $5 million or above, and 27 deals were valued at over $10 million. By contrast, in the corresponding period last year, Palantir secured 66 deals worth $1 million or more. Of these, 18 deals were valued at $10 million or higher, and 30 were worth more than $5 million.

Palantir experienced a significant increase in the size of its deals and customer base in the last quarter. The company’s strong performance was attributed to the central role played by AI, as highlighted by the management in their latest update. A meeting where a company discusses its financial performance with investors and analysts. One significant measure of our success is the high number of current customers who are entering into expansion agreements, with a large portion being influenced by AIP.

Palantir is optimistic about acquiring new clients and increasing their involvement by concentrating on guiding customers through the transition from testing to full-scale use. During the earnings call, management shared various instances of assisting businesses in implementing AIP and achieving positive outcomes. This pattern is expected to persist, as the demand for AI software is projected to expand rapidly, with an anticipated annual growth rate of 58% until 2028, leading to a revenue of $52 billion in that year.

Palantir has significant potential for expansion in the future as it anticipates generating $2.75 billion in revenue by 2024, representing a 23% growth from the previous year. The company’s increasing revenue stream suggests that it is making progress towards seizing the substantial opportunity in the AI software sector, positioning it to maintain its position as a leading player. AI stock over time.

The argument in favor of Microsoft

Microsoft has been at the forefront of AI development due to its collaboration with. ChatGPT OpenAI, a company specializing in artificial intelligence, seems to be undervalued by the market in terms of its AI capabilities. The stock has experienced a decline in the last month, dropping by 12% in value. This is surprising considering that Microsoft reported strong fourth-quarter results for fiscal year 2024, ending on June 30, on July 30.

The company saw a 15% increase in revenue from the previous year, reaching $64.7 billion, with earnings also rising by 10% to $2.95 per share. Analysts were expecting earnings of $2.93 per share on revenue of $64.4 billion. Microsoft’s Intelligent Cloud business revenue grew by 19% to $28.5 billion in the last quarter, driven by a 21% year-over-year growth in the Azure cloud services division. The increased adoption of AI services in the cloud contributed eight percentage points to this growth.

The latest remarks were made by Satya Nadella, the CEO of Microsoft. financial results meeting The company ended the quarter with over 60,000 customers utilizing its Azure AI services, showing a nearly 60% rise compared to the previous year. Nadella also mentioned that the average expenditure per customer utilizing Azure AI services is on the rise.

Microsoft holds a strong position in the cloud computing market with a 23% share, making it well-positioned to capitalize on the increasing use of AI services in the cloud. It is important for investors to recognize that Microsoft is the second-largest participant in the cloud infrastructure market. Amazon , holding a 32% share of the market. Nevertheless, Microsoft has been closing the gap on Amazon in this industry.

According to Fortune Business Insights, the AI services market in the cloud is projected to experience a yearly growth rate of around 31% until 2030, reaching approximately $398 billion in yearly revenue by the end of this period. Microsoft is in a favorable position to capitalize on this substantial growth opportunity, given its increasing impact in the cloud computing sector through AI. Therefore, investors should take into account the broader perspective, as Microsoft’s expanding presence in cloud computing, driven by AI, could significantly benefit its business in the future.

The verdict

Currently, Palantir is experiencing a higher rate of growth compared to Microsoft, making it an appealing option for investors seeking a rapidly expanding AI stock. Nevertheless, those interested in purchasing Palantir should be prepared to pay a high price as it is currently valued at 29 times its sales. In contrast, Microsoft is considered more affordable with a price-to-sales ratio of 12.

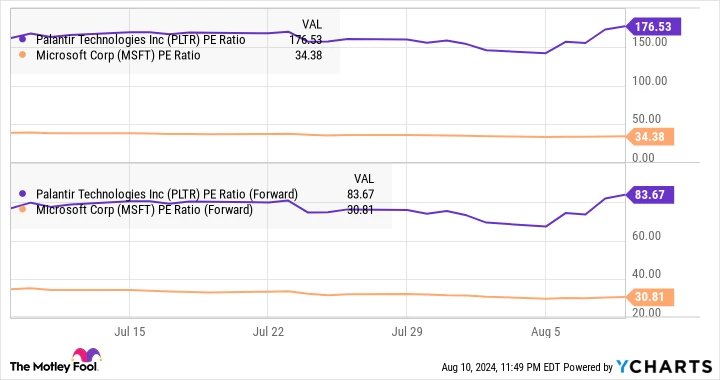

A comparable narrative emerges when examining their price-to-earnings ratios.

PLTR PE Ratio data by YCharts

On the other hand, the chart also shows that Palantir’s profits are predicted to increase at a significantly quicker rate compared to Microsoft. This is evident from the substantial difference between Palantir’s past earnings and its future earnings. In contrast, Microsoft’s earnings are anticipated to rise at a slower speed. To elaborate, analysts’ forecasts suggest that Palantir’s profits will surge by 85% annually over the next five years, a figure much greater than Microsoft’s expected growth rate of 15%.

Ultimately, the decision of which of these two AI stocks investors choose to purchase at the moment depends on their willingness to take on risk. Investors who are prepared to invest more in a rapidly expanding company may find Palantir appealing, whereas those seeking a reasonably priced stock with consistent long-term growth potential may lean towards Microsoft.