AI stocks have experienced a decline in value over the past month, with a notable 13% decrease. Nasdaq-100 The technology industry experienced a downturn as worries about a possible economic decline led to a decrease in the value of tech companies.

Nevertheless, the latest profits generated by various technology giants involved in artificial intelligence indicate that the sector continues to hold significant potential in the foreseeable future. Prominent companies in the market such as AMD s, Amazon , and Alphabet The earnings for the past month were reported to have exceeded the expectations of Wall Street in their individual AI sectors.

The significant increase in growth is consistent with data from Grand View Research, indicating that the AI market is projected to grow at a rate of 37% annually until 2030, with spending reaching close to $2 trillion. Therefore, there is still a good opportunity to invest in AI and benefit from its ongoing progress.

There are some appealing and obscure choices available. Intel ( INTC -2.69% ) and ASML Holding NV is the full name of the company. ( ASML 1.16% ) One company is making significant investments in building AI chip factories, while the other is a semiconductor equipment provider that supplies essential machinery for manufacturing various types of chips. Let’s analyze these two leading chip companies and decide whether investing in Intel or ASML is the preferable option for AI investments.

Intel

Being an Intel investor in the past month has been challenging, as the company’s stock has dropped by 43%. The decline was triggered by the disappointing second-quarter earnings report for 2024 released on August 1, causing shareholders to sell their stocks quickly.

Revenue dropped by approximately 1% compared to the previous year, falling short of expectations by $150 million. Additionally, earnings per share were $0.08 lower than anticipated, standing at $0.02.

The company’s failure to meet earnings expectations was accompanied by an announcement from Intel that they will be reducing their workforce by 15% and suspending their Q4 2024 dividend in order to lower capital expenses.

Expensive decisions, like increasing production of the Core Ultra PC chip and transferring Intel 4 and 3 chip wafers to a facility in Ireland, played a part in the recent decreases. Additionally, Intel disclosed that its contract manufacturing business was underperforming compared to projections.

Adding to the problem, a set of investors is taking legal action against Intel following significant losses that led to a $32 billion decrease in its market worth. The shareholders were caught off guard by the latest financial results and claimed that Intel made inaccurate statements about its operations and production capabilities.

Intel is facing challenges as it has not seen a payoff from its significant investment in AI and is in fierce competition with AMD. Nvidia The technology company is strategizing for the future and has the potential to make a strong comeback in the long run, however, investors need to be patient and prepared to wait.

ASML Holding NV is a company’s name.

ASML’s stock price has dropped by 20% due to a recent downturn in the technology sector. This Dutch company is the top provider of lithography systems globally, which are essential for producing various types of chips, such as those utilized in artificial intelligence. ASML holds a dominant position in the lithography market, accounting for over 80% of it, hence playing a vital role in chip production and being a desirable investment opportunity.

The company’s strong position in the market has led to it being able to attract the largest foundries worldwide, with some of its customers including Taiwan Semiconductor Manufacturing Corporation is a leading semiconductor foundry company based in Taiwan. On the other hand, its yearly income and profit from operations have continuously increased by 283% and 513% in the past ten years.

ASML released its financial results for the second quarter of 2024 on July 17, reporting a revenue of 6 billion euros, which is a 10% decrease compared to the previous year. Despite this, the company reassured investors that it considers 2024 to be a year of transition, with ongoing investments in expanding production capacity and advancing technology. ASML anticipates significant growth in 2025 as it reaps the rewards of its current efforts.

ASML faces a vulnerability due to the increasing tensions between the United States and China and the potential impact on the semiconductor market. Nonetheless, several leading foundries globally are making efforts to establish production facilities in the U.S., which could safeguard ASML’s operations in the future. Additionally, the company’s dominance in a crucial segment of chip technology is a significant advantage that cannot be overlooked.

Which is the more advantageous stock to consider for investment in the field of artificial intelligence, Intel or ASML?

Intel and ASML hold contrasting roles in the field of AI. While Intel is focused on advancing chip design and production, ASML dominates the market for the essential equipment needed for this process. manufacture artificial intelligence graphic processing units (GPUs) .

Nonetheless, the recent decrease in Intel’s performance indicates that investing in ASML’s stock may be a more dependable option at the moment. Intel is facing significant challenges in enhancing its financial position as it contends with Nvidia, AMD, and TSM.

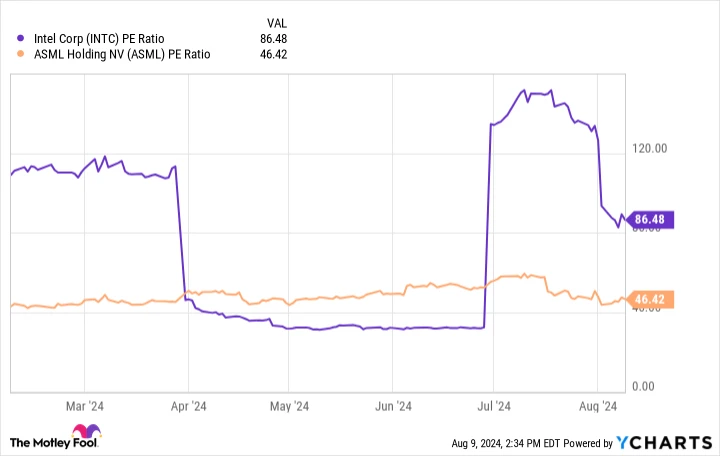

Data by YCharts.

The chart above illustrates Intel’s fluctuation in the past six months. the ratio of a company’s stock price to its earnings per share Lately, ASML stock has risen to over 86. The graph shows that ASML is more stable and offers better value, with a significantly lower price-to-earnings ratio.

In addition, ASML’s free cash flow With a market value exceeding $3 billion, ASML’s financial performance contrasts with Intel’s loss of $12 billion, underscoring ASML’s stronger market position. Consequently, ASML is considered the superior AI stock to invest in this month.