Shares of Cognex Corporation, a company specializing in machine vision technology, experienced an 18.6% drop in August, as reported by S&P Global Market Intelligence. The reason for this decline is clear: the disappointing second-quarter earnings report released at the end of July prompted a significant fall in stock value at the beginning of August.

Short-term Challenges

Machine vision technology holds great promise for the future. It plays a crucial role in automating complex processes, ensuring quality control, and overseeing manufacturing operations across sectors such as automotive, semiconductors, and consumer electronics. In logistics, it facilitates automation in e-commerce shipping.

Despite the long-term appeal of its end markets, many are currently facing short-term challenges, impacting Cognex’s performance. For instance, high interest rates are suppressing automotive sales and have led to reduced expectations for sales, production, and investment this year. CEO Rob Willett mentioned during the earnings call that “macro sentiment has now declined again, and we have seen additional delays and reductions in EV projects.”

A similar situation exists in consumer electronics. While there are positive long-term trends, Willett noted that “we continue to have tempered expectation for investment in 2024.”

Consequently, management’s guidance suggests a slight revenue decline from the second to the third quarter. It’s worth noting that Cognex typically secures significant orders in the spring as clients gear up for increased production in the fourth quarter, so major orders are unlikely to be announced before spring 2025.

The Case for Investing in Cognex

However, long-term investors typically focus beyond a few quarters of performance. The company is poised to return to robust growth with an improving global economy. Lower interest rates will likely boost automotive and consumer electronics sales (Cognex excels in the EV battery and smartphone manufacturing industries). Furthermore, the long-term outlook for e-commerce, growing as a share of total retail sales, remains optimistic.

Indeed, signaling a cyclical recovery in the automotive and consumer electronics sectors, Cognex’s logistics and semiconductor sales are showing strong growth as those industries rebound from downturns.

Should You Buy Cognex Stock?

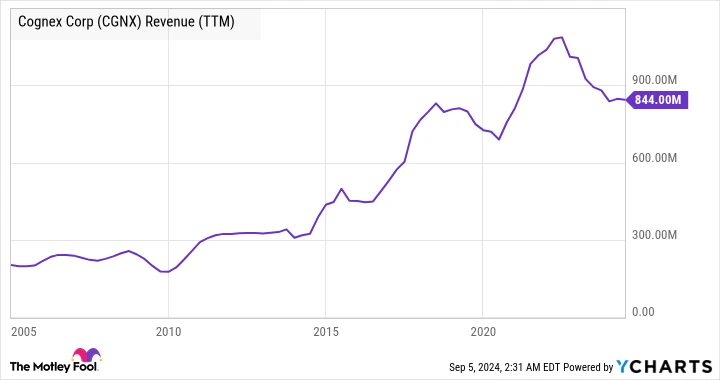

As illustrated in the chart below, Cognex has historically experienced volatile revenue growth, though the long-term trajectory is upward.

CGNX Revenue (TTM) data by YCharts

The company continues to expand into new markets and benefit from increasing machine vision adoption. This trend is expected to persist, making the recent dip in share price an appealing opportunity for investors.