Investors have had a challenging few weeks. While stocks have rebounded from the previous week’s low, the situation remains turbulent. S&P 500 The current level is significantly lower than the peak in July. There is a likelihood that the market may reach an even lower point before the situation is resolved.

However, not all stocks are being defensive. Some stocks are currently trading at or close to their all-time highs. Investors are attracted to these few stocks because they provide a level of safety that many other stocks do not offer at the moment. Therefore, people are investing in these companies as a precaution in case the recent market decline is a sign of things to come.

Coca-Cola ( KO ) One of these titles is on my radar, and I am considering purchasing more of it even though its value has recently increased. Let me explain why you may also be interested in doing the same.

Coca-Cola is the perfect example of being resilient.

Coca-Cola is the most famous beverage globally. beverage In addition to its main soft drink product, the company also possesses labels such as Minute Maid juice, Gold Peak tea, Dasani water, and Powerade sports beverage. to name a few .

However, the company is not exactly what people may expect it to be. In the past, it handled a large portion of its own bottling operations, but it has started outsourcing this task to third-party bottlers who purchase flavored syrups from Coca-Cola. Although this may result in lower overall revenue, it also leads to higher-margin earnings. The key benefit of this change is that it allows the company to concentrate on its core competency – marketing.

Why is the stock price increasing to all-time highs while others are being cautious? Furthermore, can this upward trend continue in the future?

The response to the initial query suggests that we could be moving towards a phase of economic sluggishness that could benefit the company.

The unemployment rate in the country is slowly rising, and globally, the International Monetary Fund is reducing its predictions for economic growth in the near future.

Consumers are not likely to stop consuming their preferred drinks simply because of that. There might be a decrease in available funds. It can be argued that individuals may choose to indulge in these more basic, cost-effective delights instead. more In comparison to their usual spending habits, consumers tend to allocate more money towards smaller expenses when they are not making larger purchases. For example, during the 2008 financial crisis and the following economic downturn, Coca-Cola experienced an 11% revenue growth while only seeing a 5% increase in sales volume.

Regarding the second question, it is anticipated that there is still potential for further growth in this stock, even if there is some profit-taking at the current levels. The stock is currently trading slightly below the average price target of $70.73 set by analysts, who mostly maintain a strong buy rating on it.

However, that is not the main reason why I am increasing my investment in Coca-Cola at this moment.

A suitable moment to start focusing on generating income.

Owning Coca-Cola is always a good investment due to its strong brand recognition and consumer loyalty. The company’s management demonstrates a clear understanding of the beverage industry. In the long run, having Coca-Cola in your portfolio is unlikely to have any negative impact.

Currently, I am focused on a more specific interest. As I expect economic challenges ahead, I am aiming to increase my investments in stocks that pay dividends. There is no one superior to. stocks of Coca-Cola.

The dividend yield of 2.8% looking ahead may not be very impressive, as there are other investments offering higher yields. However, it is difficult to find a more reliable option with a similar level of risk. The stock’s beta, indicating volatility, is exceptionally low at 0.59, suggesting minimal fluctuations in comparison to other investments.

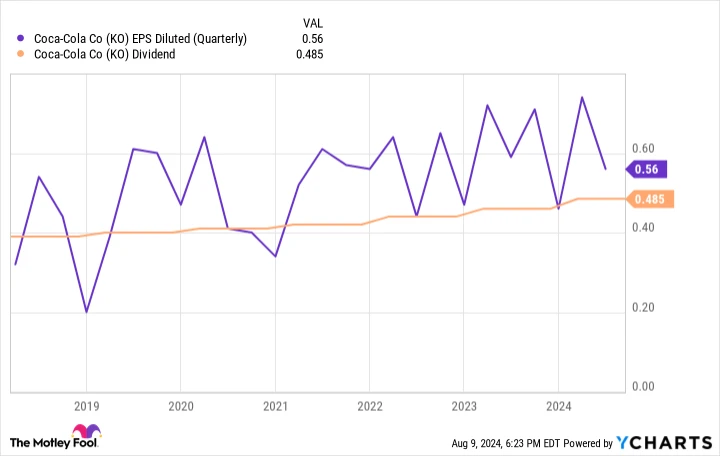

Consumers’ Maintaining brand loyalty during challenges implies that consumers will remain loyal to purchasing products such as Coke, Minute Maid, Gold Peak, and others. This loyalty allows the company to generate a net profit equivalent to about one-fourth of its revenue. Consequently, the company will consistently earn sufficient profits to cover its future dividend payments. Out of the $2.79 per share earned by Coke in the last four quarters, only $1.91 was utilized for dividend payouts, indicating a healthy profit margin.

Quarterly diluted earnings per share (EPS). data by YCharts defines EPS as earnings per share.

Coca-Cola is not only known for consistently increasing its dividend payout, but it has also raised its annual dividend for 62 years in a row. It is highly unlikely that it will break this streak anytime soon.

It’s important to note that I may not necessarily use these dividends to buy more Coca-Cola shares. Instead, I could choose to save up a larger amount of money to be prepared for a significant market decline.

It finalizes the agreement.

I might be excessively preparing for an economy that may not materialize. However, I prefer to be overly cautious by investing in a reputable company like Coca-Cola rather than taking on too much risk and later regretting it. Managing risks is a crucial aspect of achieving success as an investor.

Another straightforward bullish perspective is that Coca-Cola is a solid investment regardless of the historical or future context. The company has a consistent track record of increasing revenue and earnings over the long term, which is reflected in its dividend performance.

I would advise against dwelling too much on this matter and not getting worked up about the stock’s recent strong upward trend. Exceptional stocks often have a tendency to achieve remarkable gains that may appear unlikely initially.