When evaluating dividend stocks, there is much more to consider than just the dividend yield. This becomes evident when comparing Black Hills Corporation (-1.29%) and Dominion Energy (-0.83%). Ultimately, the yield may be less significant than the future potential of the dividend and the company’s history when making an informed decision. Here’s what you should consider and why the utility with the lower yield might be more advantageous for you.

Contents

- 1 What Do Black Hills and Dominion Do?

- 2 Black Hills is a Dividend King

- 3 Which is the Better High-Yield Option?

- 4 Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

- 5 – Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

- 6 – Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

- 7 – Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

What Do Black Hills and Dominion Do?

Both Black Hills and Dominion primarily function as regulated utilities. This implies they hold monopolies in their respective regions but require government approval for their rates and investment strategies. Such a framework typically results in gradual and steady business growth over time. Therefore, neither company should be viewed as a growth investment.

Black Hills is the smaller entity of the two, with a market capitalization of approximately $4 billion. In contrast, Dominion ranks among the larger utilities in the U.S., boasting a market cap around $47 billion, an order of magnitude higher. Consequently, Black Hills has a smaller customer base, serving around 1.3 million customers across parts of eight states, whereas Dominion caters to 4.5 million customers across 13 states.

A subtle yet crucial distinction lies in their operations. Black Hills engages in both electricity and natural gas, while Dominion, having historically managed both, is now streamlining its focus predominantly on electricity. This transition is accompanied by Dominion essentially freezing its dividend as part of its strategy to fortify its balance sheet and reduce its dividend payout ratio.

Black Hills is a Dividend King

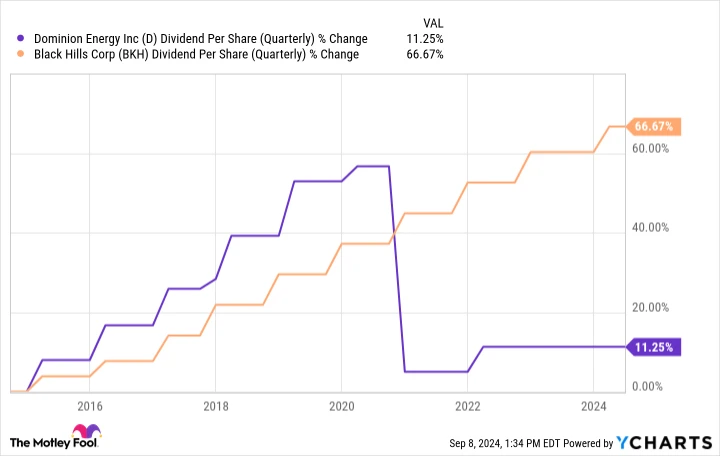

The significance of this distinction becomes clearer when considering that Black Hills has consistently increased its dividend for over five decades, earning it the title of a Dividend King. Conversely, Dominion reduced its dividend a few years ago following the sale of its midstream pipeline business, an early step towards becoming a dedicated electric utility. For those prioritizing reliable dividend income, Black Hills emerges as the clear winner.

Despite this, Black Hills’ dividend yield stands at 4.3%, slightly lower than Dominion Energy’s 4.7%. The higher yield may attract yield-seeking investors. Although Dominion’s dividend growth is currently on hold, it is expected to resume once earnings grow and the payout ratio aligns with industry norms, projected to occur within the next few years. The company anticipates earnings growth between 5% and 7% annually through 2029. However, it’s important to note that previous management assurances regarding dividend growth did not materialize, as dividend growth is currently paused.

In contrast, Black Hills has achieved an average dividend increase of around 5% over the past decade and forecasts earnings growth between 4% and 6%. This is not far off from Dominion’s expected performance once its dividend growth resumes. Opting for Dominion would mean foregoing several years of Black Hills’ dividend growth in exchange for a higher initial yield. Ultimately, the decision may balance out in terms of income, but the underlying business dynamics suggest Black Hills is more attuned to shareholder interests.

Which is the Better High-Yield Option?

Considering Dominion’s recent changes, including a dividend cut, a missed target for post-cut dividend growth, and the current dividend pause pending payout ratio adjustments, it presents itself as a turnaround stock. While not excessively risky, management must demonstrate reliability. Dominion may appeal more to aggressive investors until its dividend growth resumes.

In contrast, Black Hills represents a stable, high-yield utility stock that even the most cautious investors might appreciate. Despite its smaller size, Black Hills has demonstrated its ability to consistently reward investors through both favorable and challenging times. Forgoing a slight yield advantage with Dominion is likely a favorable trade-off when considering the foundational strength of the businesses involved.

Don’t Miss This Second Chance at a Potentially Lucrative Opportunity

Ever feel like you missed out on investing in the most successful stocks? Here’s some good news.

Occasionally, our team of expert analysts issues a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you’re concerned about missing out, now is an opportune moment to invest before it’s too late. The numbers speak for themselves:

– Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

– Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

– Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

Currently, we’re issuing “Double Down” alerts for three remarkable companies, and opportunities like this may not come around often.

See 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/12/2024