Chipotle Mexican Grill has been a perennial favorite among investors, and rightly so. The company has consistently provided remarkable returns for those who have been loyal through both good and challenging times. Although its growth potential remains substantial, with 3,500 restaurants already in operation, growth-focused investors might be seeking newer opportunities.

Expanding a restaurant chain successfully is no small feat, yet Dutch Bros seems to be on a promising path, making it an intriguing choice for growth investors.

Contents

New Stores, Accelerated Growth

Chipotle aims to double its number of stores in North America and is now turning its attention to international expansion. How does Dutch Bros’ expansion plan compare? While Chipotle envisions adding around 3,500 more locations in the U.S., Dutch Bros plans to increase its presence to about 4,000 stores over the next decade or so, growing from its current 912 locations. Although the absolute number of new stores is similar, Dutch Bros presents a significantly larger growth potential in percentage terms.

Their revenue growth has been impressive, largely driven by new store openings. In the second quarter, Dutch Bros saw a 30% year-over-year revenue increase, with comparable sales (comps) rising by 4.1%. Should it successfully quadruple its store count, the stock price is likely to follow suit.

Chipotle excels in generating comps growth, often benefiting from its established brand recognition. Dutch Bros, however, is still in the process of building its brand identity. It is methodically expanding across the U.S., currently operating in 18 states. As more people become familiar with and enjoy its beverages, especially in regions where it has been present for some time, comps growth is anticipated to rise.

Establishing the Brand and Process

Chipotle’s success can be attributed to its clearly defined lifestyle brand, robust digital channels, and streamlined processes. These strengths are part of what attracted Starbucks to hire Chipotle’s former CEO, Brian Niccol. Dutch Bros, being a newer player, has the advantage of developing these core elements from scratch rather than having to redefine itself within a large, established framework.

Last year, Dutch Bros brought on a new CEO and refreshed its executive team, setting the stage for changes aimed at launching new stores with cohesive branding and processes. Customers appreciate its lively, approachable atmosphere, complete with music in the dining areas and the unique “broistas” who take orders in the drive-thru lanes using point-of-sale devices.

To support further growth, Dutch Bros is opening a new resource center and expanding its headquarters next year. Many of its new locations are being designed with twin drive-thrus and an “escape route” for cars that receive their orders before reaching the window.

A notable absence in Dutch Bros’ strategy has been digital ordering, but this is set to change. The company has been testing mobile ordering at around 40 locations, and management anticipates that most shops will offer this option via their app by the year’s end. This aligns well with their robust loyalty program, as Dutch Rewards members accounted for 67% of sales in the second quarter.

Dutch Bros as a Potential Bargain

Chipotle has been a stellar investment in recent years, but its high valuation may have deterred some investors recently. The stock took a hit following the announcement of Brian Niccol’s departure, yet it remains pricey.

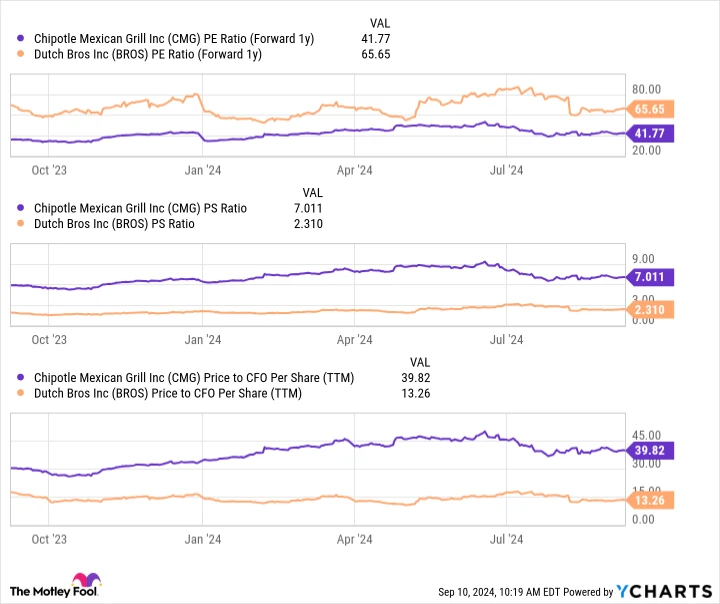

The price-to-earnings ratio is a prevalent valuation measure, but it’s not always the best indicator of a company’s value. For Dutch Bros, this metric is less applicable because the company has only recently become profitable and experienced losses in some quarters last year. However, when considering price-to-sales and price-to-cash-from-operations ratios, Dutch Bros appears much more affordable than Chipotle.

This isn’t to say Chipotle isn’t a worthy investment now. However, if you’re seeking a promising stock in its early stages, with the patience to let your investment mature, Dutch Bros presents a compelling opportunity.

Before Investing in Dutch Bros, Consider This:

The Motley Fool Stock Advisor analyst team has recently identified what they believe are the 10 best stocks for investors to purchase now, and Dutch Bros did not make the list. The stocks that did could potentially offer substantial returns in the years to come.

For instance, consider when Nvidia was included on this list on April 15, 2005. Had you invested $1,000 at that time based on our recommendation, your investment would now be worth $716,375!*

It’s important to note that Stock Advisor’s total average return is 741%, a significant outperformance compared to the S&P 500’s 162%. Don’t miss out on the latest top 10 list.

See the 10 stocks

*Stock Advisor returns as of September 9, 2024