The electric vehicle (EV) sector faced another setback on Wednesday, primarily due to the resignation of Polestar Automotive’s CEO, Thomas Ingenlath, which resulted in a significant drop of 16.37% in the company’s stock. Michael Lohscheller has been appointed as the new CEO, though it is unlikely he will promptly resolve the company’s issues or alter the industry’s landscape.

During today’s trading, Polestar’s shares plunged by up to 18.6%. Meanwhile, Xpeng experienced a 10.5% decline, and Lucid Automotive saw a decrease of 6.8%. By the end of the trading day, their stocks had fallen by 16.4%, 9%, and 4.1%, respectively.

Contents

Polestar’s Shift in Leadership

Lohscheller brings extensive experience from the automotive sector to Polestar, albeit with limited success in his previous roles. His tenure includes leadership positions at Opel, VinFast, and Nikola—none of which are particularly dominant in the industry.

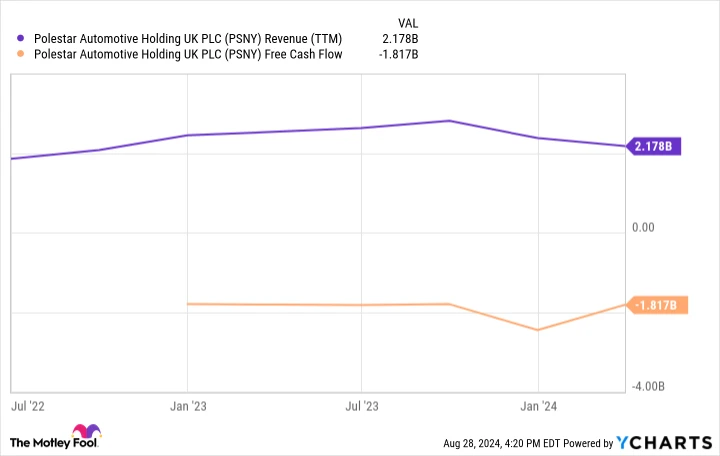

His appointment coincides with a slowdown in global demand growth for electric vehicles and intensifying competition. Companies focused on EVs are grappling with losses, as illustrated below, and the declining stock prices exacerbate the challenge of securing capital to support growth ambitions.

“

“

Canada’s Tariffs on Chinese EVs

Xpeng was adversely affected by the announcement that Canada will impose a 100% tariff on Chinese-manufactured electric vehicles. The company may encounter similar challenges in the U.S. and Europe, potentially restricting market access just as Chinese competitors are scaling up globally.

Lucid’s Untapped Potential

Recently, Lucid’s Senior Vice President of Design and Brand, Derek Jenkins, revealed in an interview with CarBuzz that the company is developing three more affordable vehicles, with production likely to commence in late 2026.

Similar to Polestar, Lucid’s challenges lie in timing and the capital required to realize its vision. The company has yet to demonstrate profitability with its current lineup and will exhaust significant funds before launching a broader, cost-effective range. Whether Lucid will possess the financial capacity to achieve this remains uncertain.

The Unpredictable EV Market

These companies are all navigating an unpredictable future in the EV market. For multiple EV start-ups to survive and justify their valuations, the industry must swiftly transition to electric vehicles and achieve profitability surpassing that of traditional automakers—a prospect that remains dubious.

The longer the journey to profitability, the more investors question the EV market’s viability, leading to further stock declines. Diminishing stock values hinder equity-based fundraising and can increase the cost of debt. With everyone eager to expand, this spells increased capital expenditures at a time when capital is increasingly scarce.

I foresee only a handful of electric vehicle companies enduring over the next decade, with many facing bankruptcy or being compelled to sell to larger competitors at significantly reduced valuations. Polestar might already be on this path.

Xpeng and Lucid still have time to establish themselves, but navigating the current EV industry remains a formidable challenge.