Shares of the Mediterranean fast-casual restaurant chain, Cava, experienced a significant surge of 35.4% in August, as indicated by data from S&P Global Market Intelligence. This impressive uptick was fueled by strong financial outcomes for the second quarter of 2024, coupled with an enthusiastic reception from Wall Street, propelling the stock to reach a historic peak. However, a subsequent sale of shares prompted a slight retreat.

On August 22, Cava unveiled its Q2 financial performance, which was overwhelmingly positive for its shareholders. Revenue for the quarter surged by a remarkable 35% compared to the same period in 2023, and the company achieved its highest-ever quarterly profit margin of 8.5%.

The Q2 report contained several notable achievements. Strong financial results led Wall Street to shower Cava with commendations, prompting many analysts to increase their price targets for the stock. Essentially, after reviewing the figures, these investment experts concluded that the potential upside was greater than previously anticipated, boosting overall investor sentiment.

Nonetheless, a development later in the month dampened the excitement. Several insiders, including co-founder and CEO Brett Schulman, sold shares, with Schulman offloading approximately 200,000 shares on August 26. Insider sales can sometimes signal that a stock is overvalued, which contributed to Cava’s stock pulling back from its peak.

Is this a concern for Cava?

If I were a Cava shareholder, I wouldn’t necessarily sound the alarm. For founders, the journey of expanding a business and taking it public is significant and often financially challenging. It’s understandable that insiders might want to cash in on some shares to finally enjoy the rewards of the company’s success.

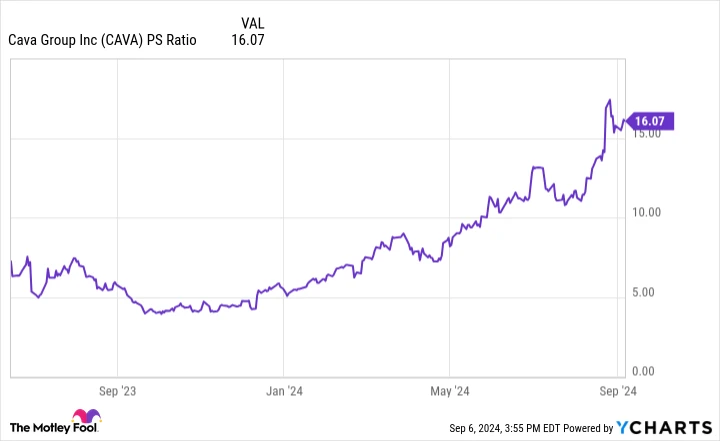

That being said, insiders typically don’t sell as much when a stock is undervalued. Investors might already be somewhat apprehensive about Cava’s valuation. As of this writing, it trades at 16 times sales.

CAVA PS Ratio data by YCharts.

While this isn’t unheard of for a restaurant stock, it’s unusual for a company like Cava that operates on a company-owned model rather than a franchised one. Additionally, all of the company’s restaurant locations are leased, not owned. Without owning real estate, one might expect a lower valuation for Cava than it currently commands.

What should investors do now?

In my view, Cava represents both a robust business and an overvalued stock. These two realities might inspire different actions among investors.

For those who were already considering selling Cava stock in 2024, the current valuation presents an attractive selling opportunity.

For investors with no plans to sell, Cava remains a strong business, with Q2 results reinforcing this notion. Over time, the importance of valuation tends to diminish for a quality business. Be aware that the stock might underperform temporarily if its valuation declines in the near future. However, should Cava continue to execute effectively, it could eventually outgrow its valuation concerns.