Bill Gates and Warren Buffett have aligned their investment strategies by significantly increasing their stakes in Berkshire Hathaway, highlighting the company's diversification and strong long-term performance. This move, while not suitable for income-focused investors, underscores Berkshire's appeal to those seeking growth. Additionally, a groundbreaking technology is set to transform industries, generating excitement on Wall Street.

The rewritten text emphasizes the importance of preparing for retirement by understanding Social Security and Medicare, considering relocation to places like Louisiana for its vibrant culture and low cost of living, and exploring strategies to maximize Social Security benefits for enhanced retirement income.

This text explores the rise of artificial intelligence on Wall Street, highlighting Nvidia's rapid growth due to the demand for its AI-related technologies. Despite Nvidia's innovations and market dominance, skepticism arises over potential market volatility, with historical patterns suggesting possible declines. The text also touches on investment opportunities from The Motley Fool Stock Advisor, emphasizing the potential for significant returns.

Explore Berkshire Hathaway's strategic portfolio shifts, including its steadfast investments in Coca-Cola, American Express, and Ulta Beauty, amidst speculation of market corrections, while uncovering a potential technological breakthrough poised to revolutionize industries.

This text explores Dan Loeb's successful investment strategies through Third Point's Offshore Fund, emphasizing his focus on artificial intelligence investments in Amazon, Microsoft, and Taiwan Semiconductor. It highlights the fund's impressive returns and offers insights into a unique "Double Down" stock recommendation opportunity for potential high-growth investments.

Discover promising high-yield stocks in a booming market with Brookfield Renewable Partners, Royalty Pharma, and Bristol Myers Squibb, focusing on sustainable dividends, market growth, and strategic investments. Plus, explore fresh opportunities with "Double Down" stock alerts for potential significant returns.

The text discusses the ongoing decline in mortgage rates, highlighting their dependence on the upcoming Federal Reserve Board meeting and the presidential election outcome. It examines how the policies of candidates Harris and Trump could differently impact inflation and mortgage rates, emphasizing the importance of voter participation in determining future economic conditions.

This text explores the strategic investment shifts by hedge fund billionaires from Nvidia to the Invesco QQQ Trust, highlighting the broader diversification benefits amid the AI boom. It emphasizes the fund's impressive long-term returns and potential future growth, despite its volatility, offering investors a second chance to capitalize on AI-driven opportunities.

The text explores Warren Buffett's recent strategy of amassing an unprecedented cash reserve for Berkshire Hathaway, reflecting his view that current stock valuations are high. It advises investors to emulate Buffett's cautious approach by buying well-valued stocks, maintaining a strong cash reserve, and adopting a long-term investment perspective. Additionally, it highlights The Motley Fool Stock Advisor's successful track record in outperforming the S&P 500.

Explore Warren Buffett's investment strategy, highlighting the shift from Bank of America to Occidental Petroleum as his top dividend stock, driven by strategic moves in response to market conditions and oil price dynamics. Uncover insights into the enduring success of dividend stocks and opportunities for savvy investors.

Ajit Jain, Berkshire Hathaway's Vice Chairman, recently sold over half of his stock holdings, a move possibly linked to retirement plans, Berkshire's high valuation, and potential tax changes. While this sale might raise concerns, long-term investors are advised not to panic. The text also highlights a promotional opportunity for investing in promising stocks through "Double Down" recommendations.

This text highlights the upcoming Social Security Administration updates on October 10, detailing key changes for 2025, including the cost-of-living adjustment, earnings-test limit, and wage cap, affecting many Americans. It also touches on strategies to maximize Social Security benefits for retirement.

Costco's New Membership Restrictions: Aiming for Less Crowded Stores and Enhanced Shopping Experience

Three Essential Steps to Overcome $50,000 in Credit Card Debt: Strategy, Credit Monitoring, and Savings

Weighing the Benefits: Claiming Social Security Early vs. Delaying Until Age 70

"Key Factors That Can Lead to Car Insurance Cancellation and How to Prevent It"

Fintech Stocks to Watch: Potential Turnaround Opportunities Amid Changing Interest Rates

"Is Now the Time to Invest in Dollar General Despite Recent Setbacks?"

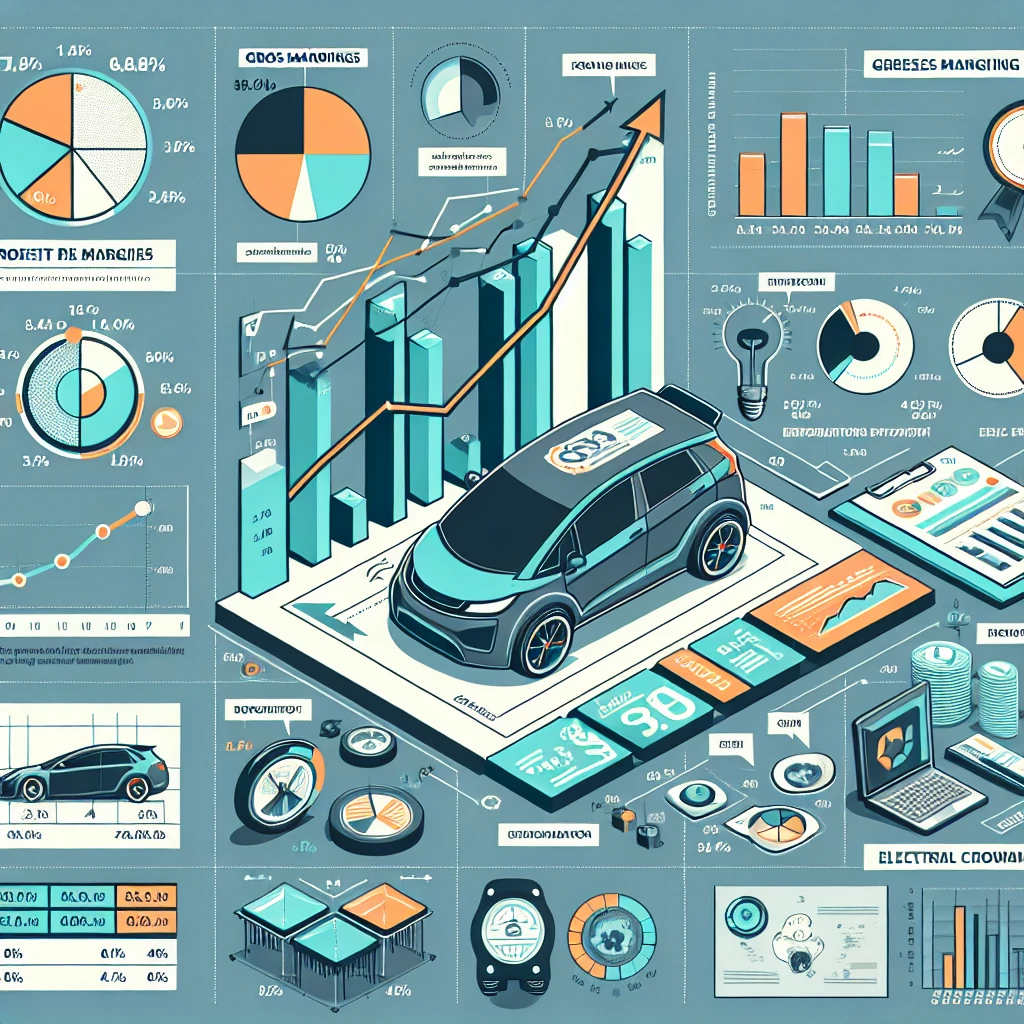

Rivian's Path to Profitability: Can Wall Street's Most Optimistic Analyst Be Right?

Evaluating Tesla: Bullish Innovations vs. Bearish Market Challenges

"Nu Holdings: A Promising Fintech Opportunity with High Growth Potential and Strategic Backing"

Amazon Positioned to Surpass Nvidia as Top AI Stock by Year-End

Why American Express Remains a Long-Term Investment Opportunity

"Two Promising Stocks for Long-Term Wealth Accumulation: Home Depot and Realty Income"

Navigating the REIT Landscape: Top Picks for Income-Seeking Investors Amid Shifting Interest Rates

Investing in Bank of Nova Scotia: A High-Yield Opportunity with Strategic Shifts

Nvidia's Continued Growth Potential: AI and Data-Center Expansion as Key Catalysts

Cava's Stock Surge: Impressive Growth Amidst Insider Selling Concerns

Nvidia and Alphabet: The Leading Contenders in the AI Stock Market

Plunge in Brent Crude Prices Shakes Energy Sector and Dampens Investor Confidence