The text examines the definitions of wealth through income and net worth, providing benchmarks for what constitutes being wealthy in America. It offers strategies for increasing wealth, emphasizing income growth, disciplined saving, and smart investing, suggesting that with consistent effort, affluence is attainable.

Intuitive Machines' stock soared following a $4.8 billion NASA contract for lunar communication services, marking a significant expansion into space communications and promising new business opportunities.

Terns Pharmaceuticals emerges as a promising player in the burgeoning $100 billion anti-obesity market, driven by positive trial results of its GLP-1 weight-loss pill, TERN-601. Despite the high-risk investment landscape and market volatility, the potential for significant returns makes it a noteworthy consideration for investors.

The text discusses the banking industry's response to the anticipated Basel III Endgame (BE3) framework following the collapse of three significant regional banks. Initially, BE3 proposed stringent capital requirements, but industry pushback has led regulators to consider a more favorable approach, offering clarity and potential relief for mid-sized banks. The Motley Fool Stock Advisor sees this as a prime investment opportunity, issuing "Double Down" alerts for select companies.

JPMorgan Chase, a top-performing U.S. bank under CEO Jamie Dimon, leverages its size and diversified business operations to achieve robust financial growth, outpacing major competitors and the S&P 500. Despite future interest rate challenges, its valuation remains attractive for investors. Meanwhile, The Motley Fool Stock Advisor underscores the potential for significant returns through strategic investments in select stocks.

This text provides a strategic guide to building a million-dollar Roth IRA for a secure retirement, emphasizing the importance of early saving, investing in stocks for growth, and utilizing Roth conversions for tax advantages. It also highlights overlooked Social Security strategies for boosting retirement income.

SoundHound AI's stock has seen a dramatic rise and fall in 2024, driven by its impressive growth in voice AI solutions and strategic market expansions. Despite a high valuation, the company projects strong future revenue growth, bolstered by a significant customer base and strategic acquisitions. This presents a potential investment opportunity for risk-tolerant investors over the next three years.

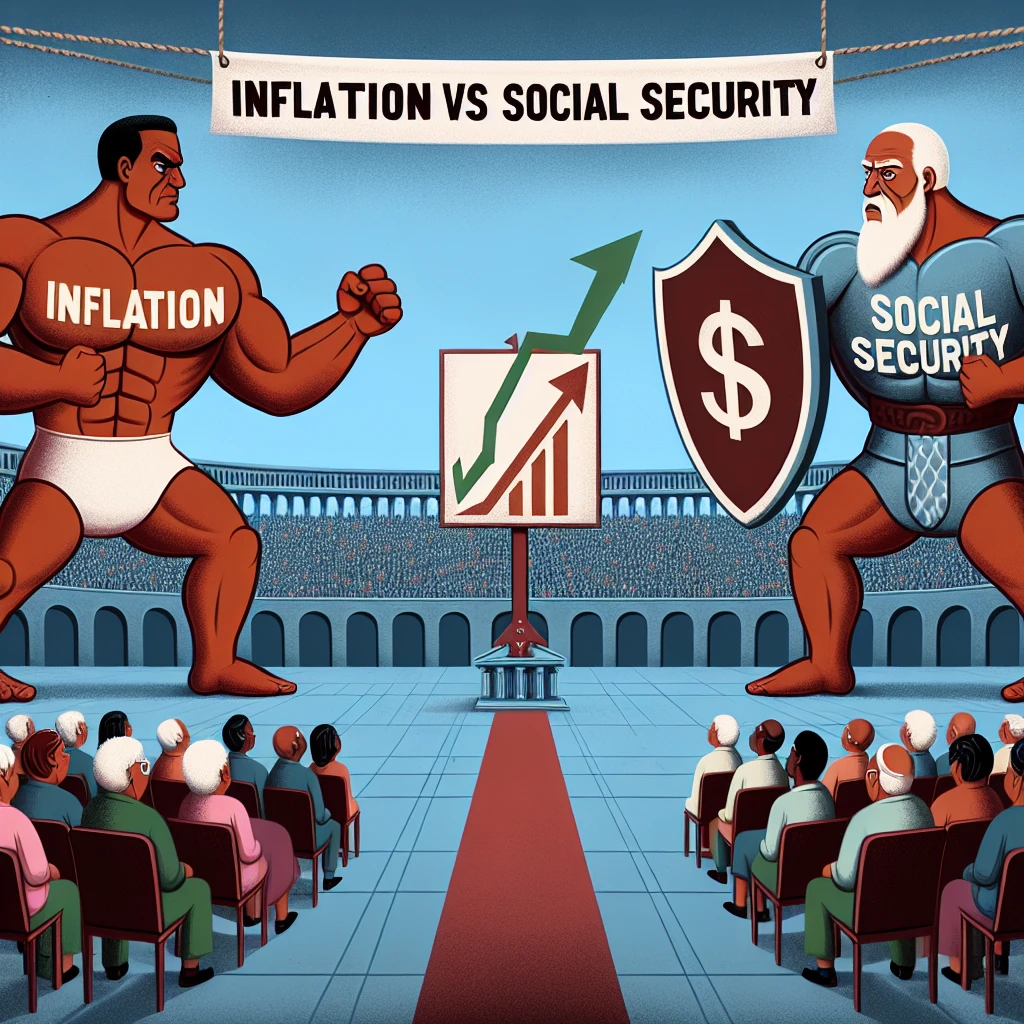

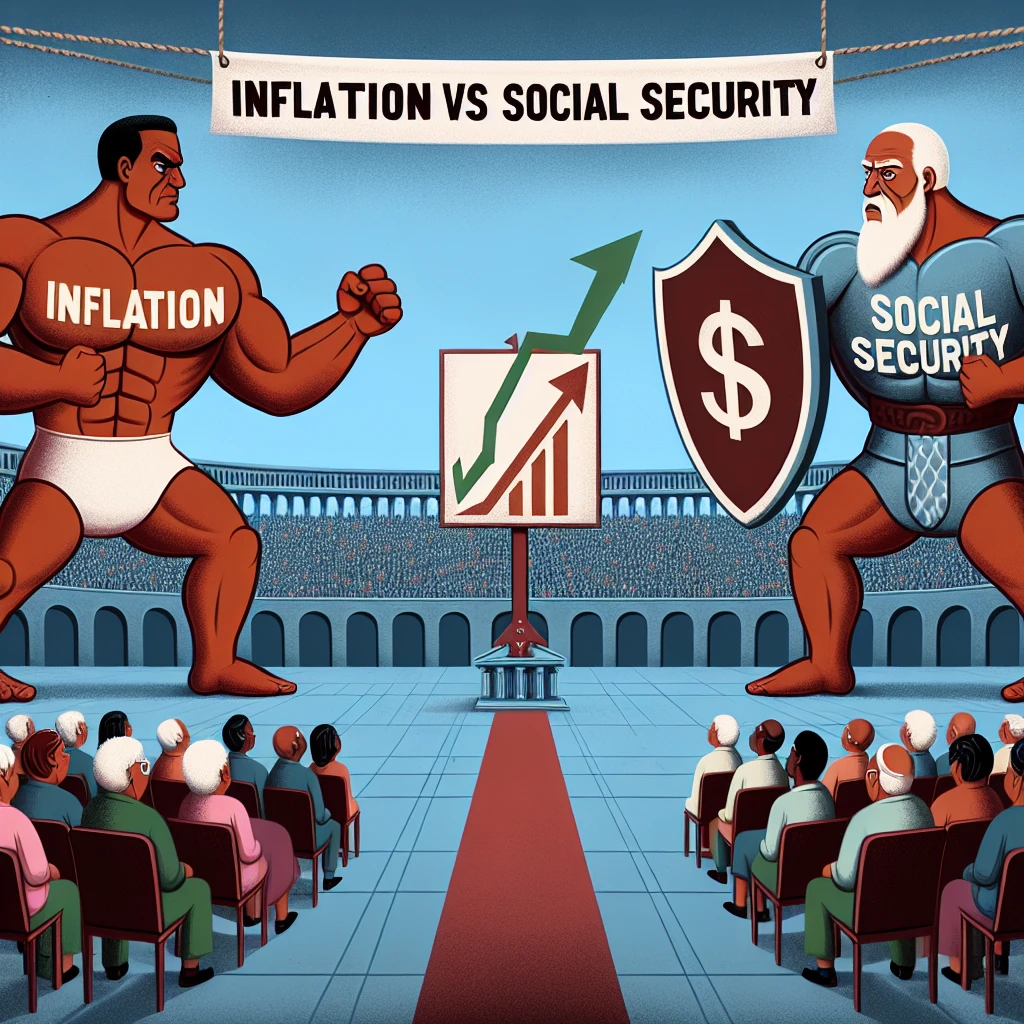

The text examines the inadequacy of Social Security's cost-of-living adjustments (COLAs) in keeping up with inflation, highlighting a 20% decline in purchasing power since 2010. It critiques the CPI-W's insufficiency in accurately representing retirees' expenses, particularly in housing and medical care. With a forecasted 2.5% COLA for 2025, retirees face financial strain, necessitating prudent budgeting and exploring additional income streams like high-yield savings and CDs. The text also hints at strategies to maximize Social Security benefits.

CrowdStrike Holdings navigates a significant July software glitch, maintaining strong financials and customer loyalty, while securing major contracts and showcasing growth potential, reassuring investors of its continued market leadership in cybersecurity.

The text analyzes recent 13F filings, revealing billionaire investors' strategic shifts from Nvidia to Amazon and Microsoft amid AI bubble concerns and competitive pressures. It highlights Amazon's cloud service and Microsoft's AI advancements as key investment attractions, while promoting a lucrative "Double Down" investment opportunity.

The Vanguard Small-Cap Value ETF presents a promising investment opportunity, offering potential short-term benefits from anticipated interest rate cuts and long-term growth advantages. Despite underperforming the S&P 500, it provides a cost-effective, diversified approach to capitalize on small-cap value stocks, known for their historical outperformance and growth potential.

This text explores how strategic stock investments, particularly in leading technology companies like Amazon and Meta Platforms, can significantly enhance wealth over the long term. It emphasizes diversification, long-term commitment, and highlights the potential of "Double Down" stock recommendations for achieving substantial financial growth.

Discover how investing can be simplified through high-quality ETFs, offering options for dividend income, growth, or a balanced approach. Learn about top ETF picks that cater to diverse investment goals and explore a transformative tech breakthrough exciting Wall Street.