A company that offers banking and financial services through digital channels. SoFi Technologies is a company. ( SOFI 4.54% ) The stock is now close to its lowest point in the past 52 weeks and is approximately 75% lower than its highest point in 2021. Investors tend to associate a stock’s performance with its price movement. For instance, as SoFi’s stock price continues to decline, some may assume that the company’s overall performance is also poor.

Is that accurate, or is the market mistaken?

Instances such as this one are fraught with risk, but successfully opposing Wall Street could lead to investment returns that have the potential to change one’s life significantly.

Here are the indications that SoFi might be a stock that has the potential to make millionaires, even though it may not be immediately obvious.

Contents

SoFi’s products and services are highly popular among consumers.

While there may be discussions about the stock, it is evident that SoFi’s customers highly appreciate the convenience of using its range of products and services. SoFi functions primarily as an online bank without physical branches, allowing customers to conduct their banking activities through the website or mobile app. Users can perform various financial tasks such as depositing, spending, saving money, investing in stocks or cryptocurrencies, obtaining credit cards, applying for loans, checking their credit status, and gaining financial knowledge, all through SoFi’s platform. The seamless experience of utilizing SoFi’s services enhances customer satisfaction and fosters a successful cross-selling strategy that boosts customer engagement with the app.

Is SoFi’s app popular among users? It seems to be the case, as the app has an average rating of 4.8 out of five stars. Apple The App Store has received over 340,000 reviews. Furthermore, consider the rapid expansion of SoFi’s customer base.

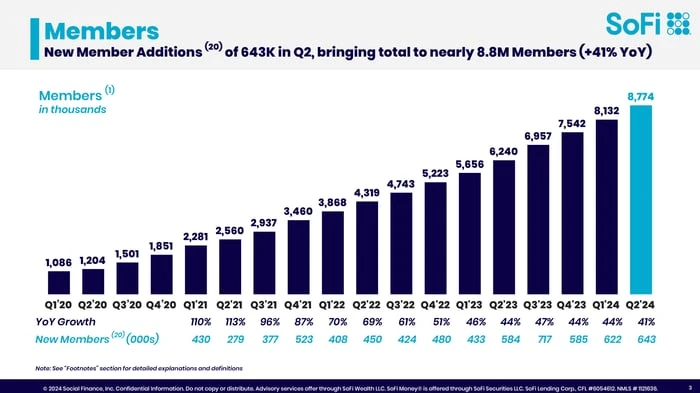

Credit: SoFi Technologies.

Observe the steady increase in the number of users – this is not due to population growth. It is evident that individuals are switching from other banks to SoFi.

The potential for continued growth in the future.

If SoFi keeps providing a high-quality product and effectively promoting it to the market, there is no doubt that SoFi can sustain its growth.

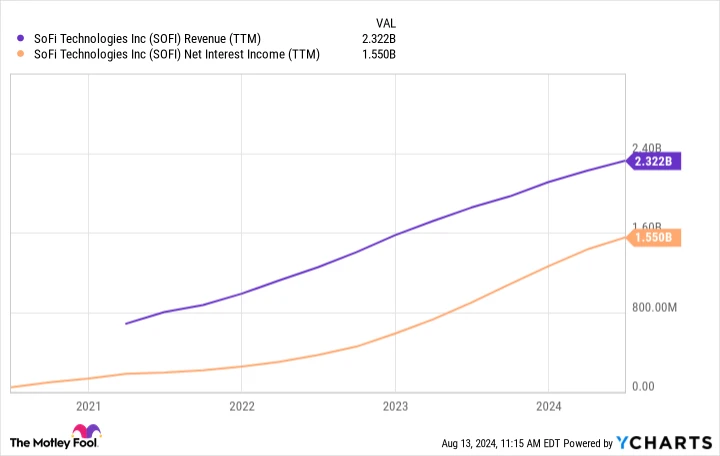

Trailing twelve months revenue of SOFI. data by YCharts.

In more precise terms, SoFi has the potential to achieve growth over several years due to three specific factors.

Increasing the number of customers.

SoFi is not expected to continue growing its customer base by 40% every year indefinitely, but it could sustain double-digit growth for some time. The United States has approximately 260 million individuals who are 18 years old or older, as well as over 33 million small businesses.

I will take a cautious approach and assume that major corporations prefer to do their banking with well-known and established financial institutions. Bank of America is a financial institution. However, there are approximately 300 million potential customers within the domestic market alone. Additionally, SoFi has the potential for international expansion in the future, although it is not necessary to do so immediately. Currently, SoFi’s 8.7 million customer accounts represent only a 2.9% market share.

Interacting with customers

SoFi has significant potential for increasing revenue through cross-selling opportunities. With a customer base of 8.7 million, the average individual currently utilizes less than two out of the 12.8 million products offered by SoFi in Q2. The company’s diverse range of financial products and services presents the opportunity for customers to expand their usage over time. Customers who currently use banking services may be interested in exploring additional offerings such as credit cards, investments, student loan refinancing, or car loans. The potential for growth and expansion in SoFi’s product utilization is substantial.

Deposit growth

SoFi is known for appealing to a younger demographic through its app, and this could work in its favor in the future. With around $23 billion in deposits by the second quarter, the typical SoFi customer holds $2,621 with the company. There is room for expansion as wealth transitions from older generations like baby boomers and Generation X to millennials and Generation Z, leading to an increase in investments, savings, and other financial activities with SoFi.

Does SoFi have the potential to make people millionaires?

Achieving millionaire status through stock investments requires more than just growth; it also necessitates a strong initial investment.

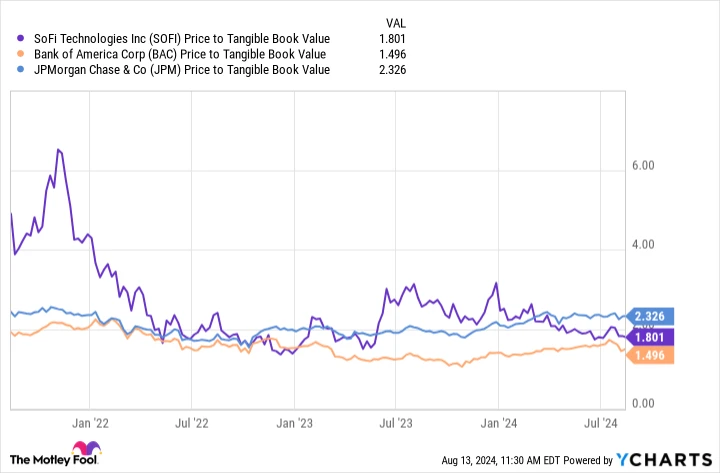

Investors, particularly those who have experienced a decrease in the value of their SoFi holdings, may be feeling discouraged by the stock’s lackluster performance. SoFi could be considered a high-priced stock. When it was made available to the public and reached its highest point a few years ago.

However, everything is different now.

The ratio of SOFI’s price to its tangible book value. data by YCharts.

Today, SoFi’s The ratio of a company’s stock price to its book value. They are among the big banks in America, with a longer history compared to SoFi, but they do not have the same growth opportunities. The current valuation is reasonable, allowing investors to benefit from a significant portion of SoFi’s future growth through returns on investment. The management anticipates book value To grow from $800 million to $1 billion this year, representing an increase of approximately 20% to 30% compared to last year.

SoFi, with a market cap With a market capitalization of only $7 billion, the company is relatively small, which means that sustained rapid growth over the years could potentially lead to significant wealth for long-term investors who are willing to be patient.