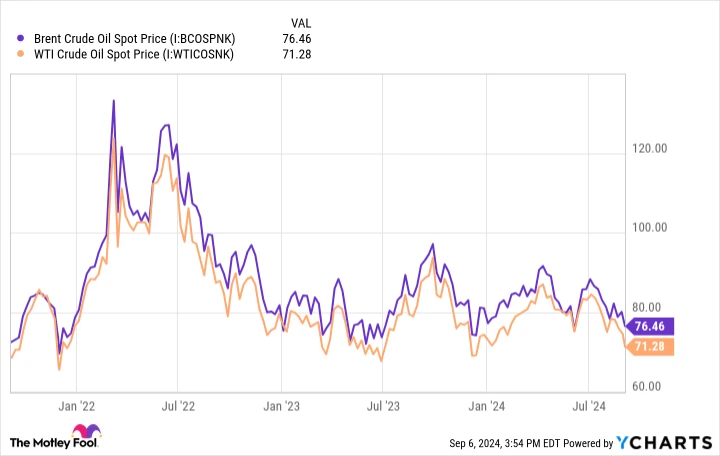

This week in energy was marked by a significant development: Brent crude oil prices plunged by 7%, settling at $71.32 per barrel, which sent ripples through the energy sector, causing most energy stocks to plummet. The downturn was largely attributed to the release of weaker-than-expected U.S. economic data. The ISM manufacturing index recorded a mere 47.2%, signaling a contraction in manufacturing orders. Additionally, Friday’s report revealed that only 142,000 jobs were added in the U.S. during August, falling short of the anticipated 161,000, with revisions removing another 86,000 jobs from previous estimates. Collectively, these factors dampened investor confidence in the future demand for oil.

Oil producers and suppliers bore the brunt of this news. Data from S&P Global Market Intelligence showed that shares of Transocean fell by as much as 13.3% during the week, closing down 12.7%, while Vital Energy experienced a drop of up to 21.4%, ending Friday down 21.2%. Meanwhile, Sable Offshore emerged as a positive outlier, with its shares rising by 29.5% this week.

The Impact of Declining Oil Prices

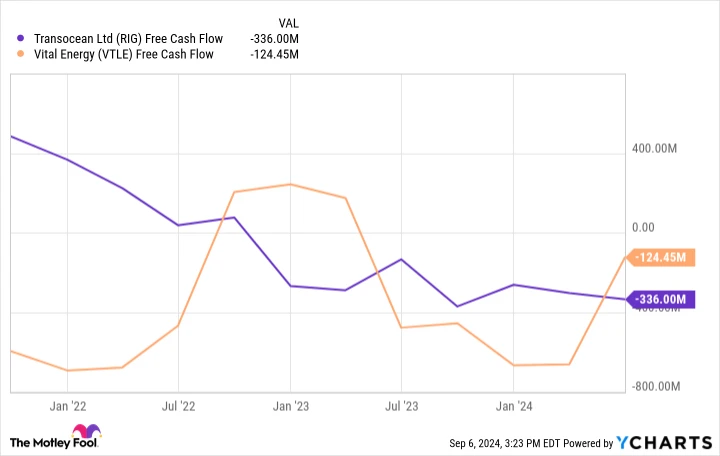

The slump in crude oil prices will not affect all players in the energy industry equally. Smaller exploration companies like Vital and service providers such as Transocean are likely to see their revenues shrink and their already negative free cash flows worsen if the price of crude continues to fall. The market’s anticipation of weak demand compounds the challenge.

According to data from YCharts, it’s uncertain when oil prices might rebound. With the global economy showing signs of deceleration, and absent production cuts from OPEC+, there are few catalysts to drive prices up in the near term.

A Major Development for Sable Offshore

This week, Sable Offshore experienced a significant breakthrough by reaching a settlement with Santa Barbara County in California. The company’s offshore platforms had been inactive since a 2015 oil spill, with the county delaying approval for the installation of safety valves. However, a federal court ruled that the county lacked jurisdiction over the pipeline, resolving the impasse.

Sable plans to install 16 safety valves and expects to commence production from its Santa Ynez Unit in the fourth quarter, which will initiate revenue generation for a company that has recently been incurring losses.

The Uncertain Future of Oil

The oil industry has experienced a volatile few years, ranging from negative prices in 2020 to exceeding $120 per barrel in 2022. Currently, supply and demand appear to have reached a semblance of balance, even as the economy shows signs of slowing down.

For many companies, generating profits without higher oil prices will be challenging. Offshore drilling operators are particularly vulnerable, as reduced demand for rigs and declining day rates threaten to submerge these companies.

The outlook for investing in the oil sector remains challenging, as economic slowdowns could further sap demand. Even if the Federal Reserve were to lower interest rates, the benefits would take months to materialize, by which time oil prices might have fallen further. This week’s decline could be indicative of future trends.