Berkshire Hathaway is a multinational conglomerate holding company. ( BRK.A 0.94% ) ( BRK.B 0.97% ) disposed of multiple stock holdings in the second quarter, however Chubb ( CB 1.19% ) was among the limited stocks that Warren Buffett and his team continued to gather, purchasing an additional 1.1 million shares during the second quarter.

This is the fourth straight quarter that Berkshire has increased its holdings in the global insurance company. The conglomerate now possesses 27 million shares, valued at $7.4 billion, in Chubb stock. Here’s why it might be a smart move for investors to consider following Buffett’s example today.

Image credit: The Motley Fool.

Why Buffett is Fond of Investing in Insurance Companies

The insurance Business possesses several qualities that attract long-term investors such as Warren Buffett. Firstly, these companies benefit from a steady demand for their products. Take Chubb, for instance, which ranks among the world’s leading property and casualty insurers, offering coverage for various risk categories including personal automotive, homeowners, accident and health, agriculture, and reinsurance.

A particularly attractive feature of the insurance business is the cash flow it can produce. Unlike conventional businesses, insurers collect their income (premiums) in advance and cover claims costs at a later stage. Since they only disburse funds when a customer files a claim, insurers have access to a substantial amount of money, known as “float,” which they can hold and invest without actually owning it.

For Buffett, the insurance companies and the cash flow they produce make up a significant part of Berkshire’s worth. This is partly due to the fact that, as he mentioned in Berkshire Hathaway’s 2021 letter to shareholders, insurance products “will never become outdated, and sales volume will typically grow alongside both economic expansion and inflation.”

Berkshire Hathaway has a collection of insurance companies within its group, such as GEICO, General Re, Berkshire Hathaway Reinsurance, and Alleghany. purchased two years back for $11.6 billion .

Chubb has delivered impressive profits for its investors.

Chubb’s business comes with multiple benefits. As one of the largest property and casualty insurance providers globally, it covers a wide range of risks. The company has shown outstanding underwriting discipline in the fiercely competitive insurance market, and regularly outperforms its competitors when it involves creating policies that generate profit.

Due to its robust underwriting practices and consistent demand, Chubb has consistently expanded both its revenue and profits. Over the past ten years, Chubb’s earnings and net income have grown by approximately 11% each year on average. In the past year, the insurance company has generated an unprecedented $15.2 billion in free cash flow, which can be reinvested into the company, distributed as dividends, or used to repurchase its shares.

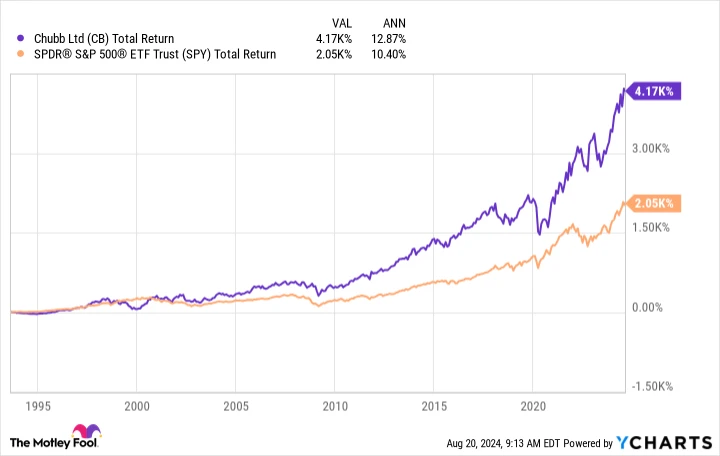

Thanks to its careful underwriting practices and consistent demand, Chubb has unsurprisingly provided outstanding returns for investors who hold their shares over the long term. For the past 31 years, the company has consistently increased its dividend. During this time, Chubb’s total compound annual return, factoring in reinvested dividends, has been 12.9%, surpassing the S&P 500 a 10.4% profit.

Cumulative Bond Total Return Index data by YCharts

Here’s why Chubb can keep achieving results

JPMorgan Chase Jamie Dimon, the CEO, recently issued a warning stating that ” numerous factors are still driving inflation ahead of us” because of budget shortfalls, increasing interest rates, and persistently high inflation. If Dimon’s prediction holds true, Chubb has the potential to keep delivering strong results for investors for a number of reasons.

Firstly, the company benefits from consistent demand, and the industry environment is advantageous for insurers. Insurance firms have has experienced increasing expenses related to claims in recent years as a result of weather-related incidents, economic and social inflation, and reduced access to reinsurance coverage.

This situation is referred to as a “hard market” in the insurance industry, where threats associated with geopolitical tensions, cybersecurity issues, climate disasters, and social unrest are expected to persist. Consequently, insurance companies have the opportunity to increase premiums and become more particular about the policies they choose to underwrite. This approach can assist investors in staying ahead of potential inflationary challenges if they arise again.

In addition, Chubb possesses an investment portfolio valued at $113 billion, primarily consisting of fixed-income securities. The previous year, the insurer generated $4.9 billion in investment income, marking a 32% increase compared to the previous year. During the first half of 2024, its net investment income has risen by another 27% compared to last year.

Chubb has consistently demonstrated its ability to grow in a flourishing economy. Nonetheless, should inflationary pressures continue, the company possesses the ability to adjust its pricing to accommodate increasing costs and a robust investment portfolio that can benefit from elevated interest rates. This positions Chubb with strong prospects for the coming decade and beyond.