There are challenging turnarounds and there are smoother ones. Investors should generally be cautious about the former, but the latter can present worthwhile opportunities for even the more risk-averse. This is why it’s advisable for investors to steer clear of New York Community Bancorp (1.83%) and instead consider investing in Bank of Nova Scotia (0.60%), which offers an attractive 6.2% dividend yield.

Let’s examine why with a brief comparison.

New York Community Bancorp Stumbles

New York Community Bancorp aspired to grow into a larger banking entity, leading to its acquisition of Flagstar Bank in December 2022. However, the early months of 2023 witnessed a wave of bank runs and failures. Despite navigating through this turbulent period relatively unscathed, New York Community Bancorp attempted to capitalize on the market upheaval.

By mid-2023, the bank, through its Flagstar subsidiary, acquired portions of Signature Bank, one of the institutions that had failed. This rapid expansion seemed promising but soon led to trouble. The bank’s increased size meant it suddenly faced heightened regulatory scrutiny for which it was unprepared. Compounding this, the bank revealed issues with some large loans, indicating a lack of control over its loan portfolio.

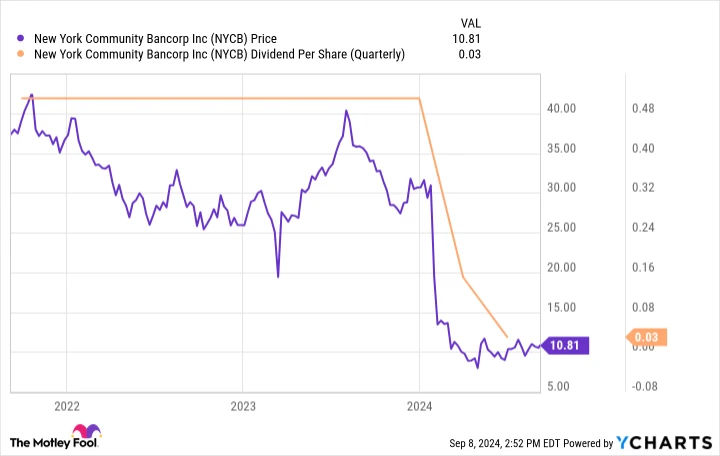

Consequently, the stock plummeted, the board slashed the dividend to a nominal penny per share each quarter, and new management was brought in. Additionally, New York Community Bancorp accepted a $1 billion bailout and began efforts to improve internal controls and clean up its loan portfolio. Although the new management appears to be making the right moves, the turnaround is not expected to conclude until at least late 2026.

NYCB data by YCharts

While there is potential for recovery, thanks to the $1 billion cash infusion that has stabilized the company’s finances, the dividend is nearly negligible, and the turnaround will take several years.

If you are seeking more immediate rewards, consider Bank of Nova Scotia, commonly known as Scotiabank.

Bank of Nova Scotia’s Strategic Shift

Scotiabank’s narrative spans a longer timeline and is less concerning. While many Canadian banks expanded into the U.S. market, Scotiabank ventured into Central and South America, attracted by the prospects of less competition and greater long-term growth. However, the volatility in these markets has caused Scotiabank to lag behind its peers in key financial metrics like earnings growth and return on equity.

In response, the bank is shifting its strategy. It plans to exit less promising markets (such as Colombia) and focus on expanding in more favorable ones (like Mexico) as it aims to establish a dominating North American presence. Part of this strategy includes growing its business in the United States, similar to its peers. Recently, management agreed to acquire nearly 15% of KeyCorp (0.25%).

This move is not something a financially weak bank could undertake, as it effectively offers support to KeyCorp. The critical distinction here is that while Scotiabank aims to align its growth with its peers, it isn’t doing so from a position of weakness. It remains one of Canada’s largest and most efficiently run banks, generating about two-thirds of its net income domestically. The primary focus is refining its operations outside Canada.

The high 6.2% dividend yield reflects negative investor sentiment but likely overstates the risk. Notably, Scotiabank has consistently paid a dividend every year since 1833, and although management has paused increases to adjust its business, there are no signs of an imminent dividend cut. For those interested in high-yield stocks, this is a turnaround worth exploring, even for conservative investors.

Scotiabank: The Preferred Choice for Most Investors

In fairness, New York Community Bancorp is poised to recover its business. However, the main attraction at this point is the potential for stock price appreciation, with the turnaround not expected to complete until 2026 or later, assuming everything proceeds as planned. In contrast, Bank of Nova Scotia’s “turnaround” may take longer, but it begins from a far stronger position and rewards investors with a substantial yield. For those who value peace of mind, Scotiabank is the clear choice.

Seize This Second Chance for a Potentially Lucrative Opportunity

Have you ever felt like you missed the opportunity to invest in the most successful stocks? If so, pay attention.

Occasionally, our expert team of analysts issues a “Double Down” stock recommendation for companies poised for significant growth. If you’re worried you’ve missed your chance, now is the time to invest before it’s too late. The numbers speak for themselves:

Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $280,262!*

Apple: If you invested $1,000 when we doubled down in 2008, you’d have $41,639!*

Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $363,277!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and opportunities like this may not arise again soon.

Discover 3 “Double Down” stocks ›

*Stock Advisor returns as of 09/12/2024