This text highlights Warren Buffett's successful investment strategy at Berkshire Hathaway, which emphasizes steady growth and avoids market trends like AI stocks. It explores how Amazon, Coca-Cola, and Apple, key holdings in Berkshire's portfolio, are innovatively incorporating AI into their business models, demonstrating the conglomerate's ability to benefit from technological advancements while maintaining its core investment principles.

This episode of the Motley Fool Money podcast explores the Federal Reserve's rate cut and its market implications, a leadership change at Nike, and earnings updates from Darden Restaurants and FedEx. Reddit CEO Steve Huffman discusses the company's IPO and growth strategy. The episode concludes with investment insights on DR Horton and Intel, and a fun take on Olive Garden's latest promotion.

Stan Druckenmiller strategically shifts his investment focus from tech giants to high-yield dividend stocks, capitalizing on market conditions and Federal Reserve rate cuts, while highlighting potential high-growth investment opportunities through "Double Down" stock recommendations.

The text explores the potential of Rocket Lab USA and Remitly Global as promising investment opportunities under $100, highlighting their impressive growth trajectories and market potential. It underscores the importance of durable growth for achieving significant investment returns and references the Motley Fool Stock Advisor's success in identifying high-performing stocks.

This text evaluates the investment prospects of AGNC Investment and EPR Properties, two REITs with high dividend yields. AGNC offers stable dividends but limited growth, while EPR combines attractive dividends with growth potential through strategic investments. It also highlights The Motley Fool's successful stock recommendations, encouraging investors to seize high-return opportunities.

This article explores the impact of AI advancements, particularly through ChatGPT, on the stock market, highlighting key investment opportunities in Nvidia, Alphabet, Meta Platforms, and Amazon within the "Magnificent Seven" tech stocks. It underscores their strategic roles in AI development and potential for substantial returns, as identified by the Motley Fool Stock Advisor.

Explore the potential of dividend stocks to build passive income with high-yield options like Kinder Morgan, Verizon, Brookfield Infrastructure Partners, and Agree Realty. These companies offer robust dividends backed by strong financials and growth prospects. Additionally, seize unique investment opportunities with "Double Down" stock recommendations, capitalizing on companies poised for substantial growth.

Explore how the S&P 500's leading companies—Apple, Microsoft, Nvidia, Alphabet, and Amazon—are leveraging artificial intelligence to drive growth, significantly shaping the index's performance. Discover investment opportunities through "Double Down" stock recommendations for potential high returns.

The text highlights the emerging economic boom in North America driven by a surge in domestic production and infrastructure projects totaling over $1.4 trillion. It identifies companies like Nucor and Eaton as key beneficiaries of this trend, emphasizing their strategic positions and potential as attractive investment opportunities amidst market fluctuations.

The text analyzes Wall Street's impressive gains in 2023 while highlighting potential market vulnerabilities through historical valuation metrics, economic indicators, and money supply trends. It emphasizes the enduring power of time in market cycles and suggests strategic long-term investment opportunities despite current concerns.

The text explores Cathie Wood's optimistic vision for Tesla, highlighting its AI and self-driving technology as key growth drivers, while also addressing the challenges Tesla faces in the EV market and the ambitious nature of Ark Invest's future stock price projections.

Vertex Pharmaceuticals stands out as a prime biotech investment due to its market resilience, promising growth in innovative therapies, and attractive valuation, making it an appealing option even for cautious investors.

The text explores the strategic interplay between Realty Income and W.P. Carey, two major net lease REITs. Realty Income, a market leader, focuses on retail properties and offers stable dividends, while W.P. Carey, with a strong European presence and higher yield, is shifting its strategy to align more closely with Realty Income's successful model. The analysis highlights their growth trajectories, investment appeal, and the potential for W.P. Carey to complement or stand independently in an investor's portfolio.

Explore the potential of DraftKings and Palantir Technologies as promising growth stocks under $100, capitalizing on expanding markets in sports betting and AI-driven decision-making, while considering expert investment advice.

The text discusses the benefits and risks of using multiple credit cards, highlighting that while they can maximize rewards and offer various perks, they also pose potential financial risks. It emphasizes tailoring credit card strategies to individual financial management skills and circumstances.

This text explores the advantages and challenges of achieving elite hotel status. It highlights the coveted benefits of top-tier status, the uncertainty of room upgrades, and the difficulty of reaching high status levels. It also discusses how loyalty to a hotel chain can limit travel flexibility, offering insights for frequent travelers considering elite status pursuit.

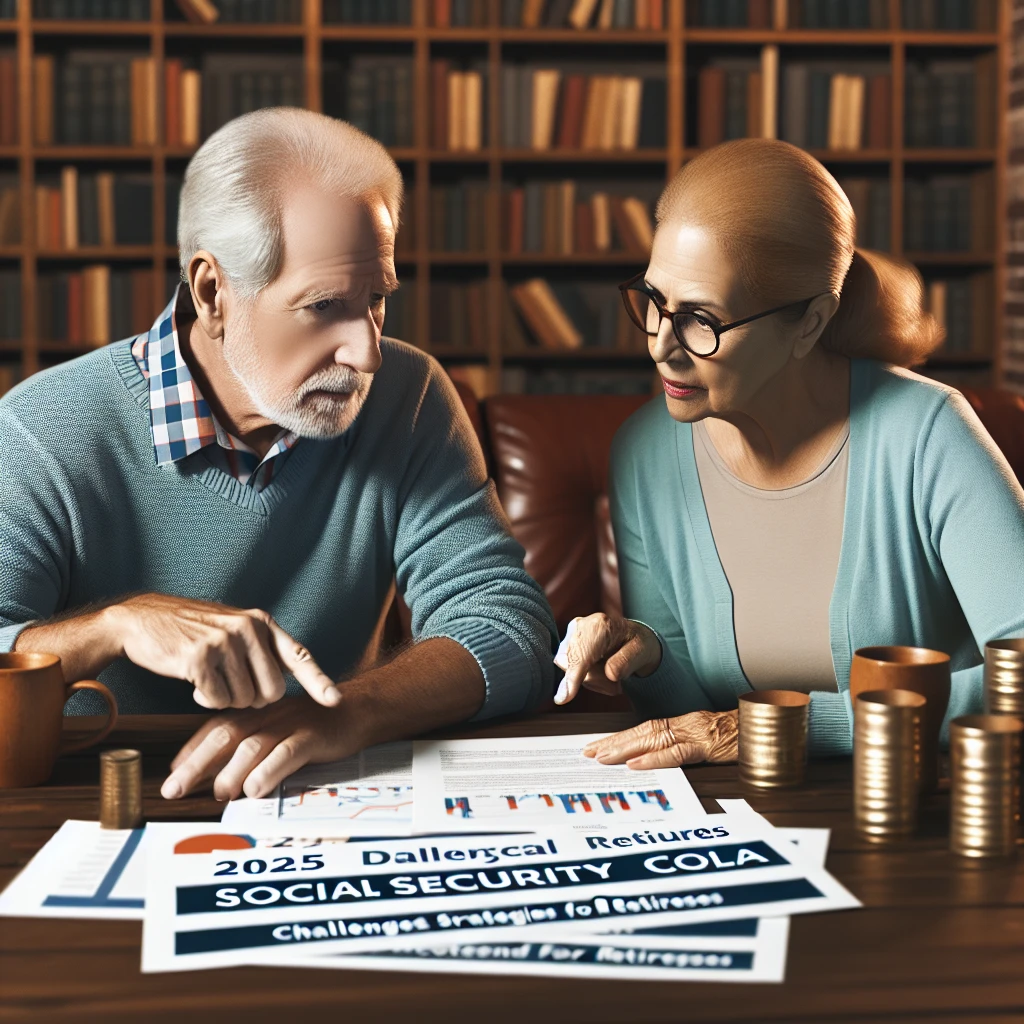

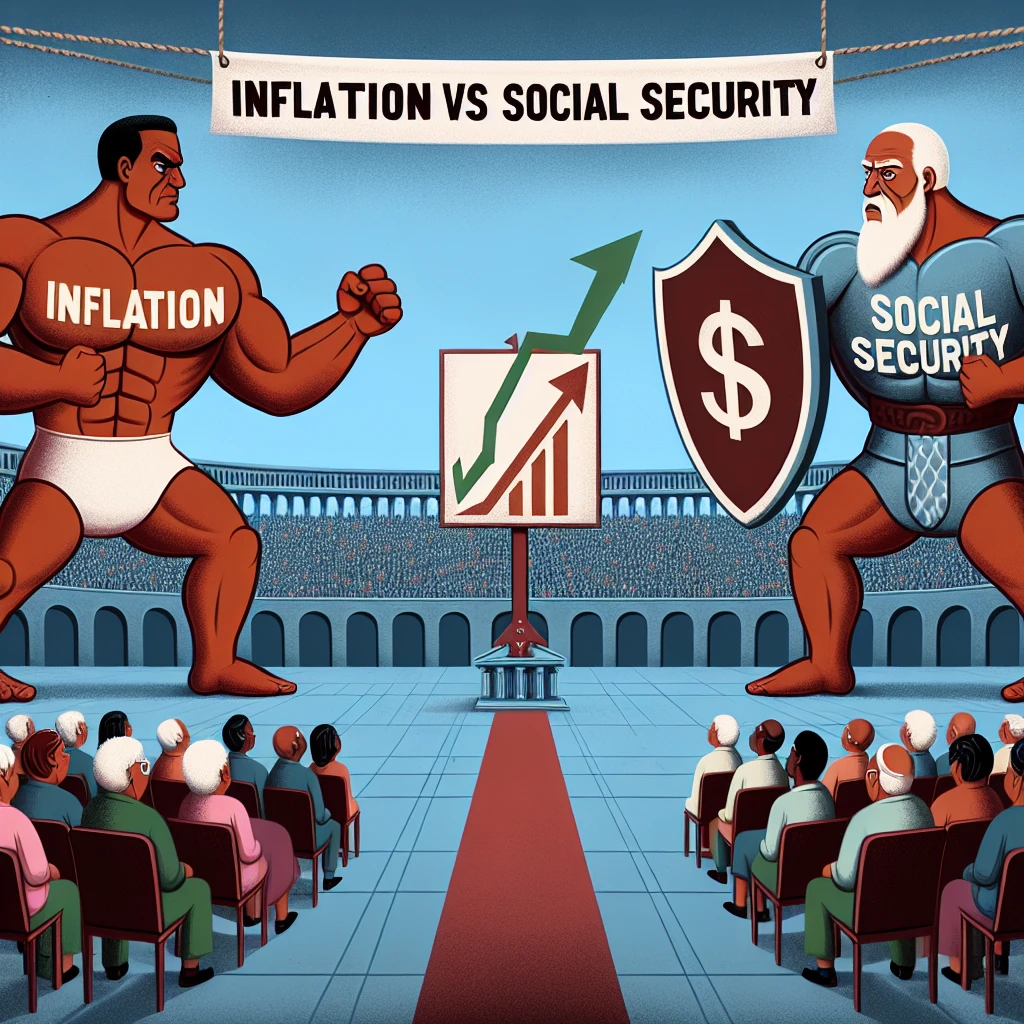

The text discusses the upcoming 2025 Social Security cost-of-living adjustment, highlighting its importance amid inflation and potential challenges it poses for retirees relying heavily on these benefits. It also emphasizes the need for retirees to explore additional income strategies and better manage their finances to offset the limitations of COLAs.

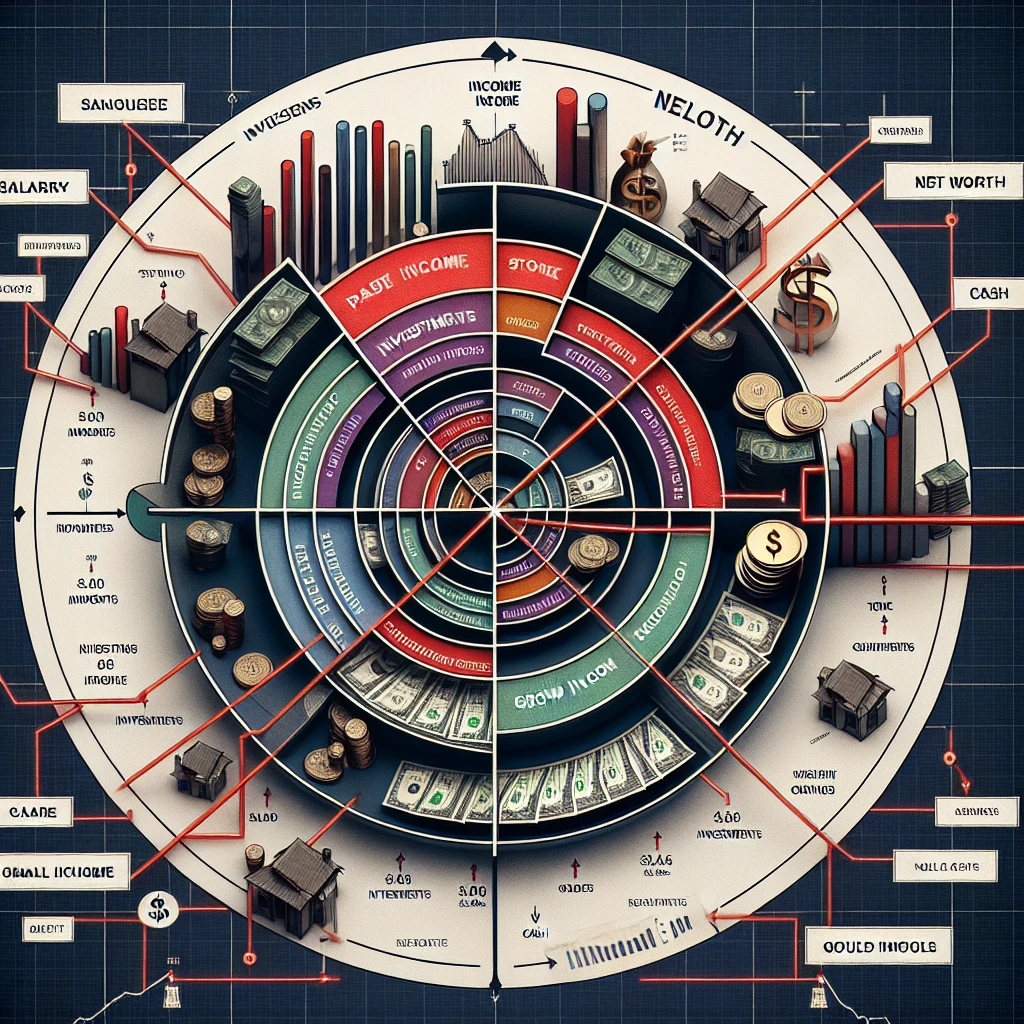

The text examines the definitions of wealth through income and net worth, providing benchmarks for what constitutes being wealthy in America. It offers strategies for increasing wealth, emphasizing income growth, disciplined saving, and smart investing, suggesting that with consistent effort, affluence is attainable.

This text explores investment alternatives to Coca-Cola, suggesting PepsiCo and Archer-Daniels-Midland as promising options due to their strong dividend yields and potential for long-term gains, despite current market challenges.

Sirius XM Holdings faces significant challenges with a 55% stock decline amid evolving media consumption trends favoring streaming services. Despite these hurdles, the company maintains a leading position with its vast audience and profitability, while recent restructuring aims to enhance strategic flexibility. Current shareholders may consider holding, while potential investors should await clearer signs of improvement. The Motley Fool highlights opportunities in other stocks with proven returns, such as Nvidia and Netflix, through strategic "Double Down" alerts.

SoundHound AI is an emerging investment opportunity, leveraging its innovative voice control technology and strategic growth plans to expand in the automotive and food service sectors. With a strong backlog of contracts and a clear vision for profitability, the company is well-positioned for long-term success.

This text provides a strategic guide to building a million-dollar Roth IRA for a secure retirement, emphasizing the importance of early saving, investing in stocks for growth, and utilizing Roth conversions for tax advantages. It also highlights overlooked Social Security strategies for boosting retirement income.

Nvidia's dominance in the AI chip market has fueled remarkable growth, with stock surging over 2,400% in five years. Despite competition concerns, strong demand from industry leaders like Elon Musk and Larry Ellison underscores Nvidia's critical role in AI, suggesting continued robust growth prospects.

The text examines the inadequacy of Social Security's cost-of-living adjustments (COLAs) in keeping up with inflation, highlighting a 20% decline in purchasing power since 2010. It critiques the CPI-W's insufficiency in accurately representing retirees' expenses, particularly in housing and medical care. With a forecasted 2.5% COLA for 2025, retirees face financial strain, necessitating prudent budgeting and exploring additional income streams like high-yield savings and CDs. The text also hints at strategies to maximize Social Security benefits.

This text explores Dan Loeb's successful investment strategies through Third Point's Offshore Fund, emphasizing his focus on artificial intelligence investments in Amazon, Microsoft, and Taiwan Semiconductor. It highlights the fund's impressive returns and offers insights into a unique "Double Down" stock recommendation opportunity for potential high-growth investments.