Semiconductors Semiconductors are crucial technologies that play a vital role worldwide, powering devices ranging from thermostats to smartphones and autonomous vehicles. With the advancement of artificial intelligence (AI), the demand for high-performance semiconductors has increased. These advanced products have become so essential that geopolitical tensions have arisen between the U.S. and China regarding import and export restrictions, especially in Taiwan, which is a key manufacturing hub for semiconductors globally.

Due to strong demand and favorable market conditions, numerous stocks in the industry have experienced growth. Arm Holdings ( ARM -1.21% ) , began in 2024. The excitement led to Arm’s valuation soaring to very high levels, but the recent decline in the market has caused Arm to drop by almost 40% from its recent peak, as illustrated below.

Arm stands out as a unique semiconductor company, which gives it a significant edge. Now, let’s explore its operations and determine if the current economic decline presents a valuable chance for growth.

What makes Arm’s business model so attractive?

Arm Holdings is a semiconductor company that focuses on designing semiconductor technology rather than manufacturing the actual chips themselves. The brain of the computer, responsible for processing data and executing instructions. chips that are enjoyed by its customers Apple , Samsung, Alphabet , Nvidia , and TSMC ( TSM 1.56% ) Arm provides a model for constructing products, and in return, they receive payments through licensing and royalties according to the quantity of items sold. There are a total of 287 billion chips with Arm technology, and they dominate 99% of the worldwide smartphone market.

Arm’s financial performance is similar to that of a software company due to its status as a non-manufacturer, which exhibits three key characteristics.

- Notable amount of excess cash generated

- Large profit margin

- Income that is consistently generated over a period of time, typically from ongoing subscriptions or regular payments.

Arm does not require significant investments in manufacturing facilities and machinery, which is commonly referred to as capital expenses Arm, unlike other semiconductor companies, allocates less than 5% of its revenue towards capital expenditures. Semiconductor company based in Taiwan. For instance, Arm consistently allocates over 30% of its budget. Due to the minimal investment in capital expenditures, the company converted 20% of its income, which amounts to $709 million. free cash flow In the last year.

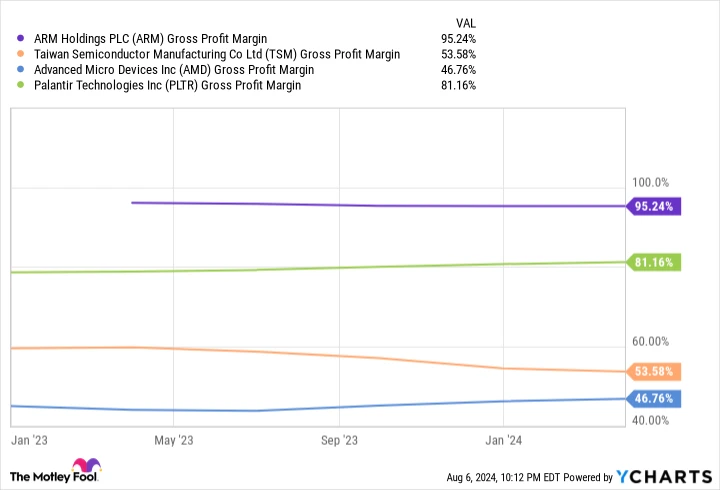

Arm’s gross margin performance is strong when compared to software companies. Palantir Technologies is a company that specializes in data analysis and software development. ( PLTR 2.49% ) and is significantly leading other semiconductor stocks, as illustrated below.

ARM Profit Margin on Gross Profit data by YCharts

A high gross margin Usually, this refers to a company’s ability to turn additional sales growth into revenue. net profits .

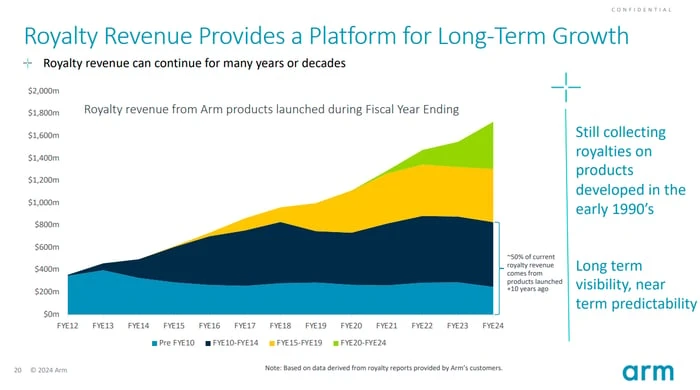

Arm’s revenue is not only generated repeatedly but also benefits from its existing products. Even when Arm introduces a new product for a different purpose, its previous designs continue to be purchased. This strategy enables the company to generate additional sales from both new and old products.

Credit: Arm Holdings for the image.

Earnings generated from previous products are great for the company’s overall financial performance as the expenses for research and development were covered in the past. This approach is excellent for maximizing profits.

Should one consider buying Arm Holdings stock at the moment?

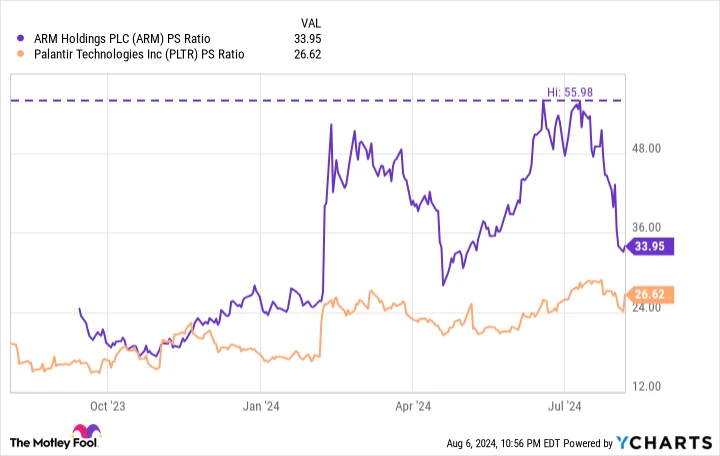

Due to its attractive business strategy and strong market conditions, investors quickly drove the stock price up from $51 at its IPO in September 2023 to more than $180 per share. valuation Remains significant. Arm’s stock once reached a value exceeding 50 during its highest point. times sales The most recent decline brought this down to 34 and the stock price below $115; nevertheless, it is still expensive.

Numerous investors and analysts regard Palantir Arm’s valuation is high, with its price-to-sales ratio currently 25% greater than that of Palantir even after the recent market adjustment.

ARM PS Ratio data by YCharts

Arm is an excellent company that is likely to generate substantial returns for investors in the long run. However, the stock price may experience further declines in the near future due to its current valuation. Investors have access to various tools to mitigate short-term risks, such as. Investing a fixed amount of money at regular intervals, regardless of market conditions. , buying on dips , or just patiently biding my time until the value decreases. Once it does, I’ll be prepared to take action.